Achieving best practice management reporting will help you make your business stronger. Alternatively, as a business advisor, you will be able to help your clients build sustainable organisations. This guide is designed to help you review your processes and set up management reporting that meet best practice.

What is Management Reporting?

In its simplest sense, Management Reporting is the act of providing information to the management of a business or organisation but that does not say very much, does it? Here are some examples of business management reports.

Best practice management reporting provides the owners or managers of an organisation with timely, accurate and relevant information that helps them make good decisions for the future of the business. Firstly, sometimes the decision may be to do nothing, but the purpose of the information is to guide decision-making and the actions managers take. Secondly, the assumption is that decisions based on good information will be better than somebody’s gut feeling.

The Components of Best Practice Management Reporting

Traditionally, management reporting has often started with financial reporting. Sometimes that’s for the valid reason that managers need to understand the financial aspects of the organisations they are running. Sometimes it’s because that’s the best that’s available.

While formal financial reports can provide a starting point, they aren’t necessarily the most useful, especially in an organisation run by people without formal accounting training. As an alternative, it may be much more useful to group and categorise transactions differently for management reporting purposes. For example, the information required for legal and compliance purposes isn’t often presented in the right way for decision-making. On the other hand, sometimes managers want more detail, sometimes less. Sometimes they want to group things one way, sometimes another.

In addition to rearranging the financial information, it is also important to incorporate operational data. Here are some non-financial management reporting examples:

- How many new customers did we gain?

- What was our average selling price?

- How many visitors did we have to our website?

This operational information will be very useful in deciding what is working in the business and what isn’t. Especially at the department or project level, non-financial information is key to good management reporting.

Segments in Management Reporting

Except in the smallest businesses, it is often useful to provide management reports to people in charge of a segment of a business. This makes sense to enable them too to make good decisions. Regardless, whether it is a branch, department or simply one person’s responsibility, having good practice management reports helps us all make good decisions and do our jobs better.

At the segment level, management reports are more likely to be based on non-financial metrics. Combining them with financial data can often add additional value and help to relate them to the overall organisation goals.

Looking to the Future with Management Reports

While management reporting usually contains an element of review of past activity, it can be most valuable in providing a view of the future. Whether you call it a budget, a forecast or a prediction, looking at several potential future scenarios is an important part of decision making. Being able to model and predict the likely outcomes of our decisions gives us more confidence in our actions.

Who Needs Management Reporting?

Not every business needs management reporting but for those who do, it is critical to the decisions they make on the business. Management reports should provide the basis for informed decisions about what a business could do in the future. Moreover, it should help assess the effectiveness of those decisions. They need to look forward at possible scenarios and back to measure performance. Simply, it should give the business owner the knowledge of what has worked and what hasn’t.

Management Reporting for Micro Businesses

It’s the smallest businesses who are least likely to need management reporting. However, that doesn’t mean none of them will. Alternatively, some of them will sometimes.

Management Reporting to the Business Owner

In a micro-business, you’re almost certain to be reporting to the owner of the business. Many of these owners will be closely involved in the business daily and sometimes that can be why they don’t clearly see what’s happening. They are so deeply embedded in doing things, they don’t have time to evaluate the business, to carefully consider future strategies. That leaves them vulnerable to any sudden change in the outside environment.

Small Business Management Reports

As businesses grow and start to employ staff, the owner may still have a good grasp of what’s happening inside the business on a day-to-day basis. However, it’s easy for them to lose sight of the big picture. This is where they can really benefit from the help of an outside consultant. Imagine, this external viewer bringing a different perspective and look dispassionately at the important numbers for the business.

Management Reports for Medium to Large Businesses

As businesses grow, there tends to be less direct involvement of the owner. As a result, there comes a time when the business is big enough to employ a manager or even a management team. This can mean that you need to provide a set of management reports to the owner and another set to the manager(s). They will both have slightly different needs with the owner probably wanting higher level reports and the manager more detail.

Consolidation of Multiple Companies

Larger businesses often involve multiple entities. These could be different branches; they could be different steps in a supply chain (manufacturer, wholesaler, retailer) or they could be related businesses that have been acquired but kept separate for operational reasons.

Consolidating the accounts from a group of entities can be very time-consuming to do manually. With the aid of good group consolidation software to collate the information and eliminate inter-company transactions, it can be a breeze.

Departmental Reporting

A logical step as a business grows is to break it into departments or divisions. These help with the internal management of different functions and activities. Departmental reporting is vital in breaking down the performance of company activities. Usually, these activities are tracked in the accounting system at the transactional level. Just to give you an idea, this is how the mainstream accounting vendors call their departments or business units:

- Xero refers to them as Tracking Categories – there are two of these category streams

- QuickBooks Online has three different types: Classes, Jobs and Customers/Locations

- In turn, MYOB refers to their department structure as Jobs or Categories

Not for Profits

Charities and Not-for-Profit organisations (NFPs) often have complex management reporting needs, even the smaller ones. Often, they don’t have the in-house expertise to produce the right reports.

Because Not-for-Profits are usually working with other people’s money, there are accountability reasons for having regular reporting. They need to be able to demonstrate that they have spent their funds wisely and in accordance with their aims. Most of all, they need to demonstrate transparency as part of good governance. For this reason, management reporting is usually mandatory. It’s not something they have a choice in.

While very small NFPs may just report at the organisation level, the larger ones will need to report by department or project. This allows them to manage different funding sources or different functions within the organisation. This is a NFP Management Report example generated in Calxa.

Reporting to boards is generally done on a monthly or quarterly basis. There is a strong focus on performance against budget, with regular reviews of actuals to budget. Looking forward the emphasis is often on what is left in the budget, especially on the expenditure side.

Why Do Businesses Need Management Reporting?

We have touched on some of the reasons above but let us consolidate that information so that it’s clear. Ultimately, we want management reporting so that we can make changes in our businesses. Reporting is a key driver of change. You need to know that you have a problem, and how big it is, before you can execute a plan to fix it.

Once a plan has been put in place, good management reports will then tell you if you are achieving the milestones and goals in the plan. Are things improving?

Management Reporting for Strategy

Especially at the CEO and board level, management reporting is important to determine how successful the current strategy is. Strategic plans usually incorporate some kind of goals and milestones. If you don’t then measure the activities associated with those goals, you have no way to know if you’re achieving them. If you’re not monitoring them, you don’t know if the strategy is effective or not. And then you’re not prompted to adjust the strategy or its implementation.

CEOs and senior management will sometimes use management reports to highlight problem areas that they feel a board needs to address. Sometimes this can be manipulative but, with the right motivation, it can make a board aware of problems they need to act on.

Decision-Making with Management Reports

While some managers may just glance at their monthly management reports and move on, the good ones will read and digest them. They will consider the contents and how it relates to their responsibilities. Then they’ll make decisions on how to improve the business. Even if the decision is to continue doing what has been done, that is now an informed and considered decision. As we all know, there are always improvements we can make in our businesses.

It’s prioritising the changes that is the challenging part.

Benchmarking with Management Reports

One traditional, and still relevant, use of management reports is to benchmark the business against others.

Benchmarking is often done with ratios and KPIs rather than raw currency figures. For example:

- Retailers might compare gross profit percentages

- Hotels might use occupancy rates.

Each industry has its common benchmarks and management will often want to know how they are performing against others.

It is also important to benchmark your organisation against your previous results and against the goals you set at the beginning of the year. For this reason, many people lock their original or approved budget once it has been set. After that, they use a separate forecast as things change during the year.

Management Reports for Control

The other traditional use of management reporting is to control the collection of revenue and expenditure of funds. Monitoring variations to budget can help to reveal fraud. Knowing that management will review variances ensures staff keep within the budget guidelines.

Whatever your reason for using management reports, the result is likely to be an action or decision, one that is well-informed.

What to Include in Management Reports

Financial information has always been at the heart of good management reporting, and for good reason. It is important to know whether or not you’re making money, whether you will have cash to pay your bills.

This management report template is a regular report bundle you can set up in Calxa.

Profitability

It’s important that the senior managers and board members of any business or Not-for-Profit organisation understand how profitable they are. While you can make a loss for a short period of time, it’s not sustainable in the long term (unless you’re Amazon!).

It may also be important to understand the profitability of each department, branch or project. In a larger group of companies, it is useful to compare profitability between them.

Future Cash Flow

Ensuring the business is solvent is an important role of management and boards. The only way to know if you can pay your bills in the future is to forecast your cash flow. Sometimes a short timespan or a few weeks is sufficient, especially in times of great uncertainty. More often, managers are interested in a longer-term view of 12 months or more.

Identifying future cash flow problems can trigger action to mitigate them. Knowing your cash flow hotspots ahead of time allow you to do different things:

- Find alternate sources of income

- Reduce or defer expenditure

- Borrow funds to cover temporary shortfalls.

Either way, having the right information (including multiple scenarios), improves the chances of making good decisions.

Past Cashflow

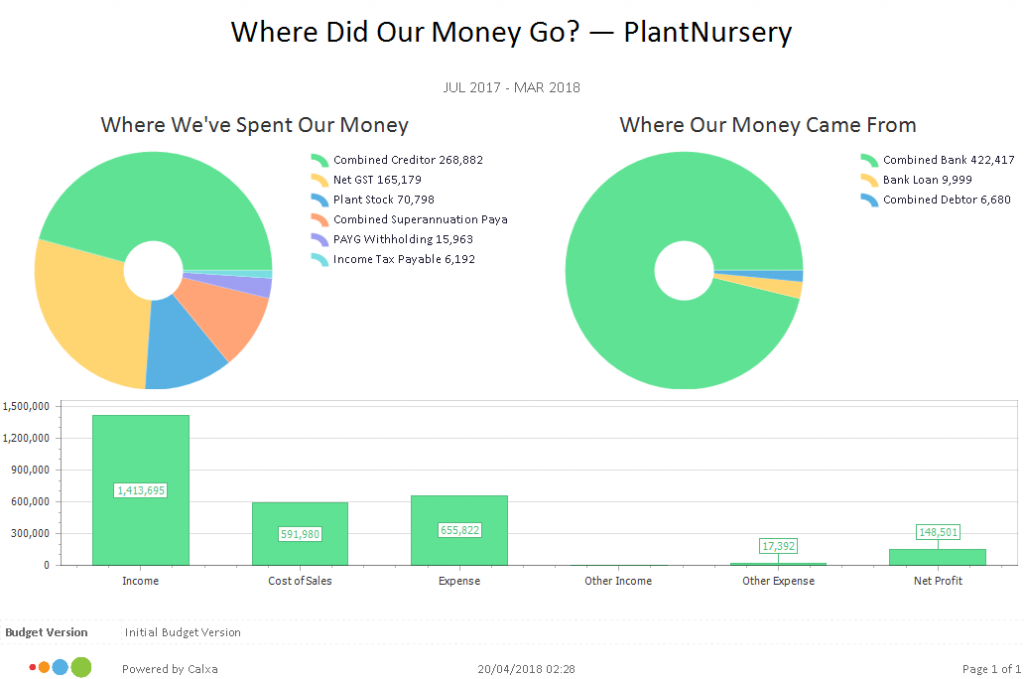

Don’t forget to also review the past. Where did your money go? Here is management report example:

Departmental Reporting

In a multi-departmental organisation, management and boards need to know what is happening in each area. It is paramount to include departmental reports in best practice management reports. Provide senior managers and board members with summary information that will let them know if each department is on track or not. Provide the department managers with the detail on their area.

KPIs

Last, but certainly not least, are the key numbers that drive your business. Ask yourself, how do you really know if you’ve made a difference?

- Is it the number of customers?

- Or, is it the average value of each transaction?

- What about, the number of people that you’ve provided services to?

You will probably also have several supporting KPIs too. These may not be goals in themselves, but they could be leading indicators and give you the insight to future problems. For example, you could have a goal of increasing the revenue from your e-commerce site.

In this case, the most obvious KPIs are number of customers and average revenue per customer. Increase one or both and you will do well. But, depending on what you are selling and the length of your sales cycle, the number of visitors to your website could be a leading indicator. A rise in visitors one month may lead to an increase in paying customers the following months.

Monitoring visitor numbers will help you predict future sales and take remedial action when needed. On its own, visitor numbers isn’t an important metric, but when it tells you something about future behaviour it can be very interesting.

How to Deliver Management Reports to your Clients

If you’re an accountant or bookkeeper looking to start providing management reports to your clients, there are a few things to look out for. Here is the cheat sheet to do this with Calxa:

- Connect Calxa to their accounting system.

- Prepare a budget.

- Use the Budget Factory for a quick draft if they don’t have one.

- Produce a bundle of reports using one of the sample kits.

- Discuss and get feedback.

- Add in the specific reports that will wow them.

- Schedule delivery to repeat every month.

- Discuss the reports with them and highlight any issues.

- Make them think differently about the business.

Keep it Simple

Keep the reports simple so that the business owner can grasp the meaning of them quickly. There are many highly intelligent people running micro businesses, but they are typically time-poor.

The challenge when presenting them with best practice management reporting is to give them clear information that they can understand quickly.

They don’t need reams of paper (though they may want more detail to substantiate something that surprises them).

For this reason, use visual charts and, when you do need to provide reports with numbers, summarise them. Give them the important information first with more detail available when or if they need it. When evaluating 2 alternate scenarios, for example, it is often useful to present a chart showing the cashflow effect of each scenario over time. Cashflow management is important to most micro businesses and, even though one scenario may be more advantageous in the long term, they may not (yet) have the resources to get to that stage.

Staff Management and Cash Flow are Important

With many small businesses being service-focused, people are a major cost. The owner needs to budget carefully for those costs and to monitor them monthly to budget. Of equal importance is how wage costs relate to sales. As sales increase, you would expect wages to increase, but that increase should be proportionate. Ideally, the ratio of wages to income will decrease as staff become more productive.

Cash, or lack of it, is the major killer for small businesses. Many start off under-capitalised. People starting businesses are by their nature optimists and it can take longer than expected to reach a break-even point or to achieve a sales target. Because they mostly run lean, they don’t always have a buffer to manage any downturn in business. For these reasons, regular cashflow forecasts are essential to the management of a small business. Understanding their cash needs for the next 12 months and being able to react early to anticipated shortfalls can be the difference between success and failure.

Become a Specialist to Stand Out

Consider specialising in a niche like cafes, retail, engineers or plumbers. Keeping things simple and understandable for a small business owner may mean providing them with relevant industry KPIs (Key Performance Indicators). Each industry generally uses common KPIs which makes it easy for business owners to compare their performance to their peers. This makes it easy for a consultant to specialise in providing management reports for that industry. When you have helped one café, the next one will have very similar needs.

Cafes tend to focus on a handful of critical KPIs:

- Food Cost: the cost of food as a percentage of the food sales;

- Wages Cost: wages as a percentage of revenue;

- Average Transaction Value: How much they are selling to each customer.

This Metrics and KPIs for Hospitality article will provide some guidance.

For retailers, there is some commonality but also some differences:

- Gross Profit: Income – direct costs as a percentage of income (though some retail sectors tend to prefer the Cost of Goods percentage.);

- Wages Cost: wages as a percentage of revenue;

- Sales per square metre: Income divided by the area of the shop.

This article 7 KPIs for Retailers will give you some ideas to start off.

Best Practice Management Reporting in Summary

Best practice management reports drive change in a business. They need to be readable so that a business owner or manager can quickly grasp what is important.

The information needs to be both relevant and timely.

It should be delivered as soon as practical and sometimes it is more important to be on time than 100% accurate. Be careful with accuracy though as people can make bad decisions if provided with erroneous data. This is one main reason you should not use spreadsheets to prepare your management reports.