Over the past few years, the disability sector in Australia has undergone a major shift. To manage the transformation, NDIS Providers are using Calxa to supercharge their business.

NDIS Shift: From Bulk Funding to Fee for Service

The introduction of the National Disability Insurance Scheme (NDIS) has changed the landscape considerably. The new scheme provides disability service users with the option to choose their service provider. This has introduced a competition amongst service providers unseen before. As a result, the newly competitive environment delivers a choice of service providers and pricing options.

This is very different to the previously bulk funded industry. The system was simply based on awarding grants to one provider charged with the job to roll out the program as contractually agreed. The organisation was paid in bulk at the beginning of a program, over the period delivered the service, and at the end acquitted the funding by reporting on expenditure allocation, outcomes and impact. For participants, it meant one choice of service funded by the Government.

From Cash Flow Rich to Cash Flow Poor

This amplified dynamic setting has required a re-think for disability service providers resulting in a change of business model. Essentially, the industry now no longer relies on Government grants but markets their services with a price tag that sits within the National Disability Insurance Agency (NDIA) pricing framework. Once delivered, the service is claimed back. In other words, funding is retrospective.

This transformation is particularly important from a cash flow perspective. All running costs for the service delivery are upfront and payment is in arrears. Organisations have become like any other business.

As a result, many not-for-profit organisations have transformed from being a reactive business to pro-actively seeking growth. Becoming and staying sustainable is paramount.

Three Features NDIS Service Providers Use Calxa For

Calxa is designed for not-for-profits and used globally. Many organisations use Calxa for their program budgeting, tracking program funding and deliver professional and useful board reports. Having been involved in several NDIS pilot programs, Calxa has further developed its features to suit NFPs.

In addition to their monthly board reports, there are three key features in Calxa that NDIS Providers find imperative to making their organisation more sustainable:

- Unit Costing

- Cash Flow Forecasting

- NDIA Bulk Claims

Unit Costing

It is important for service providers to know they can deliver that service or activity at a cost lower than the price they receive. Having a well thought out pricing model is important to balance those higher-margin services with possibly the ‘loss-leaders’. In other words, revenue doesn’t always need to be higher than the costs. But over time, the cost needs to be recovered from clients for the organisation to remain sustainable.

Calxa allows service providers to calculate pricing using non-financial metrics. For example, you can take an expenditure for a specific activity like a visit to the zoo. You would group the cost of transport, entry tickets, lunch and carer hours and divide this by an estimated number of participants. This will now give you a basis of which to compare to the NDIA pricing framework for this type of service.

You can take this one step further and create a best- and worst-case scenario for the trip to the zoo. Once you have these two calculations you add these to a Calxa graph which will show you how the two compare.

To understand more about unit costings, check out our information to Get Ready for the NDIS.

Cash Flow Forecasting

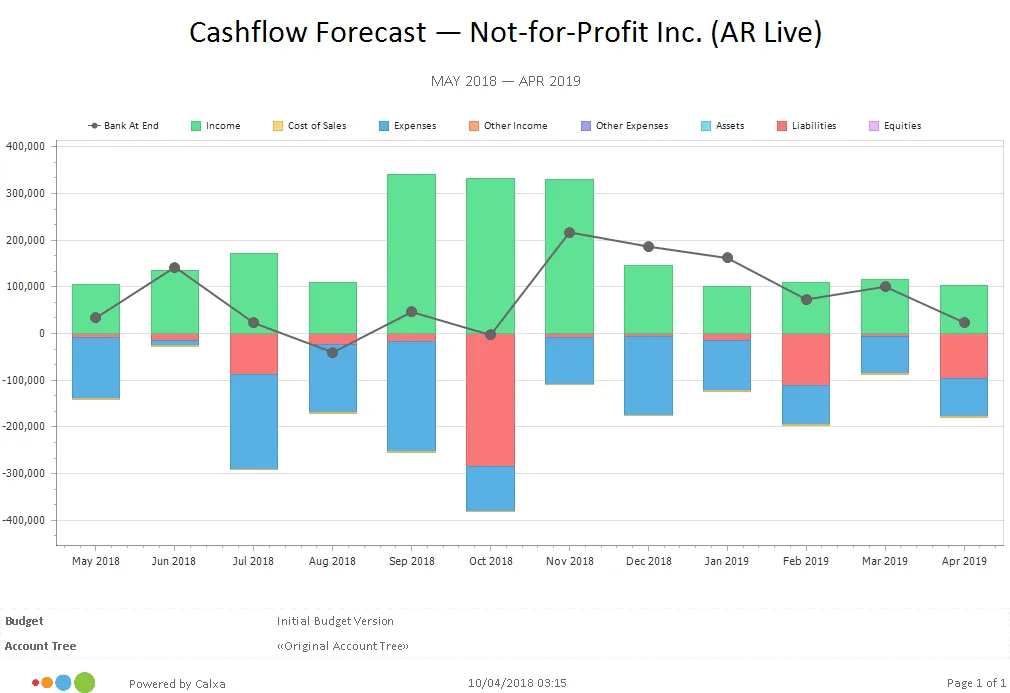

To keep the finger on the pulse, looking at a Cash Flow Forecast regularly is essential. A strong board will demand to look at a prediction of the cash position monthly. This is the best way to gauge how the strategic direction and pricing choice is going to affect the cash in the bank.

Doing a cash flow projection in Calxa is quite easy compared to a spreadsheet. Once both the profit and loss and the balance sheet budgets are created, simply select the right report template and the graph can be visualised on screen or shared as a PDF. Here is an example of what a forecast in Calxa looks like.

NDIA Bulk Claims

To keep cash flow healthy, many NDIS Service Providers process a regular bulk claim through the NDIA Portal. This is the process of claiming the services or activities delivered. Doing this one by one can be really time-consuming.

The NDIA bulk claims feature was developed for those smaller providers that don’t have a client management system (CMS) like SupportAbility or InfoExchange’s SRS. The integration is specifically with MYOB AccountRight. It works by listing MYOB time-billing invoices which have been generated for each participant at the time of service delivery.

Then, it is as simple as ticking the invoices that need claiming back from the NDIA and generating a CSV file. This is the file that then is uploaded to the NDIA portal to produce a bulk claim.

Doing this in bulk is a significant time-saving and Calxa has an NDIA Bulk Uploads feature to make the claims process even easier. To get started with NDIA Bulk Claims see our help note on how to Enable NDIA Bulk Claims.

Now you know how Calxa can help NDIS Service Providers. If you are preparing for the NDIS or want to improve your current system and processes, have a look at our checklist in this article Calxa for NDIS.

YOU MIGHT ALSO BE INTERESTED IN

Handover Document: An Administrator’s Checklist

We would all like our team members to stay with us forever, but we know that’s not the way the world works. This elevates the importance of the handover document. Here is an example of a handover checklist for not-for-profits. In the meantime, how do you prepare for...

Visualise Recruitment KPIs On Your Dashboard

Recruitment KPIs can give you an interesting perspective to your business. Generally, recruitment is something that most business owners or managers get involved with from time to time. For some it’s a regular part of their job, whilst bigger businesses will have a...

Troubleshooting Management Reports in Calxa

As accountants, we know that things don’t always turn out perfectly the first time. Troubleshooting management reports is necessary when there are odd numbers or discrepancies between your reports. Your keen analysis skills will be a major ingredient in rectifying the...