When is one cash flow forecast not enough? Most of the time! There are many possible futures for your business. And, while you can’t model them all, it makes sense to consider the best case and worst case as well as the most likely case.

Preparing multiple cash flow scenarios will help you think through the implications of different situations and be prepared. This means that you’ll come to a much quicker decision later on, when you’re under pressure to act fast.

How Do Cash Flow Scenarios Help Mitigate A Crisis?

Scenario Planning simply means building multiple cash flow scenarios during (or ideally before) a crisis. It helps you prepare by giving you the ability to think through a problem and its possible solutions in advance. Ultimately, it is part of managing cash and projecting possible future cash.

We know from the work of behavioural economist Sendil Mullainathan and psychologist Eldar Shafir (Scarcity: Why Having Too Little Means So Much) that in times of crisis we often suffer from what they call a lack of bandwidth. This is the cognitive space to think and process problems and come up with solutions. When we’re under pressure we often don’t think so clearly and it’s harder for us to find answers to our problems.

We can minimise this problem by being prepared. Thinking through alternate outcomes before the crisis really bites deep means the decision-making takes less effort when we do need to act fast.

When we’re in the midst of a crisis, it’s often hard to sort out the good ideas from the bad. This means we’re prone to rush into the wrong decisions. The earlier we can prepare and think through the alternate options, the better decisions we will make when they are needed. This type of cash flow management is essential in pre-empting cash reserves.

How Many Cashflow Scenarios Do You Need?

The traditional answer is that you should prepare at least three potential scenarios:

- Best-case scenario

- Worst-case scenario

- And, one for the most-likely case.

This is a good starting point for a scenario analysis but don’t be limited by it. Think more of your alternate courses of action and work through the ones that are potential solutions.

There are always many unknown factors. Mostly these factors will be outside your control. You can’t anticipate them all, but you can consider the more likely.

Experience always helps in a crisis. If you’ve lived through a drought, a cyclone or a major flood before, you have a better idea of how to cope next time.

When faced with a possible economic depression brought on by global events such as the spread of the novel coronavirus, COVID-19, we are likely to be presented by a new situation. These are the moments where there are not just more uncertainties but most of us have less control over them.

We don’t know what action our governments, or other governments, will take and how that will affect us; we don’t know how long the downturn will last. But even if we don’t have direct experience, we can learn from history, from the lessons others have learnt in similar events.

How Do You Create Cash Flow Scenarios?

In Calxa, cash flow scenarios have traditionally been managed with alternate versions of your budget. One budget, one scenario.

From October 2024, you’ll be able to create scenarios which represent the changes from your foundation budget.

- Create a scenario to represent the increase in revenue in your best case, plus any associated changes in expenses

- Create another scenario to represent the decrease in revenue (or smaller increase) in your worst case scenario

Then preview your budget with one or other scenario and run reports showing any combination of scenarios. If you decide one is the most likely scenario, you have the option to merge it into your foundation budget.

If you are new to Calxa, this Tips to Using the Calxa Budgeting Tool will get you started with budgets and scenarios.

Review Your Scenario Line by Line

Once you have your first draft, it’s best to review the new scenario line by line.

Use a report like Calxa’s P&L with Projected Total that shows Actuals year to date and then Budgets for the rest of the year. If you have too many, or too few, months of actuals, just adjust the start date. You’ll then be able to see what’s happened to each income or expense line for the last few months and consider what changes you need to make to the budget for the next few months. It can be helpful to have the report open on one screen while you edit the budget on another.

Don’t forget to review your Balance Sheet accounts as well.

- Were you planning to buy new assets? Consider including them as a separate scenario so you can see the effect of including or excluding it.

- Does it still make sense to do that?

- Is your government offering incentives for you to buy new assets?

- Are you in a position to buy something that will help you grow your business in these challenging times?

Consider the liability side as well and ask:

- Will you need to take out new loans?

- Reduce or increase loan repayments?

- Will you get government benefits to offset some of the taxes you owe them?

Putting all this together will give you a comprehensive review of your business and a detailed plan for the future.

Comparing your Cash Flow Scenarios

As you create your different budget scenarios, you’ll be able to see the effect on your profitability of each option. What’s going to determine your survival in a period of turmoil though, is the availability of cash. You need to know which scenario will be best for your cash flow.

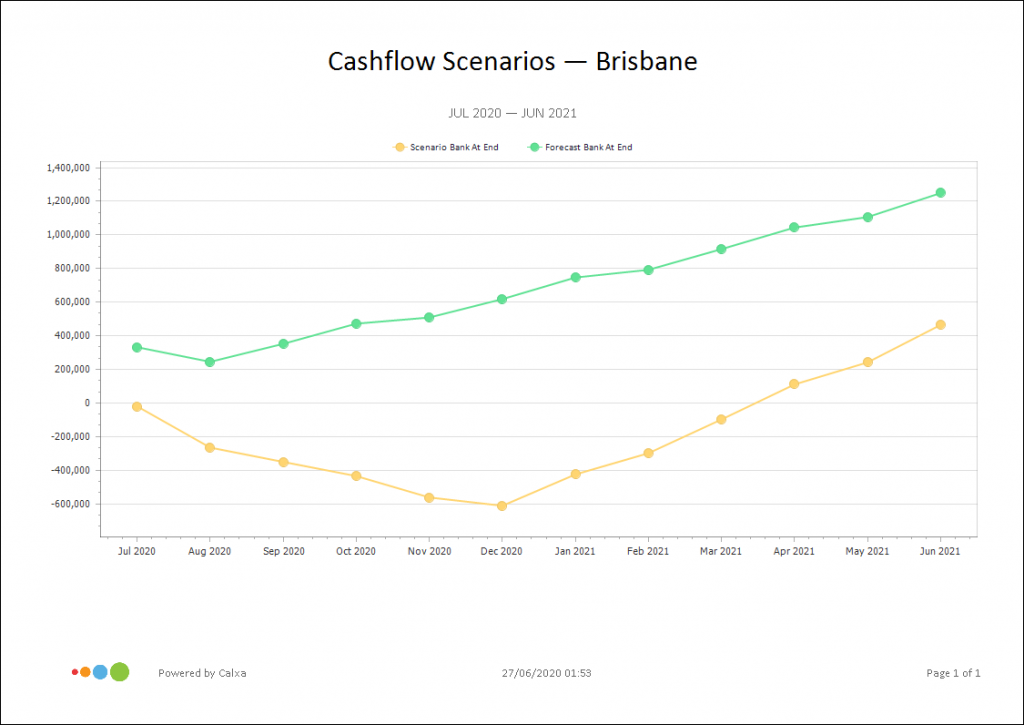

Fortunately, Calxa has just the report for you. The Cashflow Scenarios Line Chart will show the cash flow effect of each of 2 scenarios. Just select which budgets you want to report on and review the chart.

You’ll rarely find it’s quite as simple as one being good and one being bad. Often one option is better in the short term, the other in the longer term. The important point is that you have the information you need to make informed decisions. This will allow you to mitigate the impact of the crisis your business if facing.

When Should you Prepare Cash Flow Scenarios?

Always! That’s the simple, short answer. The good planners amongst us are always looking ahead and thinking about potential threats and opportunities. Certainly, when you know there is some sort of crisis coming, the earlier you start thinking about your options the better prepared you will be. Cash Flow Scenarios are paramount during a crisis.

When Should You Review Your Scenarios?

Under normal circumstances, you can get away with reviewing your scenarios once or twice a year. But with a fast-moving crisis, it may make sense to review them much more frequently. As more information comes to hand, think about how it affects your scenarios.

Does it change the balance so that now a different one is more favourable? How will the actions (or inaction) of governments affect your scenarios?

When change is happening frequently, you need to update your scenarios as a range of options become available. There may be opportunities that weren’t available a week previously. Options you had seriously considered could become closed off because of outside influences.

Work with your Advisors

Finally, don’t do this stuff alone if you can possibly avoid that.

Talk over the options with other members of your team as they will provide valuable feedback. Or, ask for feedback from your accountant or bookkeeper. They will have up to date information on what government assistance is available to you and that will help you fine-tune some scenarios.

As a last resort, if you have no-one else, talk it through with your cat. Sometimes just verbalising a problem can help your brain to clarify thoughts and see things differently.

Life in business often feels like a series of crises. By planning and considering multiple cash flow scenarios you will mitigate the current crisis and come through the other end stronger than ever.

If you want to learn more, watch our free Cash Flow Scenario for Crisis Planning webinar recording. If you are new to Calxa, try some scenarios using our free 30-day trial.