Understanding the difference between budgets vs cash flow forecasts is essential for the accurate financial management of any business. This article goes through the essentials of each. You will better understand the differences between budgeting and forecasting and when you need to use each of them.

Table of Content

Understand budgets vs cash flow forecasts

Budgets vs Cash Flow Forecasts

To appreciate the difference between a budget and a cash flow forecast, we need to define the key financial accounting terms:

- What is a budget?

- What is a cash flow forecast?

It is important that you generate accurate management reports and utilise these effectively. Using the Calxa app you can define your budgets and generate accurate Cash Flow Forecast Reports in Minutes. As a result, you will be able to better understand your business and where it is going. Alternatively, if you are an accountant or bookkeeper, you will really get to understand your client’s business.

What is a Budget?

A Budget details what will be done with the actual finances for a specific period of time (usually over 12 months). It includes estimates of revenue and expenses so that you can project your expected profit over this period. In a stable business, the simplest starting point is usually to take the previous year’s actual results and project these forward.

Add an uplift factor for inflation and expected growth to make this more realistic.

There may be still some lines that want more detailed review. The Budget Factory is a great tool to simplify this process and get you started with a first draft of your budget. Use it to get a quick head start on the budgeting process.

Budgeting for Revenue

Income is often budgeted for by starting from the units of product or services that are expected to be sold. This is simpler when the business sells a small range of products or services. However, this is much more complex when there is a mix of products. For example, it is likely to be impractical for a supermarket or retailer with an extensive inventory.

Use Metrics in Calxa for the non-financial drivers of your budgets. Forecast the number of units you are going to sell each month and the expected price. That way you can adjust those numbers to see the effect on your bottom line.

Budgeting for Employment Costs

Salaries and wages are a major expense for many organisations. So, to construct the budget, review staff numbers and salaries. It should include any expected increases. Then, build the budget in blocks to reach the total salary and wages expense. From there, it’s usually simple to add in other on-costs such as superannuation, pension costs and insurances.

Use Metrics as the building blocks of your budget and then add formulas to combine them. By building a simple structure, you’ll be able to model complex scenarios and produce a realistic and useful budget. This video tip gives a quick snapshot on how it works.

The Budgeting Process

The budgeting process is commonly an iterative one. You create the first draft, discuss it with other members of your team. Then, you update the next version.

Do a good review of the expected profit, consider how well it fits the business plan.

Lastly, revise and create the next draft based on the feedback you’ve collected.

Eventually you’ll produce a final version that everyone can agree and sign off on. Lock that in place so you can measure your performance for the year. Be prepared to create a copy and modify it as circumstances change during the year.

Preparing a Good Budget

So, a good budget will:

- Link to both the strategic and business plans.

- Include performance benchmarks that can be monitored.

- Focus pre-dominantly on profit.

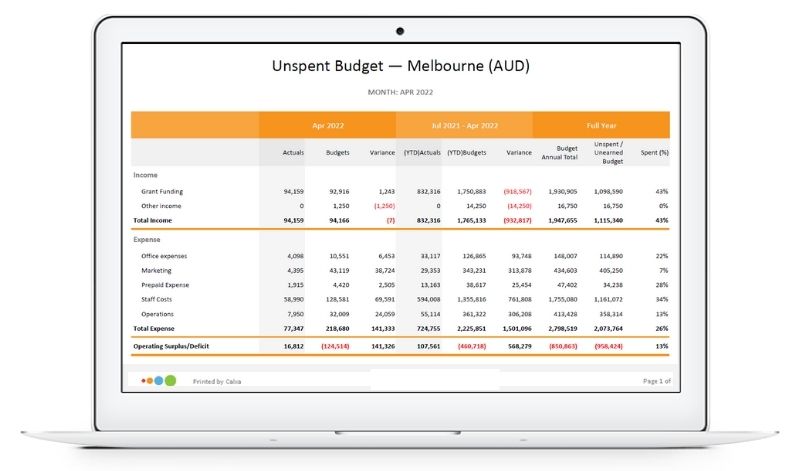

However, a Budget is NOT used to monitor the amount of cash in the bank accounts. That is where the Cash flow Forecast comes in. The picture here shows you one of many report templates that can help you review your budgets and compare them to actual results.

What is a Cash Flow Forecast?

Simply put, a cash flow forecast is a projection, detailing when the receipts and payments are likely to occur. Unless the business runs completely on a cash basis, there will always be differences in timing between the budget and the cash flow forecast. Even when business transactions are recorded on a cash basis, there are always taxes and other liabilities that need paying later.

Forecasting Income and Expenses

Income and expenses are shown in a cashflow forecast in the period when they are expected to be paid. This usually involves some estimate. After all, we are predicting the future.

In traditional spreadsheets, simplistic assumptions were usually made based on everyone paying according to agreed terms.

Modern software applications such as Calxa, can provide more precise estimates based on actual payment activity.

We look at your actual average debtor days and creditor days outstanding to create a profile to model your typical payment patterns. But, at the same time, we give you the flexibility to override this where there are material variations from the norm.

Predicting Balance Sheet Movements

While many businesses keep to just the Profit & Loss for budgeting purposes, a good cash flow forecast requires that the Balance Sheet movements are predicted too.

As well as tax and other government payments, there will be the purchase and disposal of assets, new loans and the repayment of loans to consider. Without these the cash flow forecast is likely to be incomplete and misleading.

You don’t have to worry about the more complex lines in the balance sheet. Calxa calculates the predictions for bank balances, payables and receivables, GST/VAT and similar accounts. Generally, the ones you need to review are the simpler ones.

The Loan Wizard will help you budget for your borrowings, splitting the monthly repayments into the interest and principal components for the budget. You can use an Account Tree to group those 2 movements to show just the one monthly outgoing if you choose.

Preparing a Good Cash Flow Forecast

A good Cash flow forecast will:

- Reflect the projected payments and receipts from the bank accounts.

- Account for capital purchases and private transactions such as drawings.

- Include balance sheet liability payments.

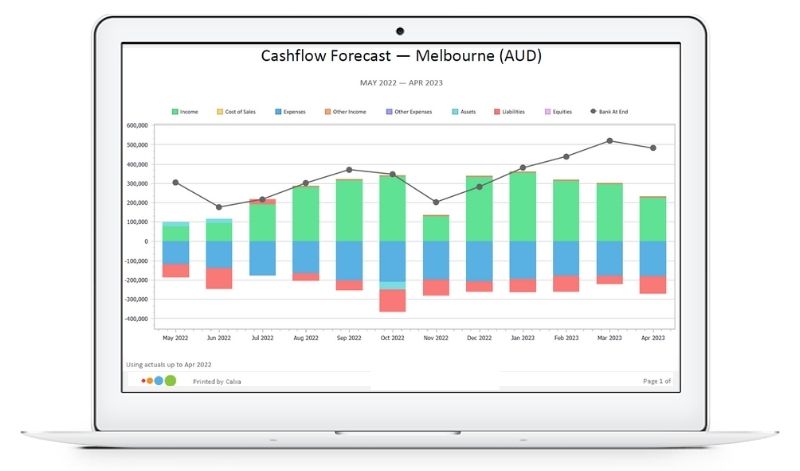

You can see in this picture how the cash at bank is shown in context to your inflows and outflows.

Understand Budgets vs Cash Flow Forecasts

The main difference between a Budget and a Cash Flow Forecast is based on two things:

- The type of transaction

- And, in particular, the timing when receipts and payments will occur.

For example, a Budget will record the income when you have sent out the invoice. In contrast, your Cash Flow Forecast will trace it when you actually receive the amount in your bank account.

You can delve into more detail by reading Budgeting Vs Forecasting.

Difference between Budgets and Cash Flow Forecasts

Budgets are usually created on an accrual or invoice basis to reflect the way transactions are recorded in the accounting system. Revenue, for example, is budgeted based on what is expected to be invoiced each month. This is regardless of when the payment will actually be received. The cash flow forecast will take care of that.

The budget amounts will be displayed excluding GST or VAT. It’s really just the same as the Profit & Loss reports in your accounting system. On the other hand, you will find the cash flow forecast displaying the income and expenses including taxes, with separate tax remittances occurring at a later date.

The budget for wages is the gross wages while the cash flow forecast will show the net wages after tax each month and separate entries for tax payments.

Many businesses don’t go to the effort of creating a Balance Sheet budget for normal planning processes, unless they have major capital expenditure planned. Although it is often a good idea, it’s essential for an accurate cash flow forecast.

In Summary for Budgets vs Cash Flow Forecasts

The core difference is timing. Your budget, like your Profit & Loss report, is based on your invoicing behaviour and will predict your likely profit for the coming year. On the other hand, the cashflow forecast predicts when that translates to cash in the bank.

By building a good profit & loss budget, balance sheet budget and cashflow forecast, you create a full, all-round view of where your business is heading.

Now you know the difference between budgets vs cash flow forecasts. If you are serious about planning ahead for your business, check out Tips to Using the Calxa Budgeting Tool and Foundations of a Great Cash Flow Forecast.

For some light reading, these articles on Tax Flow Planning for Business and How to Manage your Cash Flow for Growth will help you along the way.