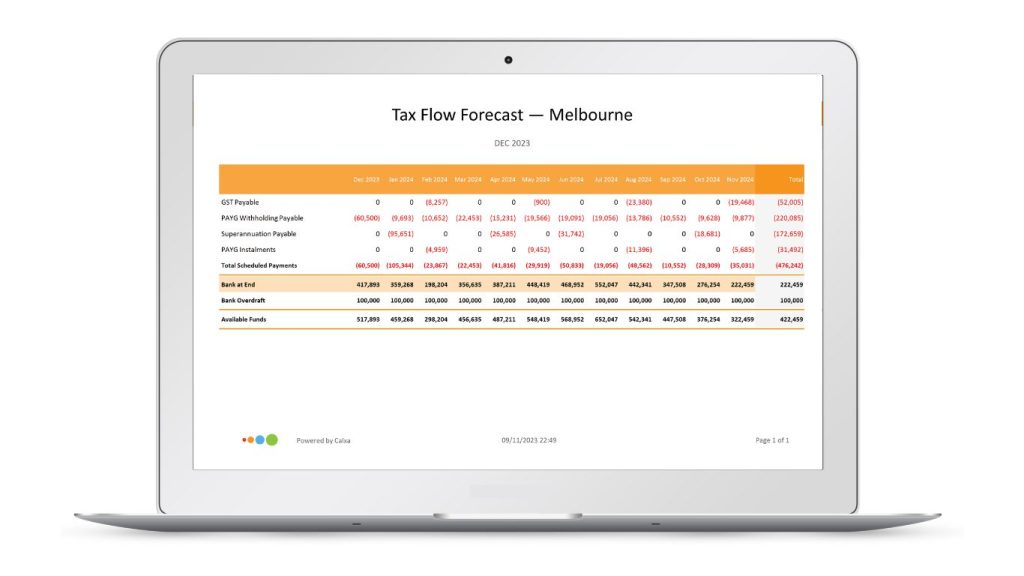

If you sort the Cashflow report templates by popularity, the Tax Flow Forecast is very close to the top. And, for good reason. A Tax Flow Forecast Report is a key tool in planning your taxation payments. It is a report that shows your tax and superannuation obligations for the coming months.

A Tax Flow Forecast will show your GST/VAT, your PAYG/PAYE withheld from wages and your superannuation and pension fund payments.

If you have PAYG or Provisional Tax calculated in Calxa, it will also include that.

The aim of the Tax Flow Forecast is to show your major outgoings at a glance.

The Bank at End line shows your forecast bank balance at the end of each month, so you know how close you are to meeting your obligations.

You could extract this information from your cash flow forecast but we’ve separated it out to make it more easily accessible in one simple report.

How will a Tax Flow Forecast help your business?

Taxes are a major outgoing for many businesses and it’s important to plan so that you have sufficient funds when your payments are due. Depending on the size of your business, these payments can be very lumpy. Rather than a steady monthly amount, they are often paid every 2-3 months and that requires planning to manage well.

Yes, it’s important to look at your overall cash flow requirements. But sometimes you just want to know the tax amounts and that’s what this report gives you.

You can see at a glance what your obligations are and plan how you can meet them.

Checking the forecast bank balance will alert you to potential cash shortfalls. After that, you can review the full cash flow forecast if that’s necessary.

But if the bank balance looks OK and you have a reasonable buffer, sometimes you can get away with a quick glance at the Tax Flow Forecast. And, know you can sleep well at night.

Automated with Report Bundles

Add this report to a Report Bundle, even if it’s the only report in the Bundle. Set the date filter to Rolling Forecast. This will always give you the information starting from the current month.

You can then create a workflow to email yourself the report at the beginning of each month so you know exactly what you’re up for that month and the following months.

How to set up a Tax Flow Forecast in Calxa

If you’ve already set up a budget, there’s not much more you need to do.

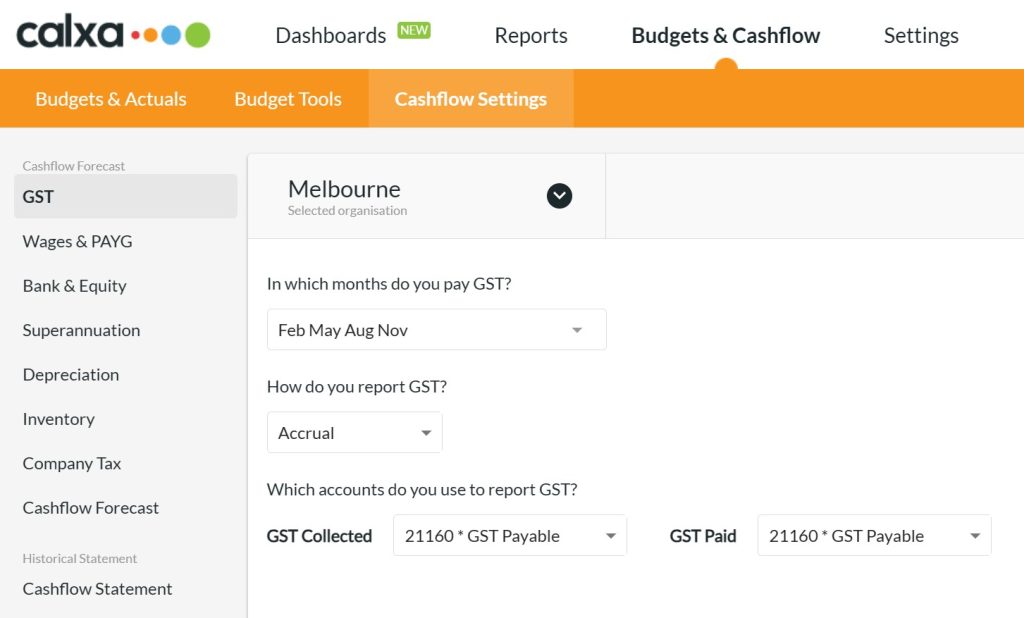

Under Budgets & Cashflow, Cashflow Settings you will find those that govern the timing of your tax and superannuation payments. The ones you need to review are GST/VAT, Wages & PAYG/PAYE, Superannuation or Pension Fund and Company Tax.

Check that the right accounts are selected in each section and that the payment frequencies are correct. If we haven’t set up the schedule you need for your country, it’s easy to create a custom schedule you get the timing right. Then, your report will give you the numbers you need.

Full details on these settings are found in our Help Centre.

Tax Planning with your Accountant

Having the Tax Flow Forecast at hand makes for a great start to a conversation with your accountant. Use this report to discuss how taxes are impacting your cash flow. Or, use it to manage your payment options early so you can plan for that upcoming tax bill. Here are some of our thoughts on Tax Planning with your Accountant.

Planning Tax Payments with your Client

If you’re an accountant or bookkeeper preparing this report for your client, the best time is right after preparing and lodging their Business Activity Statement. Then you know the right numbers and this report will provide them to your client. Giving them an estimate of their next payments will go a long way towards helping them with their cash flow planning.