People sometimes assume that a growing business is less likely to have cash flow problems. However, often the reverse is true. Revenue and profit growth can go hand in hand with a shrinking bank balance. In other words, this is all because of a mismatch in the timing of payments and receipts. It is important to manage your cash flow for growth to survive.

In times of business growth, forecasting and planning for cash flow needs are more important than ever. This article we found outlines the pitfalls to avoid when growing your business.

On a positive note, there are things you can do to manage your cash flow for growth. The critical areas to take into account are listed here:

- Timing

- The Cash Conversion Cycle

- Working Capital Ratio

- Labour Costs and Revenue

- Long term financing for long-term assets

1. Timing is Important to Manage Cash Flow

Managing cash flow for growth all comes down to timing. Growth requires the purchase of inventory, the hiring of staff before the revenue comes in. It’s important to manage the timing carefully to ensure the business survives – there’s nothing more tragic than a business collapsing from cash flow issues just when it’s on the brink of success. Manage the cash flow carefully through the growth period and the rewards will follow.

2. The Cash Conversion Cycle

For a retail, wholesale or similar business, managing cash flow is very much about managing receivables, inventory and payables. This is often represented using the formula:

Debtor Days + Inventory Days – Creditor Days

In general, you want to minimise the first two and maximise the latter – but with care. You need to balance the desire to keep inventory low with the need to have enough stock to satisfy your customers. While you want to stretch out your creditor terms, don’t do so at the expense of relationships with your suppliers. They will have their cash flow issues too so be sure to talk to them if you’re going outside the agreed arrangements. Pay them early when you can to build up some goodwill and they’ll generally be more understanding when you sometimes need to pay late.

The 3 individual components of this calculation are standard KPIs in Calxa. As a result, it is a simple matter to create a new KPI and combine them.

If your cash conversion cycle is negative, you’re in the fortunate position of having your suppliers fund your growth. This typically happens when you sell goods or services for cash and pay on extended terms. It’s one of the reasons that it’s easy to start a café. Your customers pay when they eat but you often don’t need to pay your suppliers till the following month or later.

It is also one of the reasons that it’s easy for a café to fail. Eventually, those suppliers have to be paid and if you have been banking the receipts without thought to the future liabilities, the crunch will eventually come.

3. Working Capital Ratio

The Working Capital Ratio is similar to the Cash Conversion Cycle but looks at the relationship between your Current Assets and Current Liabilities. A ratio of less than 1 (or 100% if expressed as a percentage) is generally seen as an early sign of potential problems.

Current Assets includes not just your Receivables and Inventory but also bank balances and anything else that can be soon turned into cash. Current Liabilities incorporates your Payables but also credit cards, tax and payroll obligations and any short-term financing.

When a business is growing there can be periods where the liabilities increase temporarily before revenue comes in – but this requires regular forecasting and careful management.

This is a default KPI in Calxa. While the Current Assets and Current Liability Account Groups are pre-defined, review and edit them to make sure they fit the needs of your organisation.

4. Labour Costs and Revenue

A growing business that relies on sales staff, or any significant inputs of labour, face different cash flow challenges. There is often a stepped nature to the increases in wage costs and a delay before the new people contribute to revenue. When adding new sales staff, for example, you may need to budget for several months of costs before there is an increase in revenue.

5. Long-term financing for long-term assets

One trap that is easy to fall into is to purchase long-term assets (such as equipment or vehicles) using cash or short-term loans. Ideally, the financing for an asset should match the expected life – so that your business pays for it over time and it doesn’t eat into your short-term working capital.

Use the Loan Wizard – you will find it under Budget Tools. It will help you predict the repayments for different loan options and to budget for a loan once it is confirmed.

Plan your Cash Flow for Growth

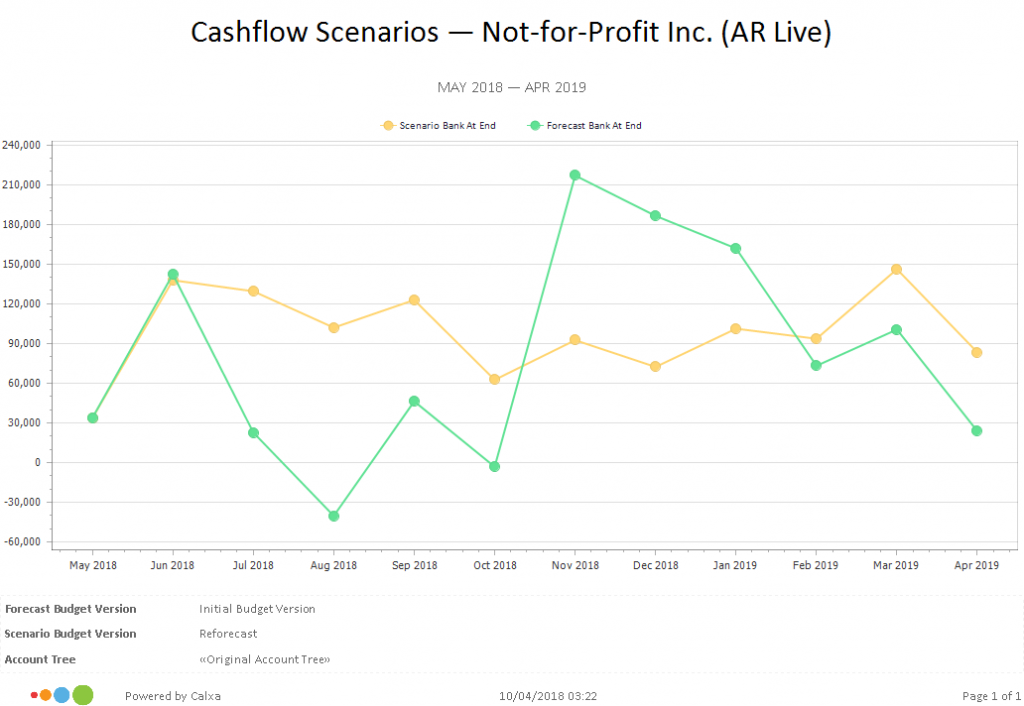

In summary, the key to successfully managing cash flow to growth is planning. Estimate your revenue and expenses and use that to forecast your cash flow. Follow this step-by-step cash flow projection checklist to guide you. It’s prudent to create two or more budgets to fit different scenarios. Business people are inherently optimistic – that’s why we are in business – but it pays to look at what things would be like if the revenue was less than you expect.

Manage your cash flow well and your business will thrive and grow. You can find more information on how Calxa can help you with your business cash flow.