Analysing the Balance Sheet covers an area many business owners stay away from. Most entrepreneurs are familiar with the Profit & Loss or Income Statement. The Balance Sheet is less commonly used and many people find it mysterious and hard to understand. If you consider that it shows the position of your business at a point in time, it’s easier to make sense of it all.

While the Profit & Loss report shows how much money you’ve made over a period of time, the Balance Sheet (also known as the Statement of Financial Position) lists your assets, liabilities and equity as they are valued at a particular date. This blog What does a Balance Sheet Tell Us? provides a short but concise explanation to help you better understand the balance sheet.

How to Analyse the Balance Sheet of a Company

It’s often hard to assess a balance sheet in isolation. Having something to compare it to is the key to understanding what’s happening and what’s changed. To make this easier, Calxa has several Balance Sheet reports that will help you understand your business better.

Balance Sheet with Prior Period

Understanding how your balance sheet has changed over time is a good way to gain an understanding of your business. Furthermore, there are so many questions to be answered:

- Have your assets increased or decreased?

- Which lines stay the same and rarely change?

Fixed assets such as buildings, equipment and vehicles are typically stable for many businesses. While bank accounts, debtors and creditor accounts often change daily.

The default setting for this report is to compare the current month to the last month of the previous financial year. This gives you a good view of what’s changed since then. Alternately, you can choose to compare your current balance sheet against the previous month to see short term changes. Some people like to compare this month to the same month last year, or even 5 years ago, for the longer-term perspective.

For those of you for whom one is never enough, there is also the Balance Sheet with 2 Prior Periods report. Use this if you want to compare your Balance Sheet with, for example, the previous month and also the same month one year ago. This will show the short-term as well as the longer-term movements. The benefit of comparing to the same period a year ago is that you will be in the same seasonal point of your business cycle.

Balance Sheet Actual vs Budget

Budgets are traditionally used for measuring performance in the Income and Expense areas, but they are also relevant to the Balance Sheet. The comparison is especially important in the fast-moving areas such as inventory levels. Having too much cash tied up in inventory will reduce what you have for other purposes so monitoring the inventory balance has its rewards.

The Balance Sheet budget in Calxa always starts with the balances from the beginning of the current financial year. Then, it applies the budgeted movements to them. In the case of accounts like bank, debtors, creditors and taxes, it’s the calculated movement. Making Sense of Balance Sheet Budgets is a good guide to work your way through this step-by-step.

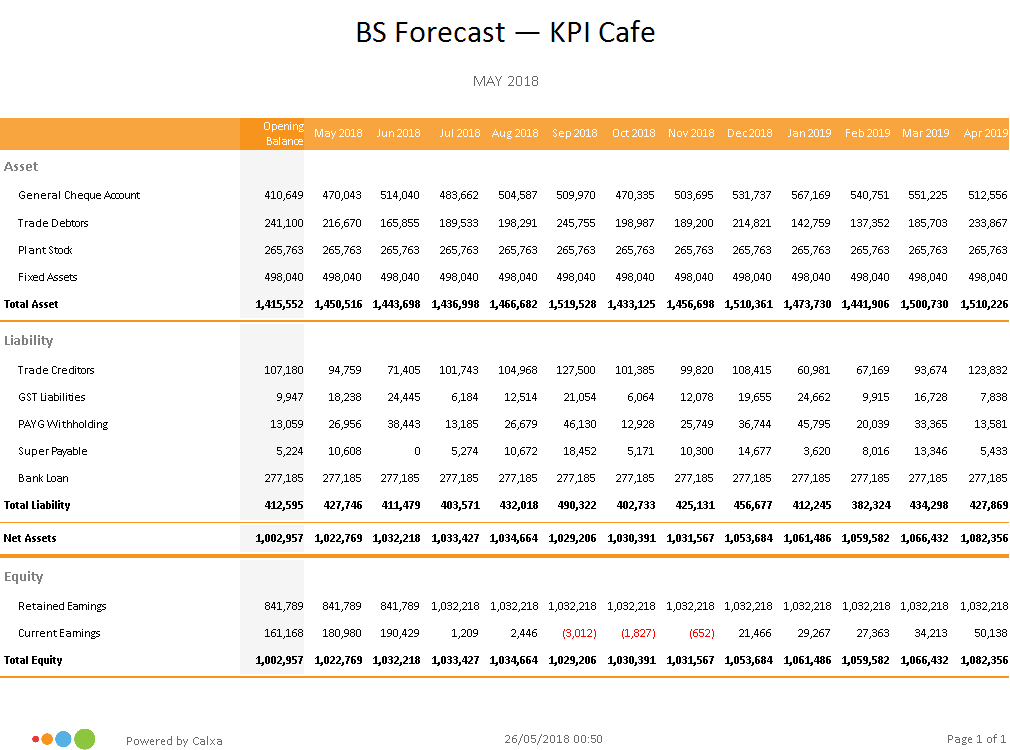

Balance Sheet Forecast Reports

To see what your Balance Sheet is likely to look like in the future, there are 2 options. First, the Balance Sheet Forecast. This report starts from the balances at the end of last month and then projects each line forward into the future. This is a popular report with banks to supplement the Cash Flow Forecast.

Secondly, have a look at the Balance Sheet with Projected Total. This typically starts from the beginning of the financial year and shows Actuals for the completed months and projected balances for the future months. Either way, you get to see the trends in your changes over time and that will increase your understanding of the dynamics of your balance sheet.

Multi-Company Analysis Reports

Any of the Balance Sheet reports in Calxa can be run for a consolidated group of companies. The ‘Balance Sheet Comparison’ Report shows each company side by side which is really helpful in giving you an overview. While this report defaults to giving you Actuals for each company, you can use it to show budget or forecast values.

Turn off the Using Actuals up to option and you’ll get the budgeted balance sheet for your reporting month. After that, set Using Actuals up to last month and your reporting month as a date in the future. This means you will get a forecast at that date, comprising actuals up to last month and budgets from there on. This will then compare directly to the results in the Balance Sheet Forecast Reports above. Use this report to troubleshoot multi-entity forecasts by reviewing the individual companies at any point.

In addition, use an Account Tree with a Header to group inter-company loan accounts to check that they all balance. You’ll see the positive and negative movements by company and the total column should be zero. Again, this will help with troubleshooting discrepancies.

Other options for Balance Sheet Reporting

There are two other reports that include Balance Sheet information. Ultimately, both of these will help with analysing the balance sheet.

- The Bank Movement Report

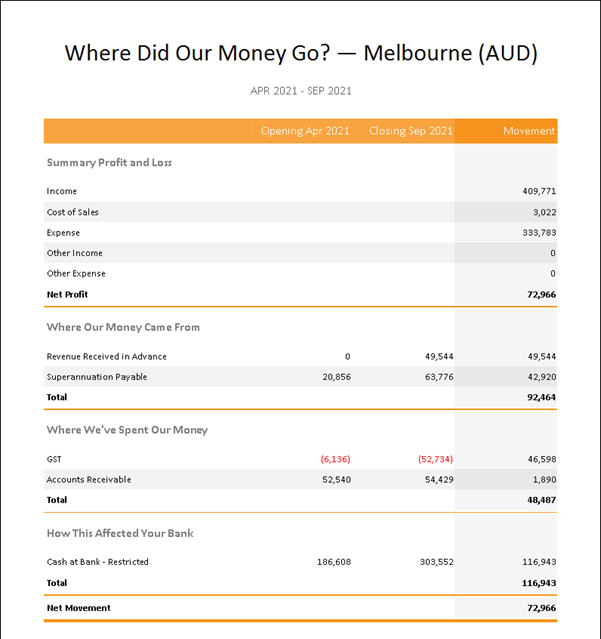

- Where Did Our Money Go?

The latter reconciles your Net Profit to the movement in your bank account by showing the changes in the Balance Sheet. These changes are grouped into ‘Where Our Money Came From’. Essentially, this is how we funded the business. The other changes are highlighted in ‘Where We’ve Spent Our Money’. Simply, this is what we’ve done with the funds.

The ‘Bank Movement’ is slightly different. Essentially, it starts from the opening balance of the bank account, shows your Profit & Loss accounts and then the movements in the Balance Sheet accounts. To finish it off, it ends with the closing bank.

Analysing the Balance Sheet for Business Insights

Your Balance Sheet contains a wealth of information about your organisation and you will learn a lot from analysing the balance sheet regularly. If that’s not something you are used to, start with one of the comparison reports or ‘Where Did Our Money Go?’. You’ll become familiar with the regular values and you’ll learn to quickly spot problem areas. To better understand the importance of balance sheet budgets have a read of our blog article Making Sense of Balance Sheet Budgets.

Above all, your accountant or bookkeeper is a great source of advice if you’re not sure on anything. To extend your knowledge from here, we recommend you read our article Balance Sheet Analysis with KPIs. This article will dive into deep analysis of the balance sheet with ratios.