Overhead Costs. Every business has them. But how do you manage them? How do you define overheads into the costs of your projects? That’s something that can make a material difference to the profitability of a project so it can be important to include in your budgets. Here’s some tips on how to do that in Calxa.

We’ll mostly work with Calxa Metrics in this example. We will assume that all of our overhead costs are allocated to one business unit and we want to reallocate them each month to other business units. For this example, we will allocate them based on the number of full-time employees in each business unit. You may use a different basis for your allocation but the principles will be the same.

Setting up the Metrics for Overhead Costs

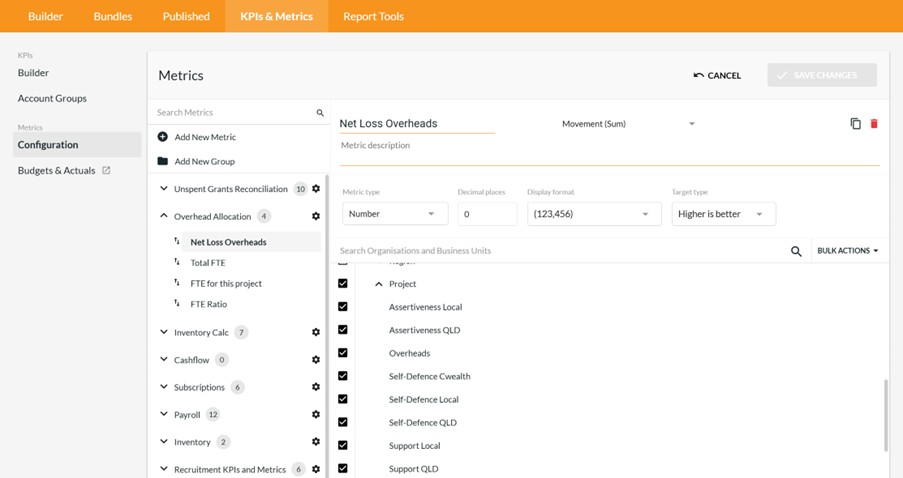

In Calxa, you’ll find Metrics under Reports, KPIs & Metrics. From Metrics, Configuration you can add new metrics. Adding a group to keep them separate from other metrics will make it easier to manage them, especially as you expand your use of metrics over time.

As you add each metric, choose the business units that they apply to. This will reduce clutter in the budget editor by only showing you relevant metrics.

Let’s look at each metric.

Net Loss Overheads

This metric is used to capture the Net Profit or Loss on the Overhead business unit. Typically, it will be a loss as most people don’t allocate revenue to the overhead department.

Total FTE

This is used to track the number of full-time employees in the organisation.

FTE for this Project

The number of full-time employees (or equivalent) allocated to a particular project.

FTE Ratio

This metric will calculate the ratio of FTEs on this project compared to the total. It will give us the basic setup for our exercise.

Recording Actuals and Budgets for the Metrics

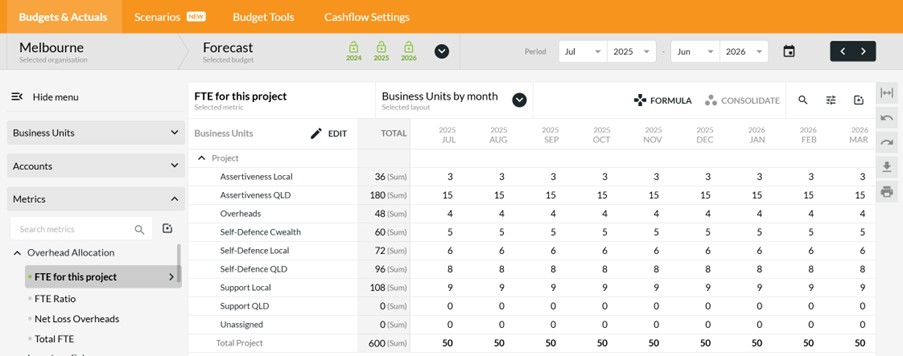

Expand the left menu in the Budget Builder so that you can budget by metric. This will be simpler than jumping from business unit to business unit.

FTE for this Project for Overhead Cost Calculation

Enter the monthly budget for the number of employees allocated to each project. Switch to actuals to populate the actual numbers for past periods. From now on, you will update this each month.

Total FTE

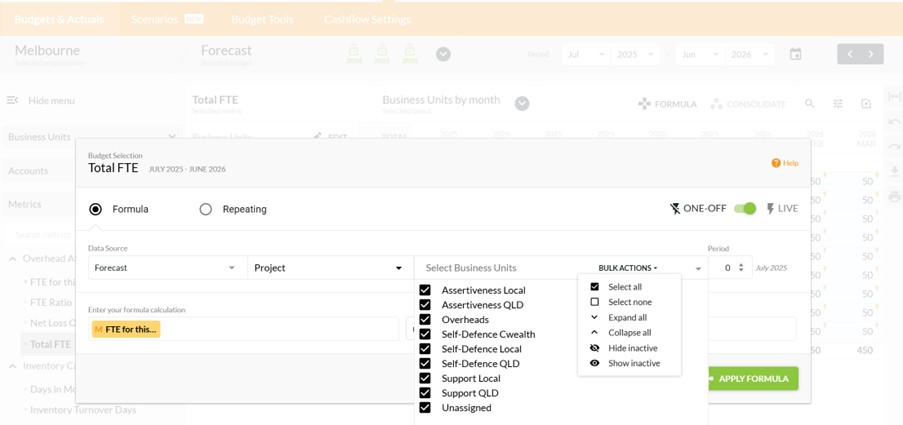

You can calculate the total number of employees with a formula. Choose the Total FTE metric on the left and then select all the rows and Formula.

For the data source:

- Choose Project (or whatever your business units are called).

- And then in the Bulk Actions, Select All.

The formula calculation needs the FTE for this project metric on the left side. That will sum them across the projects. Make sure to set the formula to Live and Apply Formula.

Use the same method to calculate the Total FTE for the Actuals.

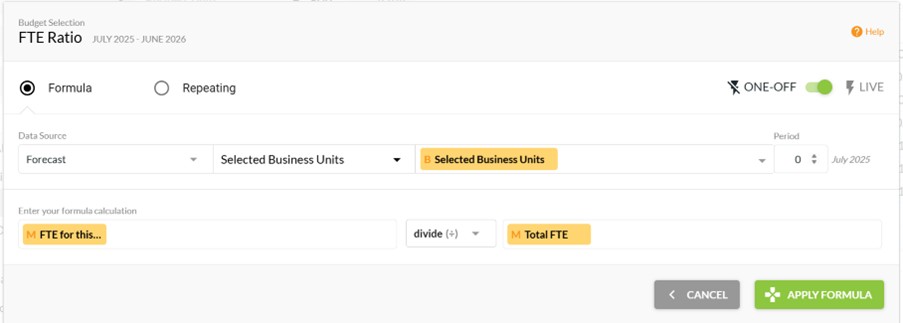

FTE Ratio

To calculate the FTE Ratio you can again select all the rows and create the formula in one go. The difference this time is that the Data Source should reference Selected Business Units. That’s the equivalent of a relative address reference in a spreadsheet. Each project will refer to the other metrics in the same project, rather than another.

Then the formula itself is simple: FTE for this project divided by Total FTE.

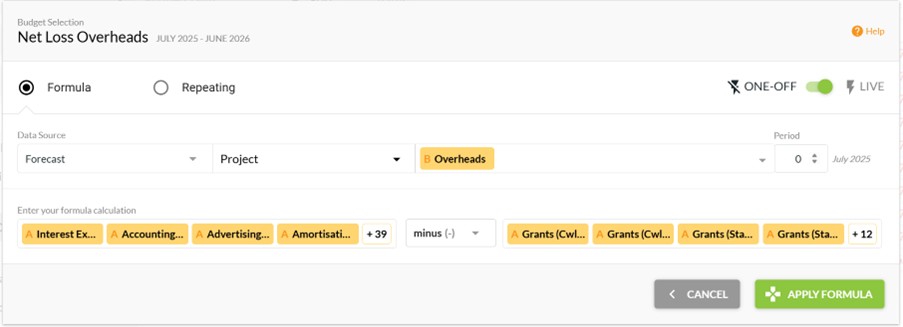

Net Loss Overheads

To calculate the net loss on overhead costs, set the Data Source on the formula to the Overheads department.

- On the left side select your Expense accounts.

- On the right your Income and Other Income accounts.

If you’re absolutely confident there will never be any income allocated to the Overhead department, you could just do Expenses on the left.

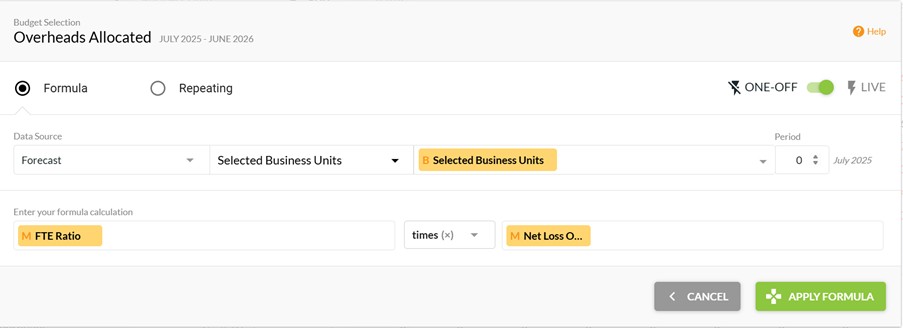

Allocating Budgets for Overhead Costs

Now, assuming we have an account for Overhead Allocation, we need to allocate a budget for the overhead costs each month.

For all the projects apart from Overheads, the formula will be FTE Ratio times Net Loss Overheads.

Use Selected Business Units as the data source as you want the ratio relevant to that project.

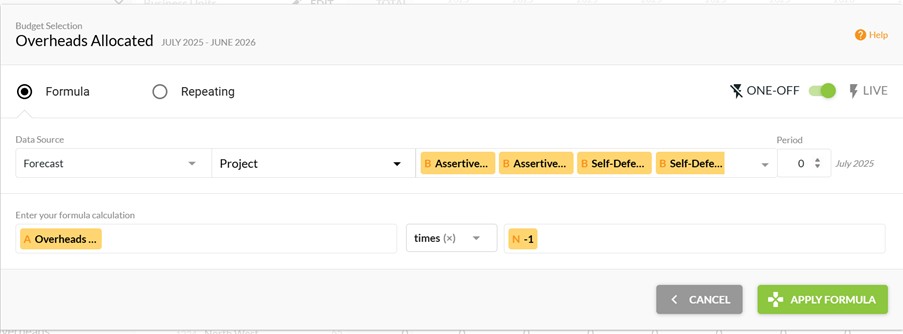

Set the formula separately for the Overhead project.

- The data source will be all the other projects.

- Whilst the formula will be the Overheads allocated account times -1.

If you’ve done everything right, the total for the Overheads Allocated account across the organisation should be zero.

Getting the Overhead Cost Actuals each Month

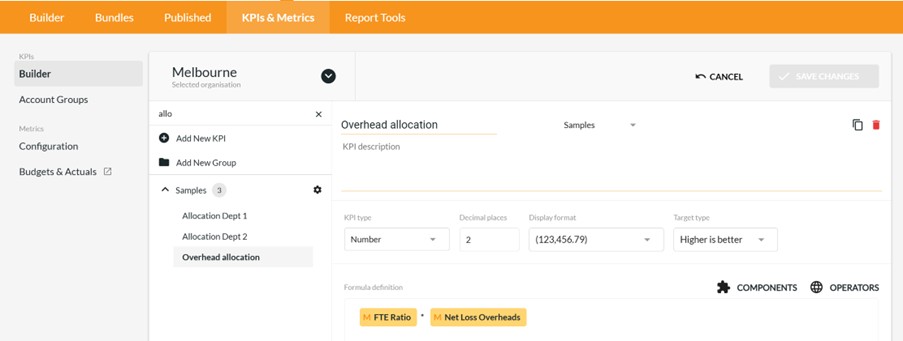

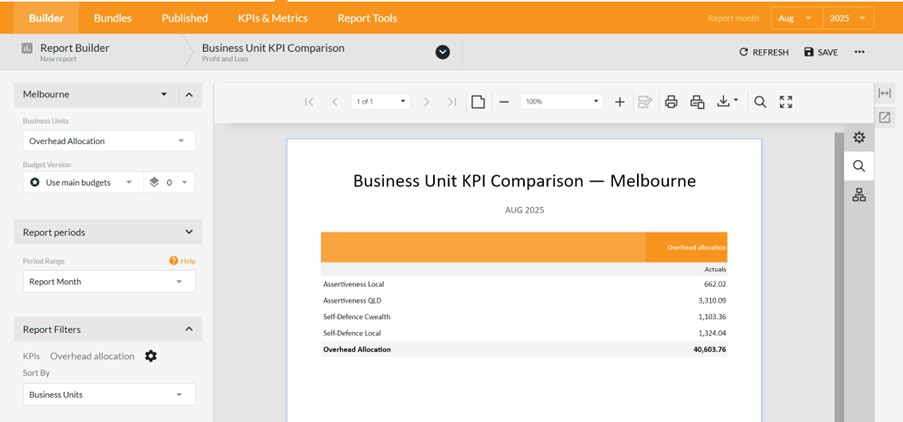

Create a KPI for the Overhead Allocation each month, based on:

FTE Ratio * Net Loss Overheads.

Then use the Business Unit KPI Comparison report to get the amounts for the month just ended.

Use this as the source for your journal in the accounting system. Calxa can’t enter the overhead cost allocations for you but you now have the data to make that happen.

You’ll now be able to budget for your overhead costs by departments each month and record a journal for the actuals. That’s one job ticked off your list!

If you work in more bespoke industries like construction, this guide will help you understand overhead allocation in this setting.

In the meantime, you can find more Calxa budgeting tips here.