KPIs for cash management provide businesses with a quick way of monitoring availability of cash. Unless you have the luxury of a few spare millions sitting idle, managing cash is important for every organisation. Here, we discuss our selection of the important KPIs for cash management every business should monitor.

While a cash flow forecast is the best way to predict what’s likely to happen in the coming months, there are some KPIs for cash management you want to consider. They can give early warnings of impending problems.

7 Important KPIs for Cash Management

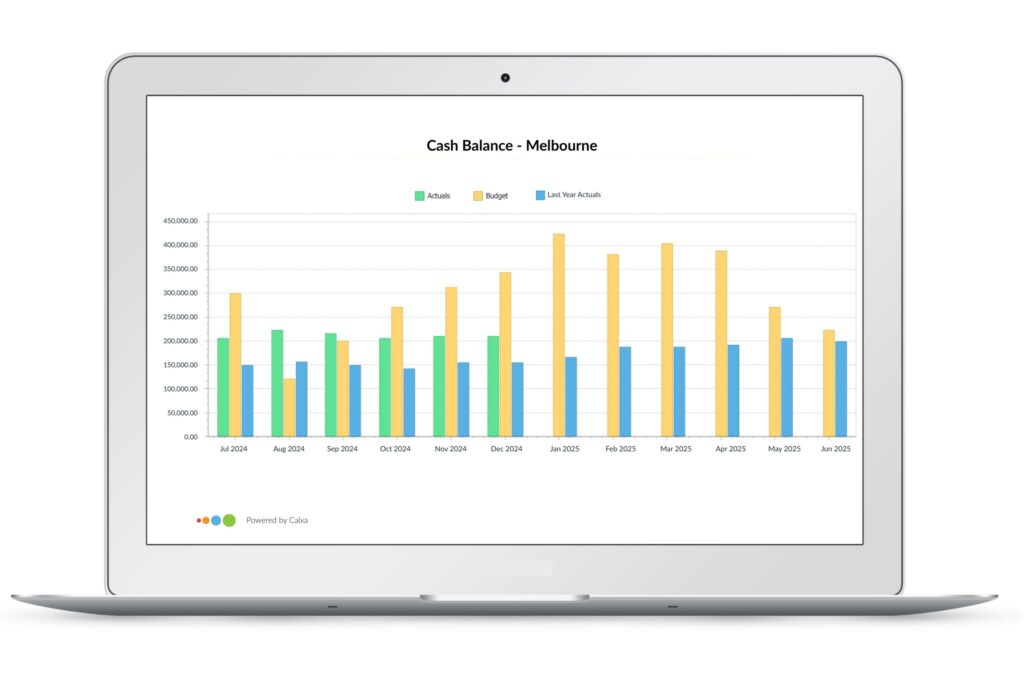

1. Cash Balance

It may sound obvious but don’t overlook the obvious! If your bank balance is trending downwards over time, you need to understand why. Many businesses have seasonal ups and downs and that’s perfectly normal . So, compare to the previous year as well as the last few months and watch for steeper or longer declines than normal.

Cash Balance is a default KPI in Calxa so available to everyone. It’s based on the bank accounts nominated in your Cashflow Settings. To make this easy, you can edit the Account Group and add or remove accounts to suit your needs.

2. Debtor Days & Creditor Days

How good is your collection process and are you letting it slide? When you’re busy working in the business, it’s easy to take your eyes of some of the less immediate tasks, especially when you think you have good systems in place. Watch out for a lengthening of the Debtor Days KPI as it suggests your customers aren’t paying you as quickly as they should and that’s going to affect your bank balance in the future.

While stretching out your payment terms can be beneficial for your cash balance in the short term, you should be wary of doing so at the expense of supplier relationships. Always talk to your suppliers if you’re having difficulty paying. And if you’re having difficulty paying your suppliers, it’s a sign to look at the underlying causes of that. Is it something temporary or does your business have long-term funding problems? Consider getting advice before you slip into insolvency.

3. The Cash Conversion Cycle

This KPI measures how long it takes you to convert the goods you buy into cash. It adds your Inventory Days (how long you hold stock) to your Debtor Days (how long your customers take to pay you) and deducts your Creditor Days (how long you take to pay your suppliers).

Inventory Days + Debtor Days – Creditor Days

The aim is to minimise the first two (sell stock quickly and collect the cash quickly) while maximising Creditor Days (again, within the terms that maintain good relationships with your suppliers). A business that gets paid in cash before ordering goods, could have a negative Cash Conversion Cycle. This is great in the short term as your suppliers are effectively funding your growth – but be careful that you are building reserves to be able to pay those suppliers eventually.

You can easily create this KPI yourself as the underlying components (Inventory Days, Debtor Days and Creditor Days) are in-built KPIs. Build your Cash Conversion Cycle KPI by selecting the other KPIs and getting the right operators between them.

4. Working Capital Ratio

The Working Capital Ratio compares your Current Assets (those things you own that could be converted to cash reasonably quickly) with your Current Liabilities (what you owe that is due in the next 12 months). A value of less than 1 (sometimes expressed as 100%) is considered a sign of a risky business. It says that for every dollar you owe, you have less than a dollar in assets and that’s a sign you could have trouble paying. Maybe not today but next month or in a few months if things don’t improve.

5. Cash Reserves in Days

This is a measure of how long your organisation could survive if cash dried up tomorrow. It takes your average daily expenses (excluding non-cash items like depreciation) and compares that to your current bank balances.

Cash Reserves/Average Daily Expenses

If you have more than 90 days reserves you are in a comfortable position and should be able to withstand short-term shocks to your business. While income completely drying up is an extreme case, it does happen in natural disaster incidents or global pandemics. And there are also the less extreme cases where you lose just one major customer. It may not be as severe as everything drying up but it will strain your business without those reserves. This number is arguably one of the more important KPIs for cash management.

Watch this video for a quick overview of how to create it.

6. Operating Cashflow

The idea with Operating Cashflow is to look at the cash that is being generated by your business each month. Start with the Net Profit figure, add back non-cash items like depreciation and then add in changes in working capital. This considers your collections and any increases or decreases in what you owe to suppliers. The Operating Cashflow KPI is often used by investors and potential buyers of a business (sometimes excluding the owner’s wages too) to measure how much cash the business is generating each period.

Net Profit + Non-Cash Expenses + Change in Working Capital

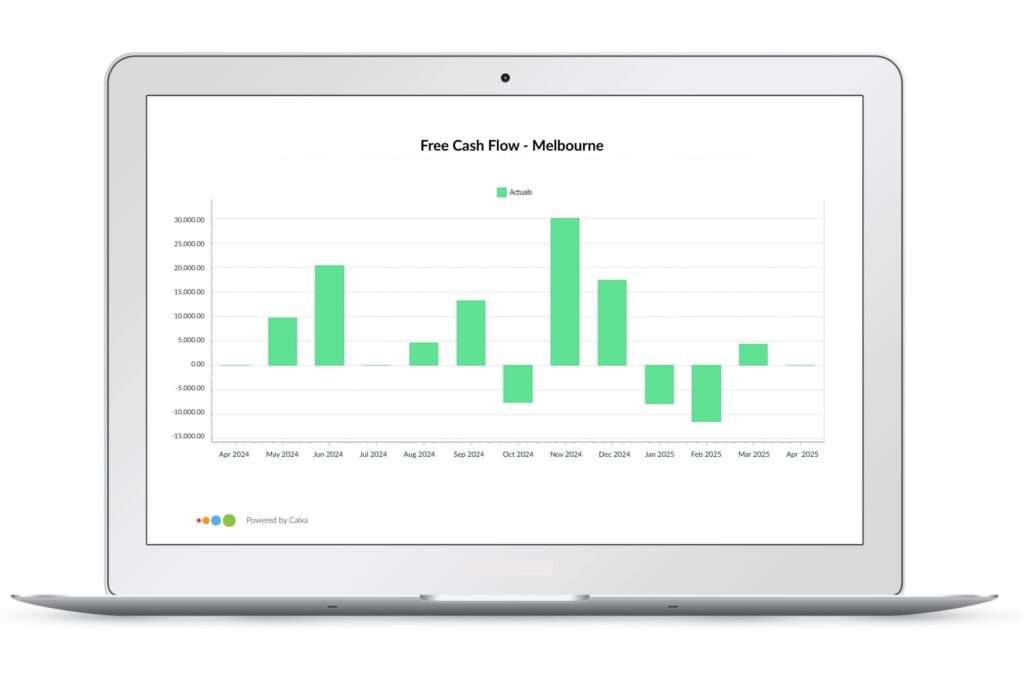

7. Free Cash Flow

Free Cash Flow expands on the Operating Cashflow concept by also excluding interest payments (which are considered a finance cost) and including asset purchases. Like most KPIs, it’s the trend that is most useful in analysing whether a particular value is ‘good’ or ‘bad’. If the Free Cash Flow generated by a business is declining over time, that suggests underlying problems that aren’t yet showing up in profitability. Be aware though, that because Free Cash Flow includes capital purchases, it can be subject to big variations when those purchases occur.

Operating Cashflow + Interest – Capital Expenditure

KPIs for Cash Management

Not all these KPIs for Cash Management will be relevant to your organisation, or not all the time. Review them all first and then pick the ones that are likely to reveal your problems so you can address them early. Add a chart for each to your monthly report bundle. Alternatively, create a separate bundle if you distribute this information to a different group of people.

KPIs for cash management are important as early warning signs of impending trouble so that you can take action while there is still time to prevent the worst. You can adjust KPIs to your industry needs. Here are a couple of articles to help you along. Have a read of KPIs for Retailers and KPIs for Dairy Farms.

To get started, follow our KPI Guide and watch this KPIs for Cash Management Webinar Recording.