5 Ways of budgeting made easy walks you through the steps of doing your budgets in the Calxa app. Essentially, Calxa is the smart alternative to preparing budgets in a spreadsheet. If you are looking for ways to make your business budgets easy to prepare, read on.

It Doesn’t Need to Be Complicated

Here are the five ways that building budgets is made easy.

- Budget Factory

- Export and Import

- Layouts and Totals

- Driver-Based Formulas

- Managing Scenarios

1. Bulk Creation in a Jiffy

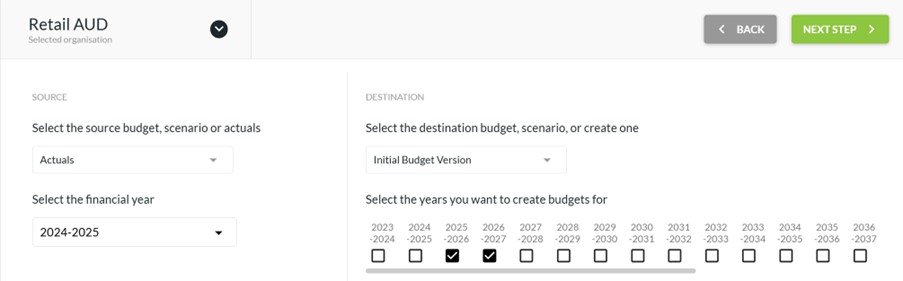

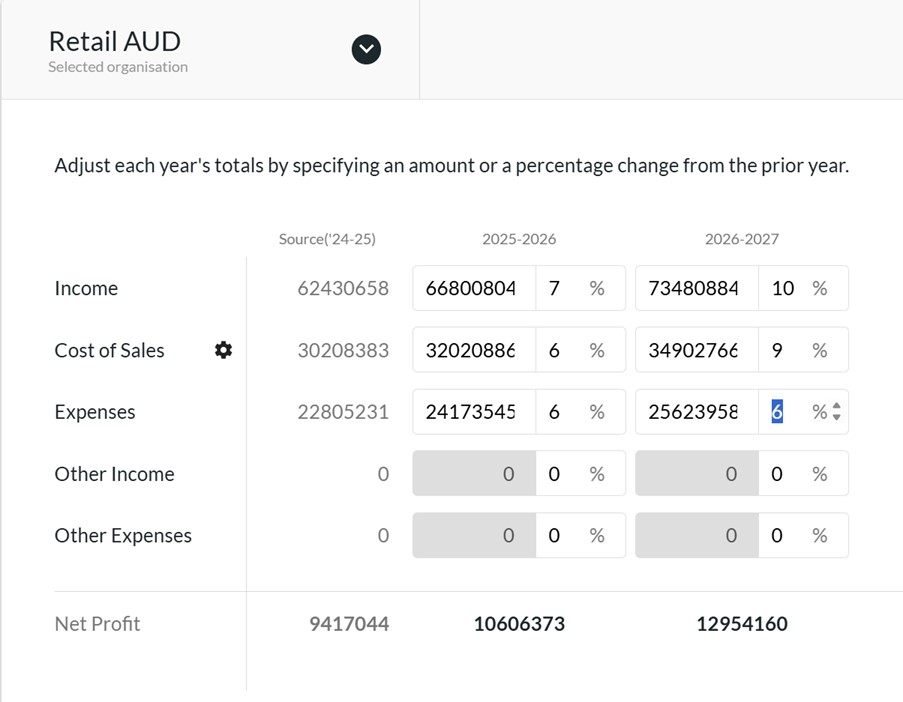

There are times when you want to make big changes to a budget. Creating a draft for next year, for example. Or, changing this year’s income by 10% on every project or department. The Budget Factory is the ideal tool for this job and makes bulk changes to your budgets effortless. Here are some good examples of when to use the Budget Factory:

- Choose the source data, such as last year’s actuals or budgets and copy that, with some adjustments, for up to 10 years ahead. Note that if your source is current year actuals, the Budget Factory will use your main budget for the rest of the year so you get a full year budget in the destination.

- If you’ve imported your budgets from your accounting system, choose the Xero Budget or QuickBooks budget as the source to copy it to an editable Calxa budget.

- You can run it for the organisation budget, for projects or departments. In addition, you can update one year or 10.

- It’s perfect for copying from one budget to another. For example, from your current forecast to save as the Original or Approved Budget. Simply, lock it in Budget Manager to ensure no-one makes any more changes then.

- Alternatively, you can choose to start from your desired net profit. Just change the option on the Cost of Sales line and set the profit you want to make. After that, it will show you the income you need to earn to achieve that as well as the related cost of sales and expenses.

- The Budget Factory is also useful when you want a forecast based on Actuals to date and the previous forecast for the remainder of the year. Make sure the previous forecast is set as the main budget, use Actuals as the source and away you go!

2.Bring your Own

Especially when you are starting out with Calxa, the best way of making your budgets straight-forward is to work with what you already have. Whether your existing budgets are in your accounting system or in a spreadsheet, it is a simple process to bring them into Calxa.

Most accounting system budgets can come across with the regular sync but you will need to select the option first. You can do that in Settings, General. For your spreadsheets or budgets from other systems, we’ve built a flexible import process to help match the columns from your export and bring them in.

If your existing spreadsheet layout won’t import easily, all is not lost. Simply export a blank budget template, copy your numbers onto it and then re-import. Simple!

3. Layouts and Totals

The Budget Builder is where all the work gets done but structured in a way that works for you. We realise that life isn’t always straight-forward, so we’ve given you some choices. Work the way you want to work!

Project or Department Budgets

Budget at the project or department level and then automatically roll them up to the organisation budget. You can even budget for combinations of business units. Choose the date range for your budgets to suit your needs. You’re not constrained by a financial year but can choose a calendar year, the current quarter or more. Set a custom date range if you want to budget across financial years. For example, if you have a project that starts in February and ends in November, set just that date range and enter it all in one go.

Choose your Budget Layout

You have a swag of options and ways to work in your budgets.

- Use the left column to choose how you want to see your budgets. Your options include to lay them out by:

- Organisation

- Business Unit

- Account

- Metric

- Then, adjust the layout to view it by:

- Month

- Quarter

- Year

- Finally, filter them to show just the rows you are interested in, or to display accounts using an Account Tree.

When you edit a total, whether it’s a row or column, we will spread your changes proportionately over the underlying detail rows or columns. If there are no existing values, we’ll spread the total evenly over your chosen months or accounts.

Choose Accounts in the left menu and you can select one account and easily adjust the budgets for each of your projects or departments. This is especially useful when you want to apply the same formula across departments. For example, choose your Purchases account, select all the departments and you can set a formula based on the income accounts.

4. Driver-based Budgets and Formulas

Budgets are never just numbers. There’s usually some calculation behind them and the budget formulas in Calxa make that easy for you. With formulas, you can set one account as a percentage of another single account or a selection of accounts. Date offsets in formulas let you work with monthly or annual increases.

When you want to build driver-based budgets, Metrics are the key. Create the components that drive your numbers, enter actuals and budgets for them and then build the top-level budget from them. Start simple but you can handle some complex scenarios like payroll and invoice factoring.

5. Managing Scenarios

One plan is never enough. There are always alternate futures that you want to map out. What if things go well? What if things go badly? You can manage these scenarios easily with the Scenario Manager.

It gives you the tools to create and group your scenarios and to archive them when you no longer need them. When you edit your scenarios, budget for the changes you expect from that scenario. You can then use Preview mode to see how they affect your main budget or forecast. Combine 1,2 or more scenarios to consider the best options for your business.

If your scenario revolves around a new project that doesn’t yet exist, and may not, add an Unlinked Business Unit. That’s one that’s not connected to your accounting system. Use it in your scenario budget to record the anticipated revenues and costs of your new venture. Run the cashflow scenario report to then compare the cash effect of the new project and use that as part of your decision-making process. If the project goes ahead, you can push the new business unit into Xero, MYOB or QuickBooks. If not, delete or archive it.

Budgeting Made Easy in Summary

Need to know more about easy Calxa’s makes building budgets? Have a look at the Tips to Using the Calxa Budgeting Tool and our webinar recording Preparing Next Year’s Budget, where we walk you through the steps one by one.