An invoice factoring loan is a popular form of debtor finance in some industries. It provides working capital by giving quicker access to cash, especially for businesses with longer payment terms on their invoices. While it does complicate the process of forecasting cash flow, the challenges are surmountable.

What is an Invoice Factoring Loan?

Factoring is an alternative to a bank loan. One of the main benefits is that the invoice factoring loan is secured by your outstanding invoices, not by physical assets. As long as you have good quality debtors, a factoring company is likely to look favourably on your application.

The factoring company will typically advance you 85% of the value of your outstanding invoices each month. At this point, they usually take responsibility for collecting payments from your customers. When they have received all payments, they will pay you the balance, less their fee. The fee is typically around 2-5%.

How Does an Invoice Factoring Loan Affect your Cash Flow?

The big challenge with invoice factoring loans is estimating the future value of the of the amount that is funded. In most cases, this is the movements in that liability account for the loan. Where your customers are fairly reliable at paying on time, or close to on time, you can usually come up with a reasonable estimate.

Example of How Factoring Plays Out on the Cash Flow

In this example, our invoice factoring loan company pays 85% of the debtors. Generally, the customers pay in the month after the invoice. The movement in what we owe the factoring company is thus the difference between the amount factored this month compared to last month. To forecast the payment timing, we will need a layered set of formulas.

- Set Factoring Rate

- Calculate the Amount Factored This Month

- Select the Data Source for Actuals + Budget

- Calculate the Amount Factored Last Month

- Create Formula for Loan Movement in the Balance Sheet

- Group Sales Receipts for Cashflow Reporting

Let’s do it step by step.

1. Setting the Factoring Rate

There are a couple of different ways of achieving this.

Option One

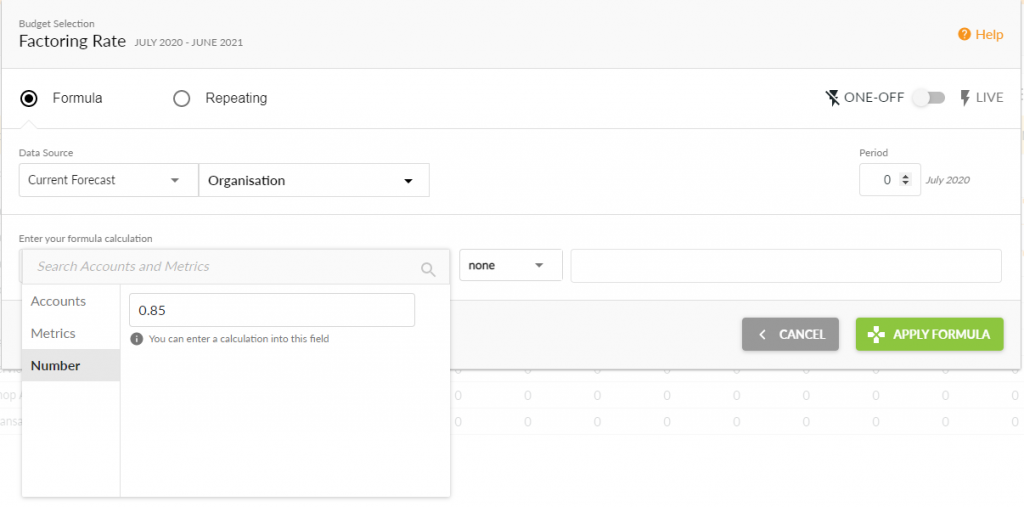

Simply set up a formula that references a number which is your factoring rate. Something like this.

Note that you can leave this as a one-off formula as there are no dependencies.

The benefit of doing it this way is that you can simply change the formula in future months if the percentage factored changes. Also, it is quick to set up.

Option Two

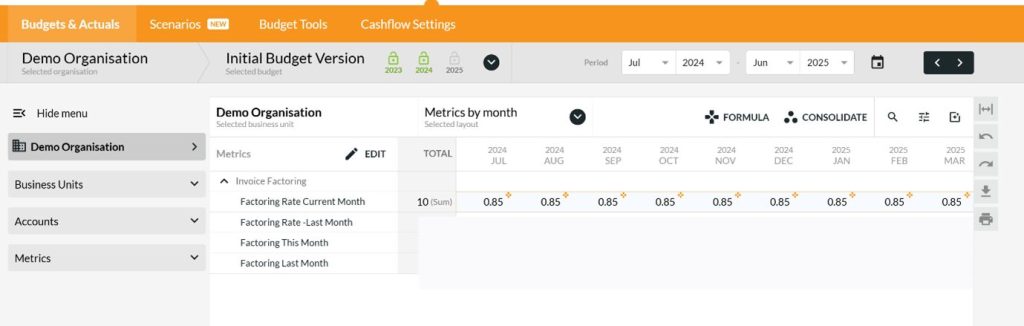

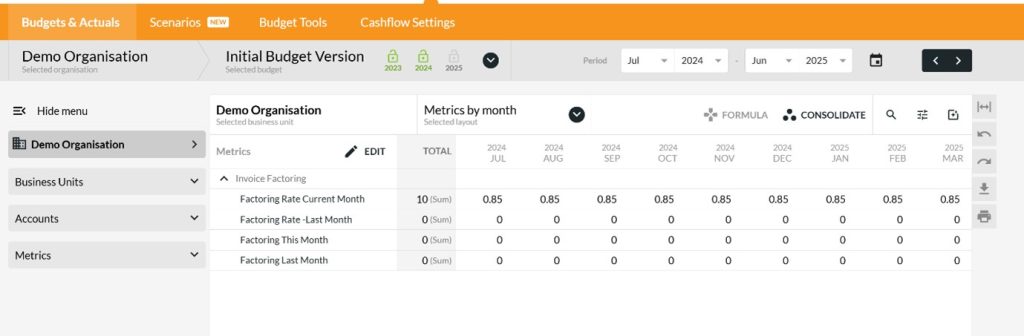

You can achieve the same adding a Metric for the invoice factoring loan rate. You could do this by just entering 12 x 0.85 (10.2) in the total column so it spreads evenly over the year.

2. Calculating the Amount Factored This Month

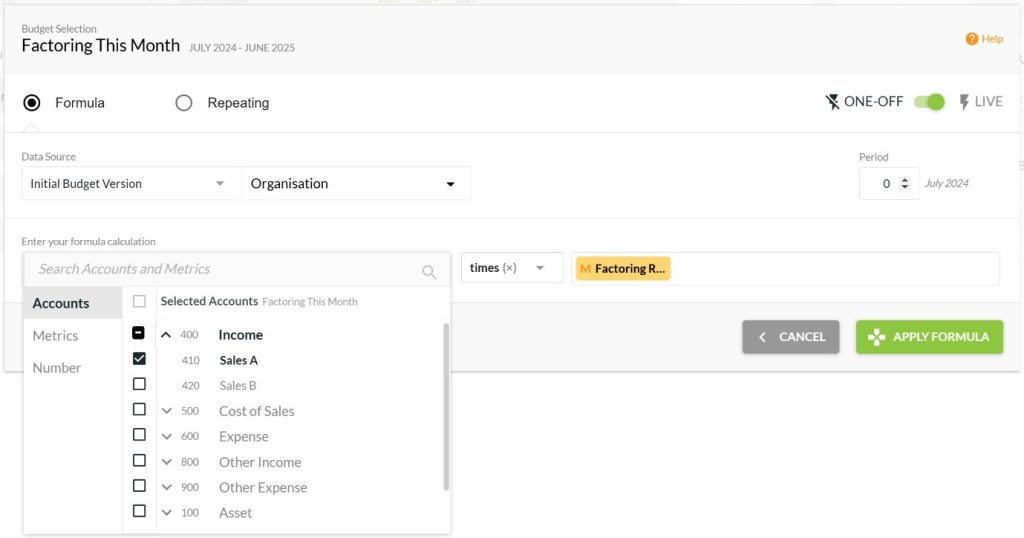

Our next Metric, Factoring This Month needs a live formula. Select your sales account(s) on the left times your Factoring Rate.

3. The Data Source for Last Month

Now, calculating our Factoring Last Month is a little more complex. We want to do a similar calculation and take 85% of last month’s sales. However, when we’re using this in a cashflow forecast, for the first month, we want to use Actuals for the previous month, not the budget. How do we achieve this?

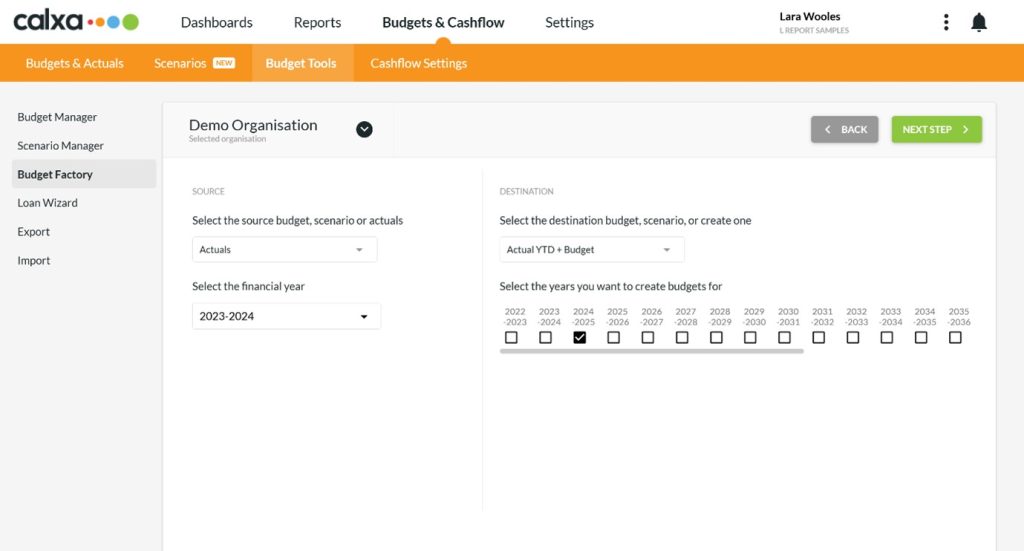

The solution is to create a new budget called Actual YTD + Budget (or something similar). The best way to do this is to use the Budget Factory.

- Select the source as Actuals for the current financial year. As you don’t have a full year of actuals, it will use your main budget for the remainder of the year. The main budget is set in the Budget Manager and will be top of the list. It will use Actuals up to the Last Actuals Period. This defaults to the previous calendar month and, for connected organisations, updates automatically when you sync. For manual organisations, it will update when you import actuals or you can set it in Settings, Organisation Settings, General.

- Then your destination budget is Actual YTD + Budget for the same year. You can create that budget here if you don’t have one already.

- Just go Next through the next couple of steps and save the budget to update. You’ll need to run this process each month to update the actuals.

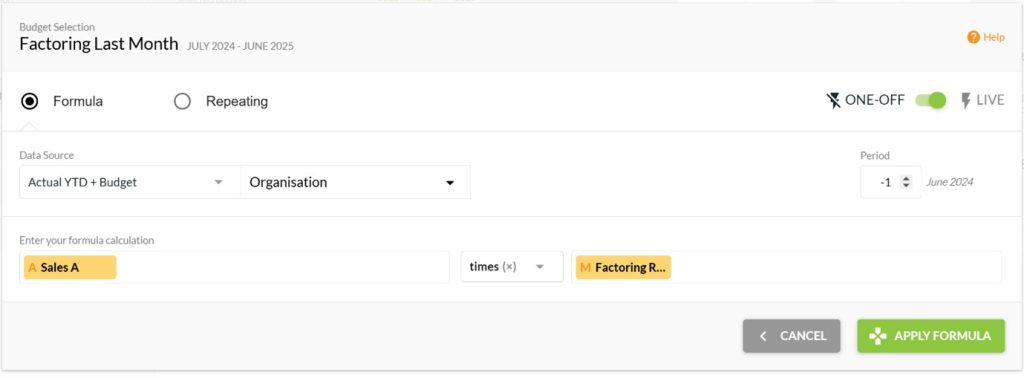

4. Calculate the Amount Factored Last Month

Then the formula for Factoring Last Month is simple. Just change the Data Source to Actual YTD + Budget.

NOTE: This metric is added to your same budget version used in the previous step.

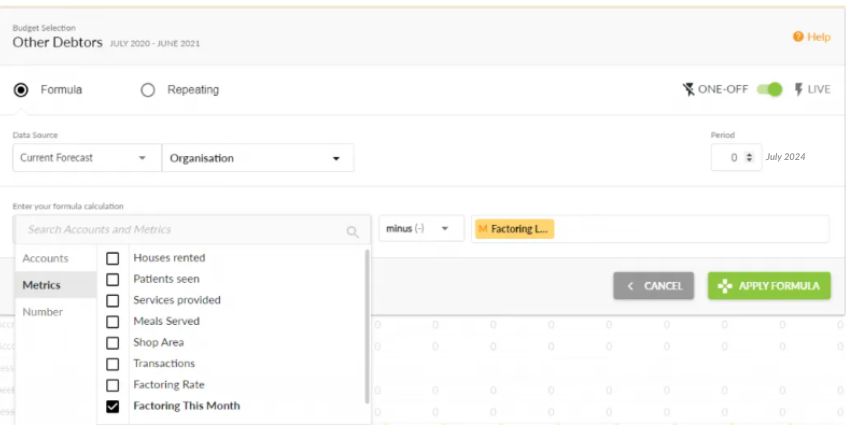

5. Formula for the Invoice Factoring Loan Account in the Balance Sheet

This formula is now simple:

Factoring This Month – Factoring Last Month

This will accumulate the movement in your factoring account each month. The opening balance will be picked up from your accounting system and this will predict what’s outstanding in the future.

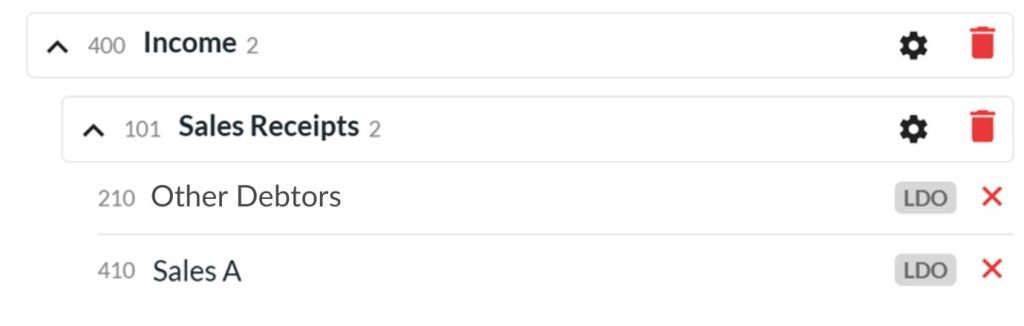

6. Grouping Sales Receipts on the Cashflow Forecast report

To group the invoice factoring loan and the sales accounts, use an Account Tree.

- Create a Header for Sales Receipts in your Income section and set it to Summary Only. This will always print as one row.

- Drag your sales account(s) onto this header and then the balance sheet account for your factoring.

- Now include this in your report and you’re done!

Summary on Handling Invoice Factoring Loans

Whilst it can be a challenge to account for invoice factoring loans, consider how this will affect your cash flow. If you are preparing regular cash flow forecasts, this work around will help getting the timing right. This video here will review how to do this in Calxa.

Now that you have sorted your invoice factoring budget, have a go at preparing a 3-Way Forecast.