How to calculate payroll budgets is an important skill for business operators. For many businesses, payroll is the biggest expense, especially for those providing services to their customers. Even in the world of manufacturing, payroll can still be a significant component of costs.

Payroll costs are made up of a number of components. This calculator will help you determine the full cost for employees based on US taxes and guide you in calculating the billable cost per employee.

In the meantime, let us look at how to calculate your overall payroll budget. For example, there are simple ways of estimating payroll budgets and more complex options. Which makes sense for you will depend on the complexity of your business and the time and energy you have available.

For now, let’s start with some of the simpler options and work towards the more complex.

Payroll Budgets Based On The Previous Year

For many businesses, one year is pretty similar to the next. You have busy periods and quiet periods. But, the overall revenue doesn’t change much and neither does the payroll cost. Not everyone is chasing rapid growth and many business owners are content with balancing work and home life. If you are in this position, it makes sense to base your wages budget on the previous year’s expenses.

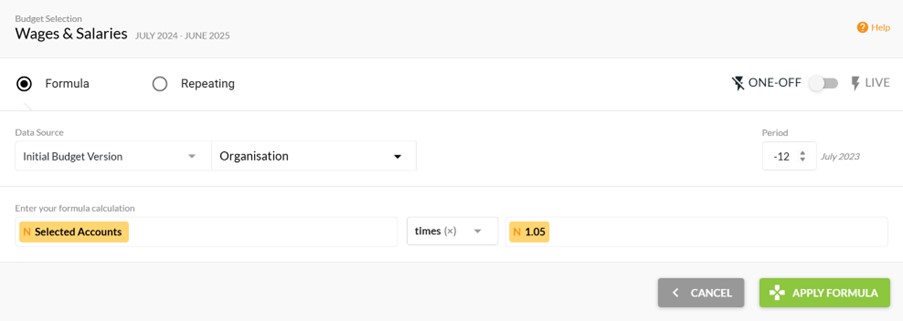

In Calxa, you can do this for all accounts using the Budget Factory. However, you can also use a formula in the budget to calculate it for you. This gives you more flexibility if you want different changes for different lines. Here are the steps:

- Simply select your wages account(s) and click on the Formula button.

- Set the Data Source to Actuals and the Period to -12 to get the numbers from a year before.

- On the left side of the formula, choose Selected Accounts.

- If you want the wages budget exactly the same, just apply the formula as it is.

- To increase the wages set the Operator to times (x) and enter a number on the right.

Payroll Budgets Based On A Regular Amount

For your business, wages and salaries may be constant from one pay period to the next. Even in larger organisations, while this might not be true at the organisation level, it can be for many projects or departments.

To start off with, the challenge is that we often pay wages weekly or fortnightly but budget on a monthly basis. How do you work out which months will have 2 fortnights, and which have 3?

Of course, the answer is to use a repeating formula. This is how to do this in Calxa:

- Select the months you want to update first. Usually this is the whole financial year but if rates are expected to change, you can do the first 6 months and then the 2nd period separately. To select the whole row, click the account name first.

- Enter the total amount of your gross wages and the date of the first pay period.

- Then how often you want to repeat it, usually every 1 or 2 weeks.

Budgets Using Metrics for Complex Scenarios

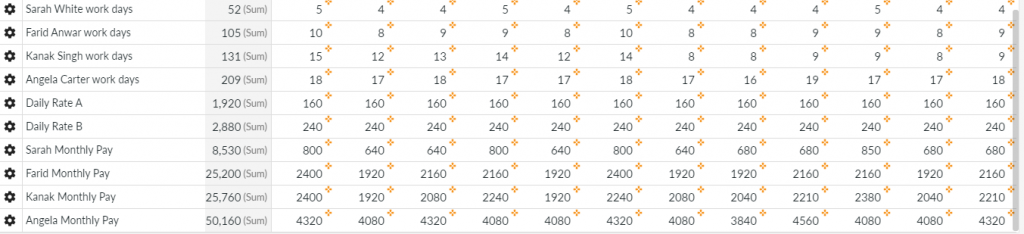

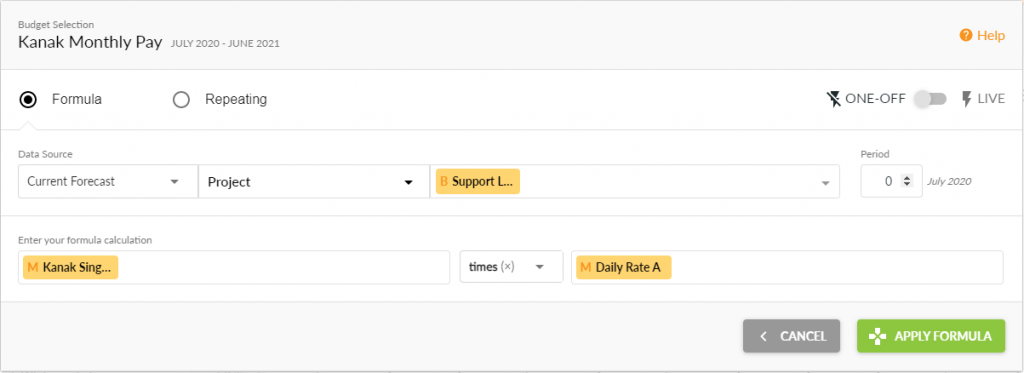

Budgeting for payroll can be simple or it can be complex. Calxa’s budget formulas make it easy to build your wages budgets step by step by incorporating Metrics. Whilst the concept is similar to what you would do in a spreadsheet, it is more connected. So, start with the smallest blocks and build up from there to come up with your wages budget.

In our example, we have 4 staff who all work regular days each week, but each works a different number of days. 2 of them are on a basic rate and 2 on a higher rate. Our challenge is to budget the total wages each month.

How to Do Payroll Budgets in Calxa

Follow these steps to start off:

- You’ll need a Metric for each staff member, for the 2 pay rates and then to calculate each person’s monthly pay.

- The workdays are simply a repeating formula nominating which days each person works in a week.

The daily rates in this example have been entered as formulas (8 x 20 and 8 x 30). However, you could just enter those numbers directly in the Metric if you prefer. You have choices!

- Then the Monthly Pay multiplies each person’s workdays by the appropriate rate.

- The final step is to go back to the Wages budget and add in the 4 Metrics for the Monthly Pays. By breaking down the components, you can later revise any of them to update the monthly budget. Note: This method works well for a small team. You can do something similar for a larger team if you can group them for budgeting purposes. For example, you might have one Metric for your mechanics, one for your fitters and one for the apprentices because each group is paid the same.

Sometimes the Best Option is the Spreadsheet

There are times though when the best option is a spreadsheet. For example, if you have complex calculations to determine each person’s pay based on changing hours and rates, overtime and other factors, use a spreadsheet. Take advantage of the flexibility of the spreadsheet to get the budget you need and then import just the wages line into your Calxa budget. After that, Calxa will give you the structure and reporting systems to make output and comparisons simple.

Get Started with Payroll Budgets

Watch the video to see how to follow this example step by step and create your wages budget.

Once you have understood the basic concepts, you will be able to expand them to suit all your budgeting needs. As you can see, there are different ways to create your payroll budgets. Decide which is best for your situation and you will have covered one of your major expenses.

For more ideas, read our article 7 Clever Things to Do with Budget Formulas.