Working Capital Ratio is a simple KPI that tells your business health. There’s a variety of numbers to choose from when assessing the health of your business but the Working Capital Ratio is one that’s commonly used. It is relatively simple to prepare. Even without a tool like Calxa.

Essentially, it provides a quick guide to your short-term ability to pay your debts. It is a liquidity ratio that measures how easily you can access the cash you need to keep your business running.

How to Calculate a Working Capital Ratio

In short, it is your Current Assets divided by your Current Liabilities. Now, if you haven’t studied accounting, you may still be none the wiser so let’s convert that to plainer English.

- Current Assets are the things you own. Technically, it is things you have rights to. But let’s keep it simple. Current Assets can be converted to cash fairly quickly. Bank accounts are an obvious inclusion but also in there are things like your outstanding debtors (the customers who owe you money). They also count in your inventory or stock on hand.

- On the other side, Current Liabilities are the things you owe. These need to be paid in the short term, generally within a 12-month timeframe. You can include things like credit cards, loans, accounts payable, what you owe for GST/VAT and payroll.

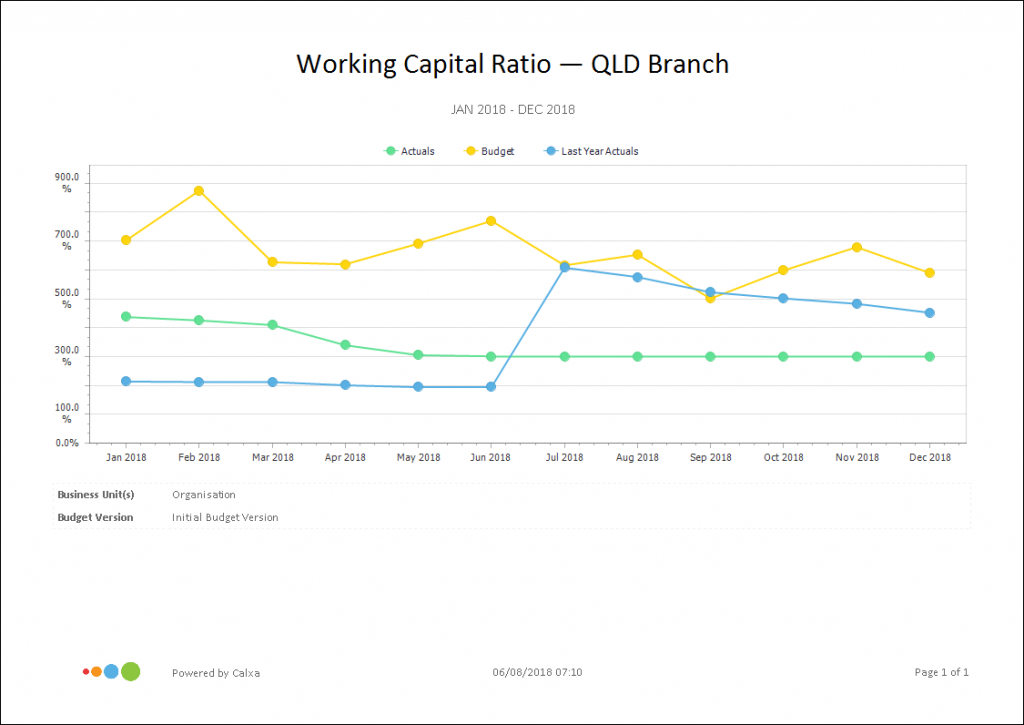

You can find a Working Capital Ration chart here.

Good, Bad or Ugly?

Now, you have identified your Current Assets and your Current Liabilities and divided one by the other. This will give you a number. Note that some people prefer to use a simple number, however, others will express it as a percentage.

How do you know if you should be worried or if you can relax?

If the ratio is less than 1 or 100%, that’s generally seen as a warning sign. It means you don’t have enough Current Assets to pay your Current Liabilities.

You owe more than you own or are owed.

A working capital ratio of 80% suggests that for every dollar you owe, you only have 80c available. That’s bad. It doesn’t mean you should panic but it may be time to watch your cashflow carefully. Foremost, it is time to get advice about a longer-term plan for prosperity.

A ratio of around 2 or 200% is usually considered a healthy sign of short-term liquidity. You shouldn’t have trouble paying your creditors, keeping your credit cards under control or keeping the taxman happy. That’s good.

Factors for Consideration

Be wary of a couple of factors that can inflate your working capital ratio though:

- The first is long-term bad or slow-paying debts. If your accounts receivable balance includes amounts that are unlikely to be paid or won’t be paid for a long time, the ratio is overstated.

- Similarly, if you have very slow-moving inventory, it’s questionable whether that should really be considered a current asset. For example, in Calxa you can easily edit the KPI account group to exclude it if necessary.

Monitoring the Trends

As with most KPIs, it’s monitoring the trends rather than the one-off values that really gives you insight into your business. For instance, a business with cash sales can operate for quite some time with a very low working capital ratio. On the other hand, that is more difficult for others.

The key thing to watch is whether your Working Capital Ratio is getting bigger or declining. If you started the year with a ratio of 200% but it’s gradually dropped to 120% by April, you should be looking at why.

- Have you used cash or credits to buy assets that would have been better with long-term finance?

- Are sales declining?

- How are your margins? Are they being squeezed?

How to Improve your Working Capital Ratio

There are 2 ways to improve your Working Capital Ratio.

- The first is to increase your Current Assets. Getting more cash in the bank is always positive in this regard. Increasing debtors because you’ve achieved more sales is good but if they are increasing because you’re failing to collect, that’s bad. Collecting your debtors quickly won’t directly affect your Working Capital Ratio but generally, that cash is better off in your bank account. Similarly, an increase in inventory will appear to improve the ratio because it has increased your current assets. But stock that isn’t moving quickly will be a drain on your working capital unless you can sell it before you pay for it. Buying fast moving stock on long credit terms can be good business.

- On the other hand, reducing your Current Liabilities will improve the Working Capital Ratio. If you have spare cash, it usually makes sense to reduce expensive debt like credit cards. It will be cheaper to pay that debt now rather than later.

One common strategy to reduce current liabilities is to refinance with longer-term debt.

Taking out a loan over 3-5 years to repay overdrafts and credit cards shifts the liability to the non-current section. You still owe the money but you will take pressure off your immediate needs. This will give you a structured plan for repayments.

Having a short-term loan facility is a useful tool to give you flexibility in your business decisions but it ceases to be useful when used to its maximum.

How to Make your Working Capital Ratio Worse

One of the common mistakes many business owners make is to use short-term debt, like an overdraft facility or credit card, to finance long-term assets like vehicles or equipment. It’s always a good idea to match, as much as you can, the finance term with the life of the asset. Using flexible, and generally more expensive, short-term loans for major assets reduces your flexibility and makes it harder to manage your working capital.

Poor stock management is detrimental to your working capital ratio. While an increase in inventory will initially improve the ratio, if you can’t sell the stock, there’s a risk it will need to be written off or sold at a loss. Similarly with accounts receivable:

If you train your customers to pay quickly, there’s no big problem with a high balance. It’s when your customers don’t pay and you have to write off bad debts that you have problems with insufficient working capital.

When is Negative Working Capital OK?

Sometimes, it makes sense to have a low, or even negative, working capital. This occurs especially in industry sectors that have cash sales. In retail and hospitality, it’s quite common for a business to buy goods on credit and then sell them quickly for cash.

The key to success is to ensure you sell the goods before you have to pay for them. By having no, or very low, debtors and no, or very low, inventory, you can substantially reduce your current assets. If you then buy the stock you are selling on credit, your suppliers effectively fund your business.

This strategy works well when you have a reliable supply chain and can order what you need at short notice. It works when you can turn the stock into cash well before you need to pay your suppliers.

Where the negative working capital strategy is risky, is when things go wrong.

- What happens when you can’t sell the stock?

- How can you avoid suppliers from tightening their credit terms?

Unless you have cash reserves or additional borrowing capacity, you may quickly be unable to pay your creditors when they are due. This is one of the reasons that small hospitality and retail businesses come and go so quickly. They can be started with minimal capital and funded by the negative working capital. But they are vulnerable to any sudden change in circumstances and can quickly run out of cash.

The ‘I’ in KPI

Remember that ‘I’ stands for Indicator. It’s a sign that things are going OK or not so OK. On its own it doesn’t tell the whole picture but it gives you a good glimpse, very quickly, and that’s why it’s useful. Monitor the trends and use it for an early warning sign of trouble to come.

If you want to have a go at KPIs have a look at our Financial KPIs for Business – A Calxa Guide.