The introduction of the new financial reporting standards in New Zealand (NZ), is bringing a change to Not-for-Profit reporting.

What’s changing?

From this financial year onwards, some 30,000 charities and other Public Benefit Entities (PBEs) in New Zealand are required to follow accounting standards as set by the External Reporting Board (XRB) and file annual returns. At this stage there are no requirements for other NFPs such as incorporated societies to comply, but it is expected that many will follow the same standards.

The exact format of the annual reporting depends on the size of the organisation; with more stringent requirements for larger charities. This reflects recognition by the XRB that the cost of compliance for smaller charities can sometimes outweigh the benefits.

How are organisations categorised?

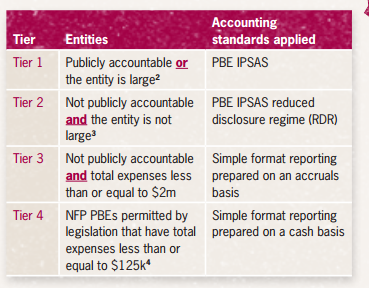

There are 4 tiers of PBEs for reporting purposes. The great majority are in Tier 3 or 4 and able to use simple format reporting on either a cash or accrual basis.

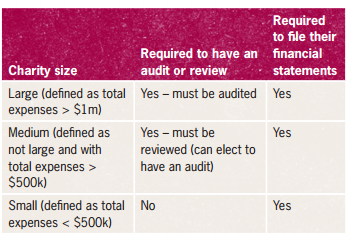

To keep things a little bit complicated, there is a separate sizing matrix for audit requirements:

*Source: Grant Thornton’s New financial reporting requirements – helping the Not for Profit sector navigate complexity.

How can you manage the new reporting requirements?

Many charities who previously had no need to file reports will now have to do so every year. This will require some effort in the short term, but should result in greater transparency and more public trust in the sector. Now is the time to start reviewing your accounting processes to ensure that you comply.

While the first reports aren’t due to be lodged for almost 12 months, you’ll save yourself a lot of anxiety by getting prepared early.

Here’s our simple checklist to get you started:

- Identify which tier you are in for reporting and get an understanding of the requirements.

- Identify your size for audit purposes and plan for a review or audit if needed.

- Review your current accounting practices and procedures for compliance.

- Clean up your accounting file so you start from solid numbers:

- Are the opening balances correct?

- Are there any debtors/creditors that need to be managed or written off?

- Start thinking about the reporting requirements and what information you need to gather. If you aren’t collecting it now, it may be difficult to report on it at the end of the year.

Preparing your annual reports

We are working with MYOB to provide you with a simple method of producing annual reports from Calxa. We’re currently finalising a sample Report Bundle which will give you all the reports required for Tier 3 or Tier 4 reporting. We would encourage you to start working with this soon so that you can (a) become familiar with the reports and (b) find out early what additional information you need to collect. Email us if you want to be notified when this is available and we’ll send you the instructions.

Standardised Reporting for NZ Not for Profits

To find out more about New Zealand Not for Profit reporting, have a look at these resources:

Updates to the Reporting Standards

Since we published this articles, the new New Zealand Charity Reporting Standards have been implemented. Based on feedback and practicalities, there will be changes and updates to the standards. Here is a summary of the 2018 Updates. If you need some help implementing a good reporting regime, contact one of the New Zealand based Calxa Accredited Partners JK Business Systems or Keep It Simple Solutions.