Securing a business loan is more than just demonstrating that you can generate a profit and have a positive cashflow. Preparing 3-way forecasts including P&L, Balance Sheet & Cashflow Forecasts is a breeze in Calxa – and a key component of any business loan application. Your friendly banker will also be looking at some key ratios before approving your loan.

Key Financial Ratios for Loans

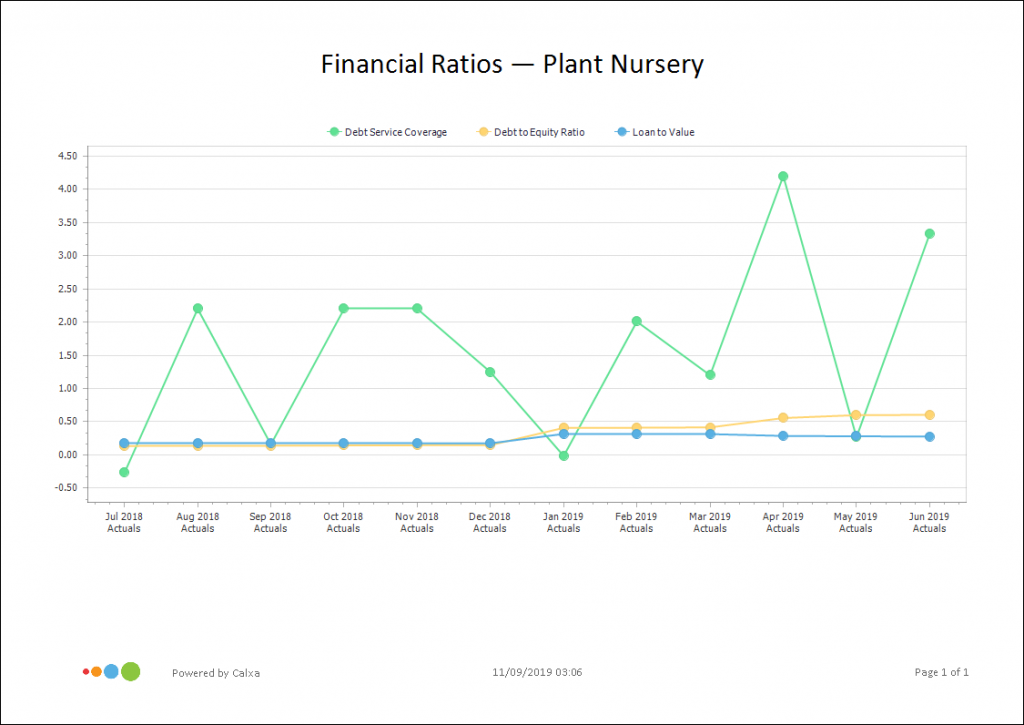

Three ratios are commonly used by bankers when assessing loan applications. It is important to understand these.

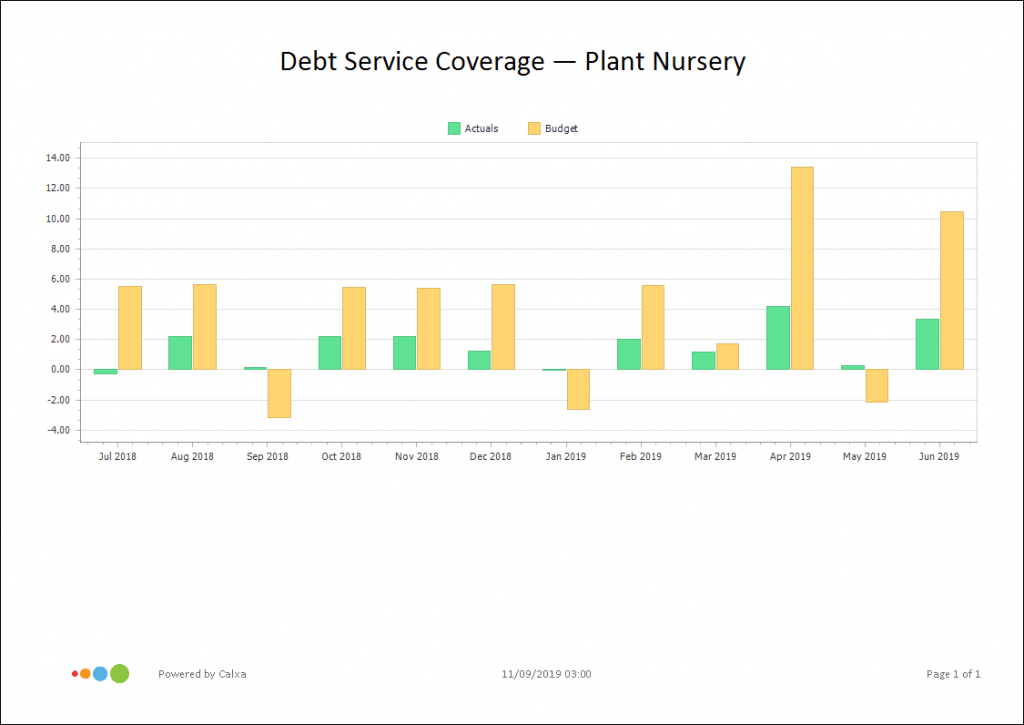

1. Debt Service Coverage Ratio

This is an incredibly important ratio when applying for a loan. Whilst it may seem complex, it is essentially a way for the bank to determine how comfortable they are with your level of net income (profit) and your ability to meet your loan repayments from this income. This is calculated by dividing your net income by your debt service amounts (which is basically your principal and interest repayments). In line with this, it tells the banker how many times you could make the loan repayments with your net income.

If the ratio is 10 or more, the banker will feel pretty comfortable.

If it is just over 1 then they will be very nervous. Especially in the event that a profit downturn may reduce your ability to repay the loan from your net profit.

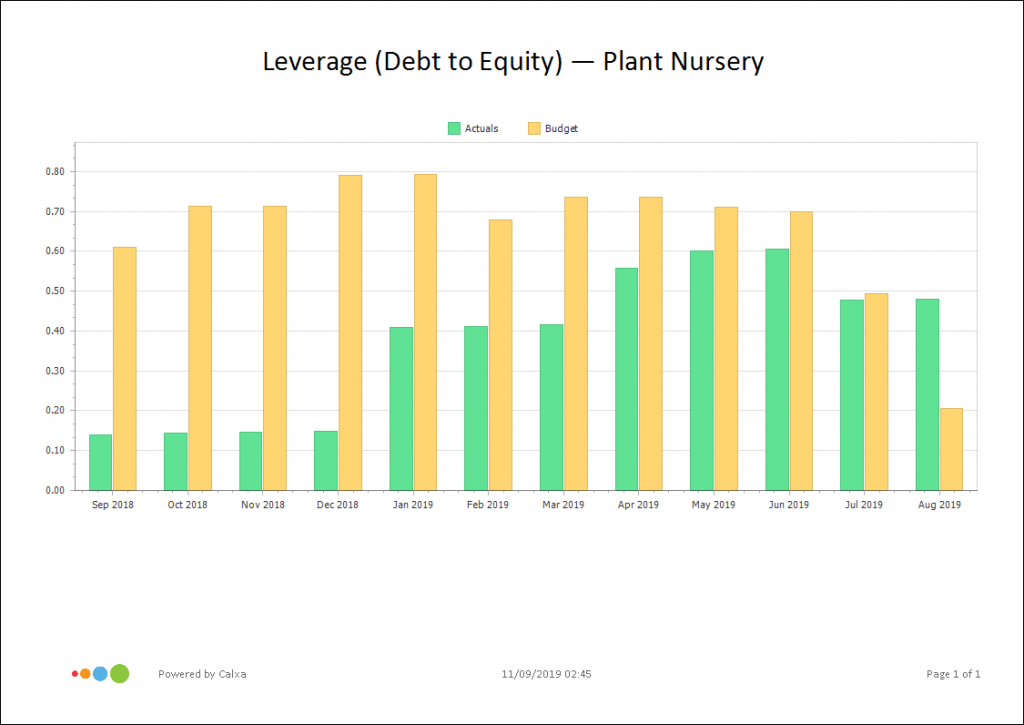

2. Leverage Ratio

You want to really understand this ratio. It is a ratio that provides a way for the bank to determine how much of their money versus your own money is being used to grow the business. Ideally, they like to see you putting something in as well. The Leverage Ratio is calculated by dividing your total business liabilities by total equity. In addition, there are three ways to improving this ratio:

- Pay off some debt

- Contribute more money in to the business

- Make more profit and keep it in the business

To help you out, this ratio is a standard KPI in Calxa. We call it the Debt to Equity Ratio.

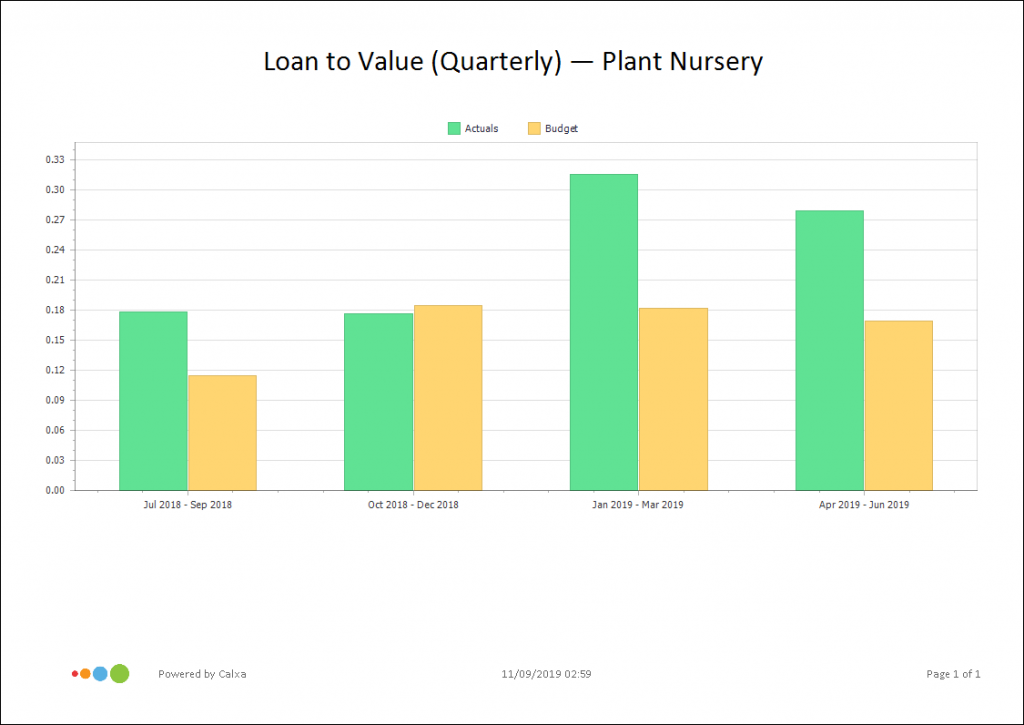

3. Loan to Value Ratio

Finally, this ratio is calculated by the total dollar value of the loan divided by the collateral (or security) offered in return for the loan. Fundamentally, in this ratio the banker is determining how much wiggle room they have in the event of the business defaulting on the loan. If the bank ends up with the collateral, they will want to make sure they can sell this for a value high enough to recover the outstanding loan balance.

A value of 0.6 is a common ceiling for business borrowings. That represents $100 dollars worth of collateral or security for $60 worth of borrowings.

Create Customised KPIs to Perform the Calculations

You will find 17 default KPIs in Calxa that are commonly used in business. But, to make this even better, you can also create your own KPIs. These can be used to provide further detail and insights into the financial information that is being presented. To help you make this work, when creating KPIs for specific purposes, it always pays to use a naming convention so that they are all grouped together in a logical sequence. By simply using a sequenced alphanumeric description they will appear in the preferred order on your reports.

In the case of the Leverage Ratio mentioned earlier this is a default KPI. It is known as the Debt to Equity Ratio in Calxa. In this case, if you want this ratio to appear with the other banking ratios, simply create a new KPI. You set this up with the new description and copy and paste the formula from the default KPI to your new customised KPI.

Add Key Financial Ratios to your Budget Reports

Once you’ve created these KPIs, they can easily be added to the bottom of your budget reports. Both the Actuals vs Budgets & P & L Projection reports give you the option of including KPIs in the report criteria. And, so do the standard Profit & Loss reports. In addition, these new customised Bank Ratios can be represented in graphical format by using any of the KPI charts.

Whilst you are there, why not create a Report Bundle for all of your loan application reports. When adding individual reports to the Bundle, you can rename the reports and give them a more relevant description and deliver them all at the click of a button.

Taking the time to prepare accurate budgets and forecasts is critical in being successful in any loan application. Going the next step by providing further analysis in the way of key financial ratios can only help improve your chances of getting over the line. Have the last few months been a drain on business cash flow and you are wondering why there is no money in the bank?

Then now may be the time to consider injecting some more working capital into the business via a new loan facility.

Doing your homework and being fully prepared for all of the hard questions your banker may throw at you will certainly sit you in good stead.

Learning about KPIs & Ratios

For further details on setting up Calxa’s customised KPIs for bank lending ratios refer to our help article showing you how to use the Calxa KPI Builder. You can also get some more ideas on different types of KPIs by reading these articles:

Current Ratios in the Not-for-Profit Sector

Importance of KPIs for Not-for-Profit Organisations

Metrics and KPIs for Hospitality

KPIs for a Bookkeeping Practice