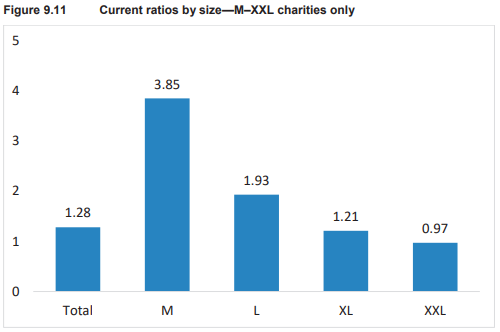

The current ratio, or working capital ratio as it’s often known, is commonly used as an indicator of the viability of an organisation, whether it’s a business or a Not-for-Profit. It compares your current assets like bank deposits, debtors and trading stock to your current liabilities. These are amounts owed to suppliers, credit card balances, outstanding GST and so on. Both are usually restricted to those that are expected to be converted into cash within 12 months. The Australian Charities and Not-for-Profit Commission (ACNC), in its Australian Charities Report 2016, provides some interesting statistics on the average current ratio in the Not-for-Profit sector.

Bear in mind that a ratio greater than 1 (so your current assets are higher than your current liabilities) is considered positive. If it’s less than 1, there are increased risks of financial failure. Based on the 2016 data, the average for all registered charities was 1.3 but there was considerable variation in that data.

For medium charities (those with income of $250,000 to $1m), the ratio was 3.85. For large charities ($1m to $10m) it was a lower 1.93. And the XXL category (over $100m) had the lowest ratio of 0.97 – probably reflecting their greater capacity to manage the risk. This suggests that the sector as a whole takes a fairly prudent approach to risk, avoiding excessive short-term liabilities.

What’s your Current Ratio?

It’s not hard to work out your current ratio. You can do it on the back of an envelope if you have a copy of your latest Balance Sheet handy. Just add up the Current Assets (If your report doesn’t subtotal them for you) and divide by your Current Liabilities.

If you want to see how it’s changing over time, use the KPI Analysis Chart in Calxa. Simply select the Working Capital Ratio (it’s one of the default ones). Start from the beginning of the financial year (FY 1) and include the comparison to last year actuals. Many organisations have seasonal ups and downs. Generally, what you want to see is an upwards trend, or at least stability. Unexplained declines are a cause for further investigation.