Looking at the comparison table, at first glance Fathom Software looks similar to Spotlight Reporting. And, sometimes, you’d get the same impression from reading their promotional material. Delve deeper though, and the differences become apparent. Let’s start off with a comparison table.

| Reporting Requirements | Spotlight Reporting | Fathom Software |

| Accounting System Budgets | Yes | Yes |

| Import Spreadsheet Budgets | No | Yes |

| Driver-based Budgets | In Forecast | In Forecast |

| Balance Sheet Budgets | Yes | Yes |

| Cost Centre Budgets | from Xero or QBO | No |

| 3-Way Forecasts | Yes | Yes |

| Multiple Company Consolidations | Yes | Yes |

| Multi-Currency Reporting | Yes | Yes |

| Loan Calculator | Yes | Yes |

Spotlight Reporting compared to Fathom Software for Budgets

Spotlight offers much more flexibility than Fathom for standard budgeting. For starters, it has some formula options and the ability to build budgets based on drivers. The Fathom software doesn’t do budgets generally. There is an editor in the cash flow forecast section but if you want to compare actuals to budgets, you need to import them from either a spreadsheet or your accounting system.

There were a few things that frustrated us with Spotlight:

- Reports are separate in each of their modules such as report, forecast and dashboard.

- Furthermore , some reports have more flexibility than others.

- Also, you can only create budgets at the organisation level. If you’re connected to a Xero company, Spotlight can use the Xero budget but not a spreadsheet import.

On the other hand, with Fathom, you can import from a spreadsheet or use the Xero Overall Budget.

A while back the comparison question arose on the AccountingWeb forum and has feedback worth considering. Alternatively, have a look at this write up on reporting apps in the Acuity Magazine.

Cash Flow Forecasts in Fathom or Spotlight

It’s clear that both the Fathom software and Spotlight Reporting were designed by financial accountants, in contrast to apps like Calxa or Castaway that take a management accountant’s view of the world.

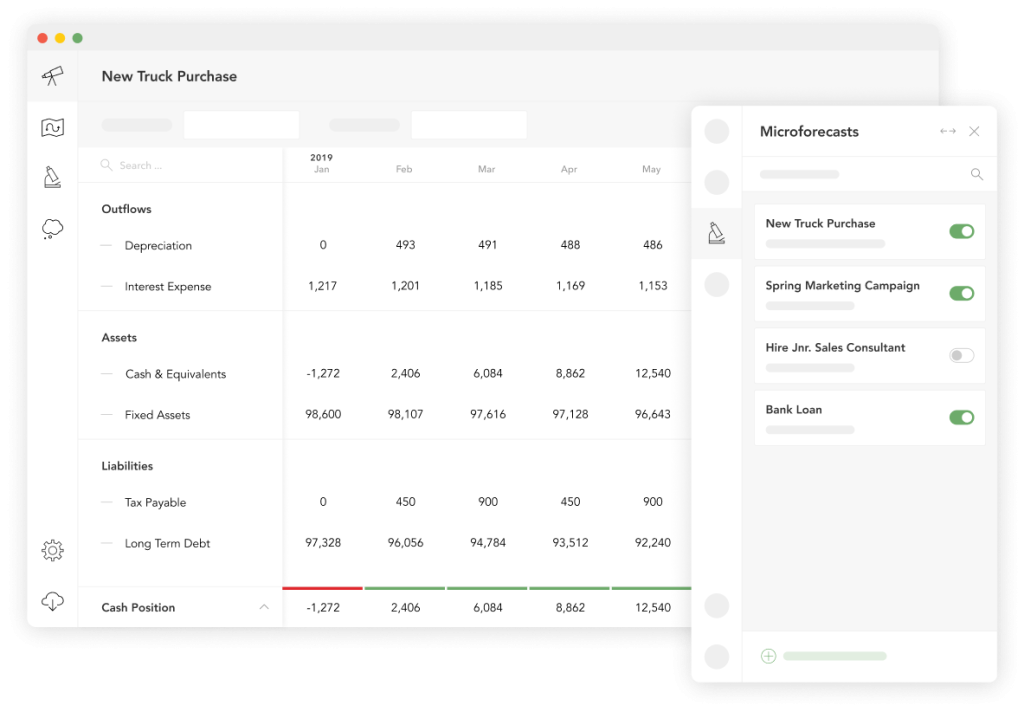

Cash Flow Statement with Fathom Software Example

Both, Fathom and Spotlight, take the traditional Cashflow Statement and project it forward. The results are split between Operating, Investing and Financing sections.

This is the Fathom software example:

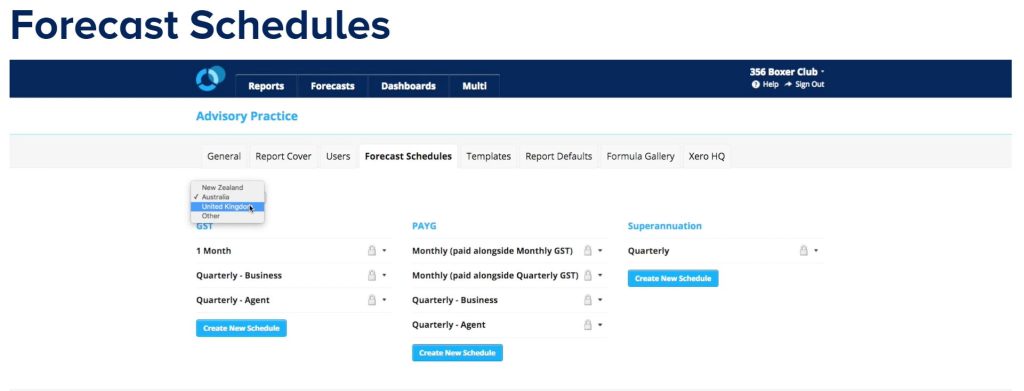

Cash Flow Schedules

You will find both applications have schedules for the timing of tax and payroll liabilities that cover most of the common options in Australia, New Zealand and the UK. With the exception that Spotlight assumes all Superannuation is paid quarterly in Australia.

Both have payment schedules that you need to set account by account for the timing of payments and receipts in a way that’s reminiscent of SAGE WinForecast. It’s a slow process but you can make your settings account by account.

Fathom Software Shines with Macro Forecasts

Where Fathom shines over Spotlight is in the management of scenarios for cashflow forecasts. They have options to flex the whole forecast but also to add in micro-forecasts. These can take some time to set up as you need to add rows for accounts, one by one. However, if you want the flexibility of being able to mix and match different combinations to create your scenarios, it’s worth the effort.

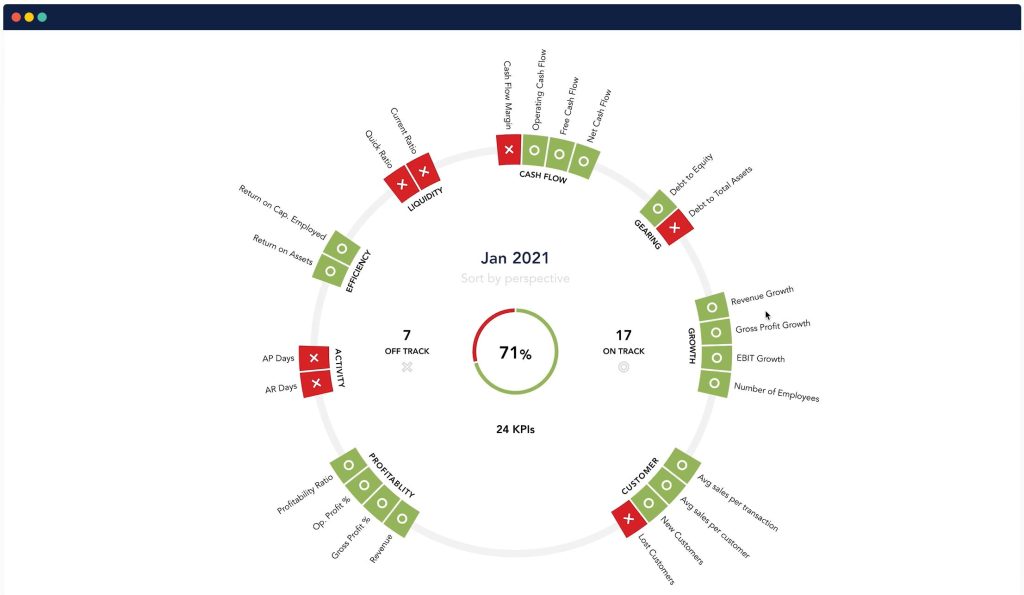

How Fathom Software and Spotlight Report on KPIs

Back when we first got to know Spotlight and Fathom (at Xerocon 2012), the distinction between them was clear. Fathom did KPIs, Spotlight did comparative reporting on P&L and Balance Sheet. Today, Fathom software still shines in the KPI area. There are a selection of pre-defined metrics but they also provide a flexible editor to create your own from any combination of accounts.

Spotlight has a KPI editor but you need to recreate the KPI for each organisation. There’s no easy way to move them from one company to another.

Consolidations in Spotlight Reporting and Fathom

Spotlight Reporting and Fathom software, both will give you a consolidated Profit & Loss report or a Balance Sheet. They will also give you a cashflow forecast, subject to the limitations noted above.

Neither will compare budgets to actuals for a consolidated group and neither will report on departments across companies.

They have a similar number of exchange rates (90+) but not all. That’s not a problem for most people, unless you operate in Argentina or Iceland. In addition, they both allow overrides of imported rates for balance sheet and P&L calculations but they share some deficiencies too.

- Neither has the option to fix exchange rates for specific accounts so assets and capital accounts can be reported differently, depending on currency movements.

- They both also use the current balance sheet rates for accounts that should be set to the end of year rate, like Retained Earnings.

For many users, using them for internal management reporting, these differences are minor. However, for others they are a deal-breaker.

Reporting on Cost Centres in Fathom and Spotlight

We should be clear at the start of this discussion that cost centre reporting is not something that is promoted widely by either Spotlight or Fathom. Fathom tackle it by treating each cost centre as an entity and then using the consolidation feature to group them. This workaround is fine if you have 4-5 but hard work and potentially expensive if you have many more.

Spotlight report on the actuals reasonably well from Xero and QuickBooks Online and will use the budgets from the accounting system. You don’t have any other options for budgets though so you’re limited by the features of the accounting system.

And, to be frank, Xero haven’t done a great job with Tracking Category budgets.

How Spotlight and Fathom Compare for Accountants

Many accounting practices use Fathom or Spotlight, some use both. If you choose one or the other, you can always quote the 1980s catchphrase “No-one ever got fired for buying IBM”, except that we all know what happened to IBM…

Fathom works because it is “quick to pretty”. Connect, run the standard reports, done.

Spotlight has more flexibility and options with it’s report packs. Spotlight has more templated fields that can be merged into your own wording. In contrast, Fathom produces more standard formatted text along the lines of “Revenue was up 10% on the previous year” with less control over the output.

In both applications you can create your own annotations to add to the report packs.

Comparing Not-for-Profit Reporting using Fathom or Spotlight

Fathom doesn’t get used very much by Not-for-Profits. That’s not a criticism, it’s just not an industry they try to cater for.

Spotlight does a little more but not with the flexibility of something like Calxa. You can do tracking category reports in Spotlight and it will pick up budgets from Xero but that comes with all the limitations of Xero’s budgeting. Some NFPs make it work for them but it’s not always the ideal solution.

Final Summary

Sometimes it’s a little unfair to compare two products. A Ferrari and a Toyota Corolla are both cars but they have a different purpose, they are designed to do different things. That’s true of reporting apps too. Fathom started with KPIs and added some forecasting. Their focus was on producing a limited set of reports quickly and easily. Spotlight started with producing financial reports with more detail than Xero provided. Over time, they added some forecasting options and some dashboard reporting.

With both accounting system add-ons, the primary focus is on analysis of historical data and the future vision is something tacked on. They both have their fans and their critics. Have a look at both but also read our comparison of Calxa and Spotlight or Fathom and Calxa for more options.

Note from the Calxa Team

It is not uncommon for our new and existing Calxa customers to ask us how we compare to other apps. This prompted us to have a closer look at a number of Xero & QuickBooks Online Cash Flow Tools.

The review was split across various members of the Calxa Team. We then collected this data and summarised it to create a series of comparison-style content. These articles are designed to be helpful when you are evaluating functionality of a Cashflow App.

We want to acknowledge that the world around us moves fast and changes are inevitable. Of course, technology developers make improvements to their apps all the time. This means, that some of our discussion may be outdated by the time you read this.

So, please, keep this in mind when you digest this article. It simply reflects our point of view at the time of evaluating these apps.