Finding a solution amongst the many financial reporting apps can be a difficult task. Many accounting firms we talk to are already including Fathom reports into their client servings. In the interest of helping those looking for alternatives, we recently compared Calxa with Spotlight Reporting. So today’s write up is showing how the Fathom reports compare to Calxa.

Fathom Reports vs Calxa – the Quick Summary

Traditionally, Fathom reports have focussed almost exclusively on KPIs and charts. However, in the last couple of years, Fathom has added forecasts which improved their general usability. This provides more of an overlap with the features of Calxa and complicates the evaluation process for many.

Fathom is probably still the favourite if you want something quick, good-looking, and based on actuals.

On the other hand, Calxa is the clear choice for anyone working with budgets as well as with jobs or tracking categories. There are features to admire in each product so read on for the details.

| Reporting Requirements | Fathom | Calxa |

| Accounting System Budgets | Yes | Yes |

| Import Spreadsheet Budgets | Yes | Yes |

| Driver-based Budgets | In Forecast | Yes |

| Balance Sheet Budgets | Yes | Yes |

| Cost Centre Budgets | No | Yes |

| 3-Way Forecasts | Yes | Yes |

| Multiple Company Consolidations | Yes | Yes |

| Multi-Currency Reporting | Yes | Yes |

| Loan Calculator | Yes | Yes |

Fathom vs Calxa for Budgets

Technically, Fathom doesn’t do budgets. There is no budget editor. However, you can import them from a spreadsheet. This means your budget is vulnerable to all the challenges of spreadsheets. That said, it can work and the app has some simple actual to budget comparison reports. To manage budgets for cost centres, you need to treat each one as a separate entity. This can work for small numbers but would soon get very cumbersome if you have many divisions or projects to manage.

Calxa, on the other hand, is built around budgets, and cost centres. It provides a budget editor that is fully functional and can handle many situations:

- Automatic consolidation of cost centres to the organisation budget;

- Working with formulas and drivers;

- Providing multiple layout options to view and arrange your budgets.

It gives you much of the flexibility of a spreadsheet but with the structure that minimises risk of errors.

How Does Cashflow Forecasting Compare?

Fathom uses the financial accountant’s view of cashflow forecasts. In this method, the forecast is an extension of the Statement of Cashflow. It starts from Operating Activities and then adds in Investing and Financing Activities.

Quite differently, Calxa takes more of a management accountant’s view showing the projected values for receipts from income accounts, outgoings from expense accounts and then the movement in the balance sheet accounts.

One concrete example of this is the treatment of GST/VAT.

Fathom reports show a change in Tax Liability line which is perfectly correct from an accounting perspective. Essentially, in any given month it shows the tax that has been accrued less the amount paid. As opposed to the Calxa cash flow forecast, where you see only the outgoing payments. Both of these are important pieces of information. So, make sure to understand which one will help you run your business better.

If you are in the market for a Xero add-on to do some predictive reporting, check out Top 5 Xero Cash Flow Alternatives.

Scenarios for Fathom Reports and Calxa Forecasts

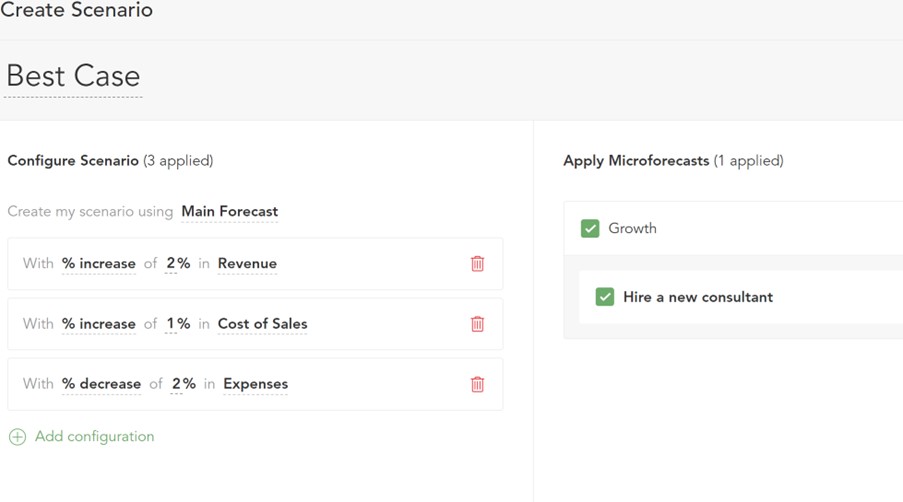

Managing different scenarios is important when forecasting cash flow. There are many possible futures for your business and it is important to consider at least some of them. In this case, each app takes a slightly different approach to managing scenarios.

In Calxa, a scenario is simply a copy of a budget or forecast. It can even be based on actuals. Using the Budget Factory you can flex income, cost of sales and expenses up or down globally and then make any manual adjustments you need to the scenario.

Fathom has a similar flexing option but also adds in micro-forecasts.

Add micro forecasts to Fathom reports

These are forecasts for just a few accounts that can be added to a main forecast as needed. You can add one or more micro-forecasts to the scenario giving you flexibility in how you manage the changes.

Comparing the Output of Calxa and Fathom Reports

Yes, they both produce reports but in quite distinct ways. Here are some key points:

- Fathom reports mostly come in pre-defined templates that are sets of reports.

- On-screen previews of Fathom reports are limited. Most need to be downloaded to a PDF or Excel to get the results.

- Reports that don’t easily fit on an A4 page are provided as Excel reports, which can have many columns.

- While the standard PDF templates are well-formatted and pleasing on the eye, the spreadsheets are very plain and simple.

Report Options

In Calxa, there is a multitude of reporting options:

- While there are some pre-set Report Bundle kits, most of the reporting is centred on the 180+ templates which you can then build into a bundle of your own.

- With lots of template options and then a choice of filters, there isn’t much you can’t produce in a Calxa report.

- You can report on a month, quarter or year like Fathom does or run a report over 18 months or 5 years to manage a project.

- All the Calxa reports are displayed on-screen first and can be downloaded to PDF, Excel and a variety of other formats.

Report Distribution

Both reporting tools provide the option to schedule reports but manage that quite differently. From Calxa, you can schedule delivery of any report bundle as a PDF or Excel attachment to a list of email addresses. Fathom reports, in contrast, start with an email notification to users advising that a report is ready to view. The user then needs to log in to Fathom to see it. Note that scheduled Fathom reports only work with their custom templates, not the standard ones or the Excel reports.

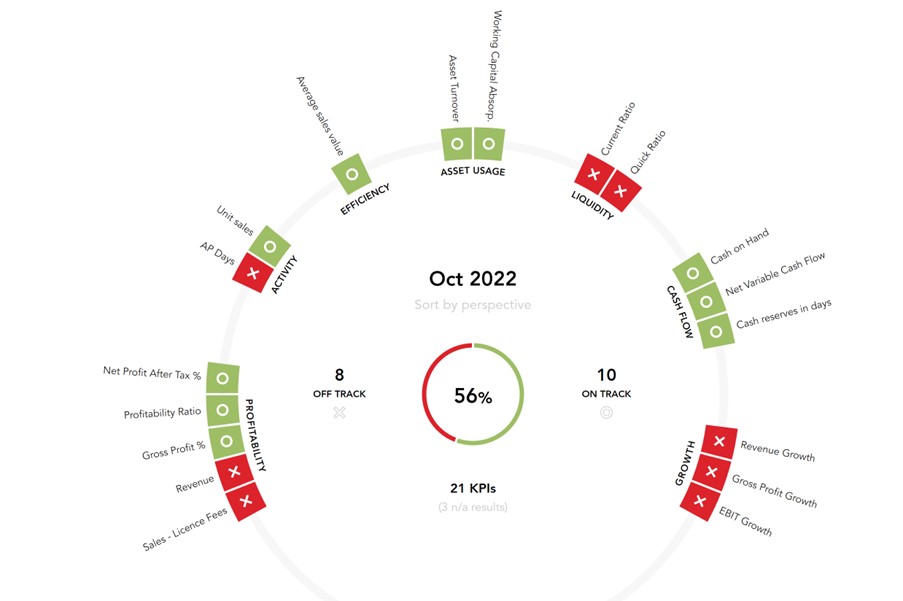

Reporting on KPIs in Fathom and Calxa

Fathom has lived and breathed KPIs since day 1. The first thing you see after connecting to your accounting system is an on-screen report of around 20 standard KPIs.

KPIs displayed in Fathom Reports

You can add your own KPIs to the list, just as you can with Calxa.

Both apps provide a formula editor that can combine account information and non-financial metrics. The differences are small but may be important for your needs:

- Calxa gives you the option to include rolling 12-month values.

- With Fathom you get the choice of this month or the prior month.

- Depending on the formula you’re trying to create, either could delight or frustrate you.

Both have room for improvement, perhaps?

While Fathom present the KPIs on-screen very quickly in their Analysis section, you need to delve into reports to get something printable. In Calxa you can add KPIs to any of the Profit & Loss reports or use one of the KPI charts. Alternatively, you have the option to include them in your Account Tree if you need to populate the KPI anywhere within a report.

Fathom Consolidated Reporting vs Calxa’s

At first glance, consolidations are similar:

- You create a group and choose which entities to include in the group.

- Both follow a similar process for automatically grouping accounts from each entity.

On closer inspection, Fathom reports give you the option to add headings to the chart of accounts. This is more modular in Calxa, where account trees allow you to have different account layouts for different purposes. Where this is useful is when you need the ability to group, summarise and sub-total amounts in different ways. Ultimately this gives you total flexibility over the rows of your reports.

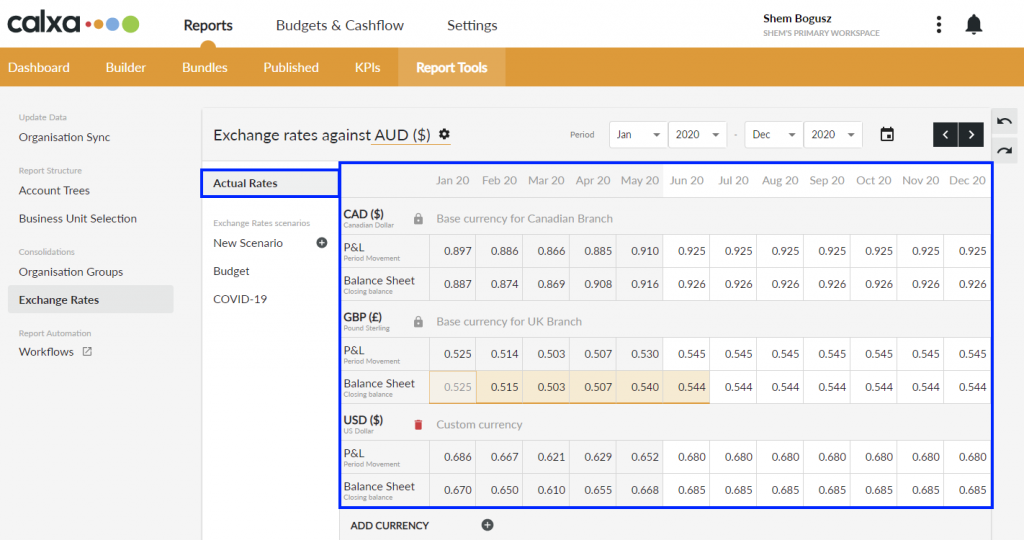

Calxa’s Multi-currency Consolidation compared to Fathom Reports

If reporting with different currencies across your group is important, you will find the following nuances useful:

- Even though both use the same source for exchange rates, Fathom reports allow you to work with 97 currencies. In comparison, Calxa will give you access to all 180+ exchange rates. This probably won’t matter for most of the world but it will be vital for some.

- Both allow overrides of the imported rates on a monthly basis.

- Fathom then uses the closing rate for all balance sheet accounts, whereas Calxa uses the year-end rates for Retained Earnings and provides the option to fix rates for any balance sheet account permanently, providing compliance with IAS 21.

Select from 180 currencies for your consolidated reports in Calxa

Eliminations

Fathom handles eliminations by allowing you to remove accounts from your reports. In some ways this is easy, but it also has risks. If the removed accounts aren’t equal, you can easily put your Balance Sheet out of balance. The Calxa approach groups the eliminated accounts into one row and hides that if they balance but shows it if they don’t. This makes it easier to see any unbalanced eliminations, especially with the comparison reports.

In either application you could create a manual organisation for eliminations and include that in the consolidated group. This takes a little more effort but gives more visibility.

Cost Centre Reporting compared in Calxa and Fathom

Whether you call them cost centres, business units, jobs, projects or departments, they are built into the heart of Calxa. Fathom provides some limited reporting on actuals but none on budgets unless you treat each cost centre as a separate entity. This can not only get costly but also may be cumbersome if you have many cost centres.

With Calxa, you can consolidate cost centre budgets to the organisation level. You can report on one, some or all of them. You can budget and report on the intersection of 2 Xero tracking categories or QBO classes and you can consolidate departments across entities.

Fathom Reports vs Calxa Reports for Accountants

Accountants love Fathom because it is quick to give you a professional output. In the words of Ernest Chunge from CharterNet Advisers:

“Fathom is the go-to app if you want ‘quick to pretty’.”

Ernest uses both Fathom and Calxa for different purposes. The Fathom reports help deliver quick insights to his clients. Whilst, Calxa helps him meet more complex client needs.

Pulling in less data from the accounting system makes the extraction quicker. Add to this that its reports come in pre-set packs that are mostly based on analysis of actuals. You can see how this efficiency is achieved.

As a Fathom alternative, Calxa is popular with accountants for its power and flexibility.

- When they want good budgeting or they need departmental reporting, Calxa makes that easy.

- If it is important to get the multi-currency reporting absolutely spot-on, Calxa is the tool of choice.

There are many accounting firms who choose to use both Calxa and Fathom. This gives them the option then to pick the right tool for each job.

For a client who wants something quick and simple, Fathom can give you the results for little effort. When the needs are more complex, Calxa will save time and provide the detailed result the client needs.

Limits of Calxa and Fathom Reporting

Straightaway, it’s worth mentioning that Calxa has no hard limits on any features. In comparison, Fathom does. Their limits are well within the bounds of many day-to-day uses but something to be aware of for those who have more complex requirements. For example:

- Fathom imports a maximum of 8 years of monthly information from your accounts. As an aside, they recommends 5 as guide. Calxa will bring in everything you have back to the beginning of time. This results in Calxa’s initial sync taking a little longer.

- With Fathom you are limited to 60 divisions from Xero or QuickBooks and only 20 jobs from MYOB. Again, Calxa does not impose limits itself but Xero’s API limits, for example, do effectively restrict tracking categories to around 1500. We have dealt with MYOB and QuickBooks users with several thousands of jobs or classes.

- Consolidated Groups are restricted to 300 entities in Fathom and 50 if using multi-currency. This is ample for most situations but if you do need more, then Calxa is your choice for your reporting.

- Calxa’s forecast reports run for a maximum of 10 years but you can chain them together to reach 20 years. The Fathom reports limit you to 3 years of forecasts.

Final Summary

There is no “one size fits all” reporting solution in this comparison. Calxa comes closest to that with its range of reports, tools and features. However, the price of that is possibly some added complexity and a bit more to learn. We suggest start with this line of thought:

- If the most important thing to you is to produce a standard list of KPIs based on your actual results, look at the Fathom reports first. It will do this for you quickly with a great looking output.

- On the other hand, if you need choice and flexibility in your reporting for more complex needs, then consider Calxa first. It will give you the power to ‘slice and dice’ your data for professional management reporting.

With both products you will want to watch a video or consult the help material from time to time but they both make that clear and presentable.

As usual, our advice is for you to determine your needs first and then match the tools to those needs. Do your due diligence and consider the pros and cons of each to work out which one suits you best. To help you along the way, have a look at our evaluation checklist.

Note from the Calxa Team

It is not uncommon for our new and existing Calxa customers to ask us how we compare to other apps. This prompted us to have a closer look at a number of Xero & QuickBooks Online Cash Flow Tools.

The review was split across various members of the Calxa Team. We then collected this data and summarised it to create a series of comparison-style content. These articles are designed to be helpful when you are evaluating functionality of a Cashflow App.

We want to acknowledge that the world around us moves fast and changes are inevitable. Of course, technology developers make improvements to their apps all the time. This means, that some of our discussion may be outdated by the time you read this.

So, please, keep this in mind when you digest this article. It simply reflects our point of view at the time of evaluating these apps.