Reporting your Income and Expenses by function rather than their nature is much more common in the US, Japan and some European countries than in Australia and New Zealand. However, you have the choice in the Calxa App to create a Profit and Loss by Function without having to restructure your Chart of Accounts.

By using Calxa’s Account Tree functionality in the report filters to show either Business Units or Accounts as rows under any top-level header, you have the flexibility to switch your income statement to this view.

What Is a Functional Income Statement?

Presenting your financial profit and loss by function means classifying income and expenses by their role in the business, eg:

- Administration

- Marketing

- Sales

- Production

- and so on

This is opposed to the more traditional way of displaying it by their nature like Wages, Materials, Freight Costs, etc.

In practice, the distinction is rarely totally clean in modern accounting practice. A typical profit & loss statement by nature will often have sub-headings for functions so it technically is a hybrid of the 2 methods. For management reporting, the key question is always:

Does it help you manage the business better?

Who Uses Functional Profit & Loss Statements?

While they are supported by the Australian Accounting Standards Board, they aren’t commonly used in Australia for statutory reports. They are more often used in management reports though where it’s important to report by department or function.

Internationally, there is wide variation in their use:

Here are some examples:

- One industry that makes use of them across countries is the hotel business. The USALI (Uniform System of Accounts for the Lodging Industry) is very much focused on functions within a hotel splitting Rooms from Food & Beverage, for example.

- Organisations following US GAAP or IFRS are often required to report expenses and income by function. US public companies are required to present a functional income statement format under SEC regulations.

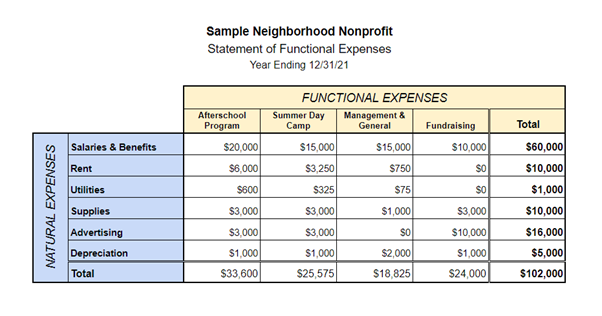

- Charities, especially in the US, often use a matrix-style report to show a breakdown of functional and natural expenses in a simple table.

In Calxa, you would reproduce this using the P&L Comparison report. Use a Business Unit Tree to group the functions and an Account Tree to summarise the natural expenses.

How Do I Create a Profit and Loss by Function in Calxa?

It’s easy to set part or all of your reports on a functional basis in Calxa. Some organisations prefer to use functions for just the Income. Then they show Cost of Sales sections and plain accounts for the Expenses.

Using Business Units in Calxa to Separate Functions

To do this in Calxa, we assume that you have used Business Units to allocate the functions in your accounting system. This could be Tracking Categories in Xero, Jobs in MYOB or sub-account segments in Acumatica and so on.

Switch between Reports to Display by Function or by Nature

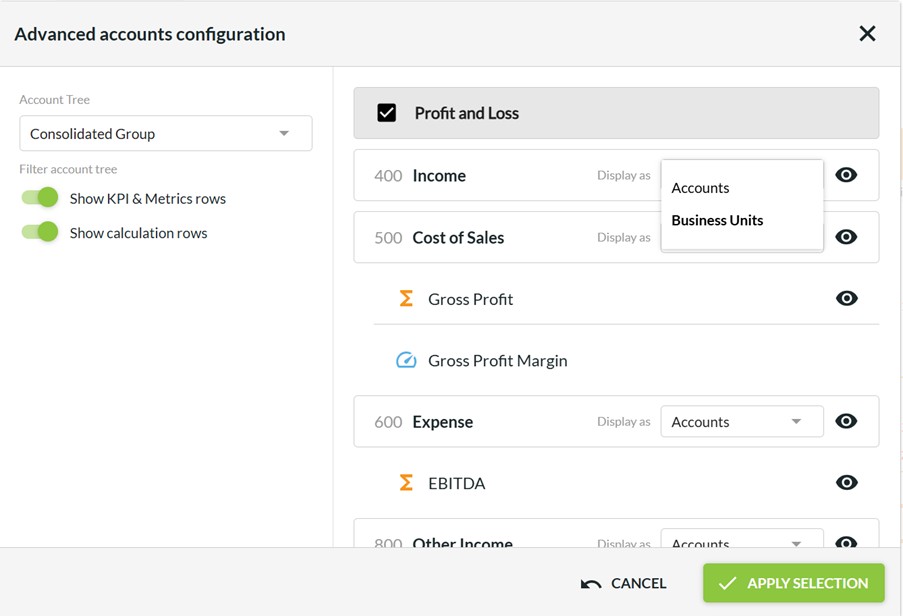

You have the choice of when to report by function and when by nature in the Calxa app, go to Reports:

- Choose any of the P&L style reports

- Now, select the organisation (or consolidated group) and Business Units you want to include

- In the filters on the left, find the Row data section and the Account Tree selector

- Pick an Account Tree and then the Advanced option

- Save the report to a bundle so your settings are remembered for next time

When Is a Functional Approach Useful?

Because we use Business Units to manage the functional part, you have lots of flexibility in how you use them for reporting. Here are some examples.

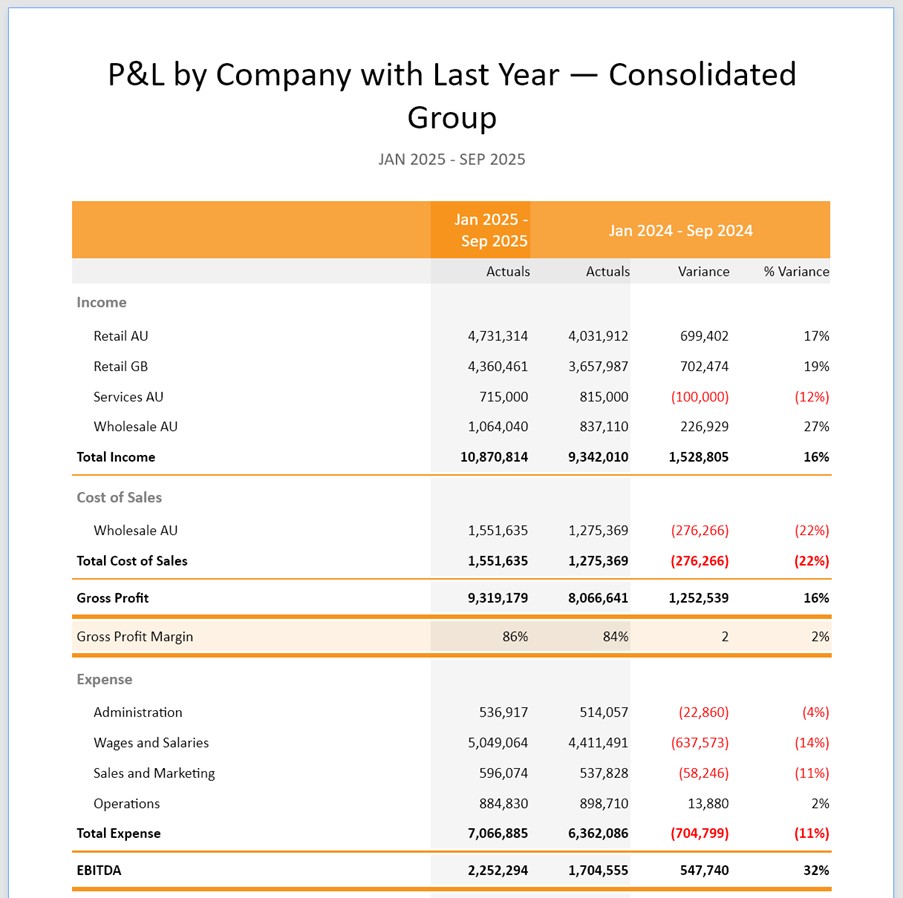

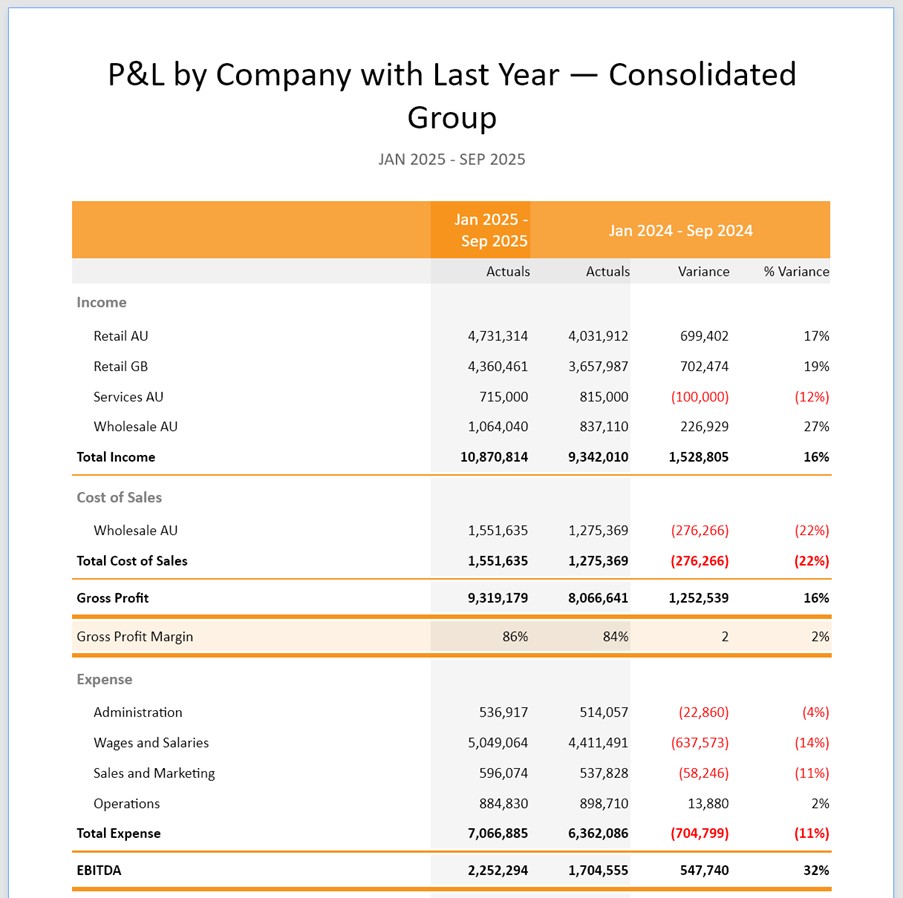

Consolidated Group by Company

Single Company by Branch or Location

Not-for-Profits and Charities

Charities and non-profit organisations often use a variation on functional reporting to show income by funding source. This provides management with a overview of where the funding has come from, not just what sort of funding it is.

Building Flexibility into Your Reporting

Our goal at Calxa is to give you the ability to create the management reports you need to run your organisation. Having the flexibility to put your business units into the rows of your reports gives you one more choice.

If management reporting is important to your organisation, check out our best practice guide.