One of the benefits of using Calxa has always been the simple connection to an accounting system. An alternative, is to use Calxa with your spreadsheets.

Linking to your Xero, MYOB or QuickBooks means Calxa does some of the hard work for you. However, not everyone uses those systems.

When to Use Calxa with Spreadsheets

Sometimes you may need to work outside your accounting system. In these cases, there is the option of creating an organisation in Calxa and importing Actuals from a spreadsheet. Heck, you can even enter them manually if you really have to.

Even if your main use of Calxa is with a link to your accounting system, there may be times it is useful to work with an additional organisation. Let us look at some of the possibilities and see if there’s one that suits your needs.

1. You Use an ERP or Industry System

When your business is complex the small business systems like MYOB, Xero and QuickBooks are no longer enough for your requirements. Similarly, you may be using an industry-specific system which is great for the intricacies of your business but is lacking in management reports or cash flow forecasting.

You can solve this problem with a few steps:

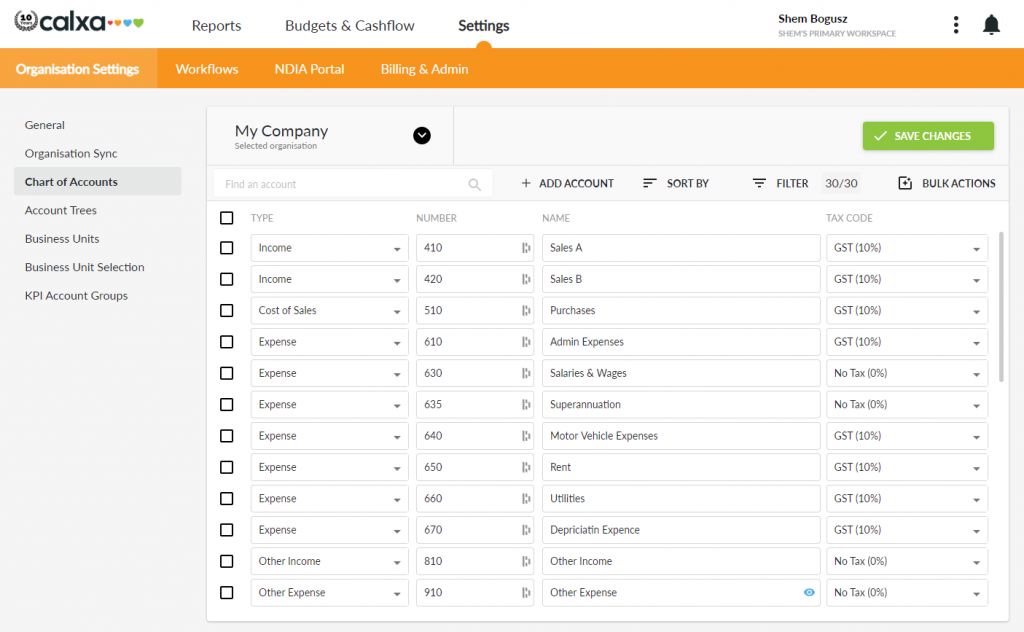

- Create an organisation within Calxa

- Set up your accounts

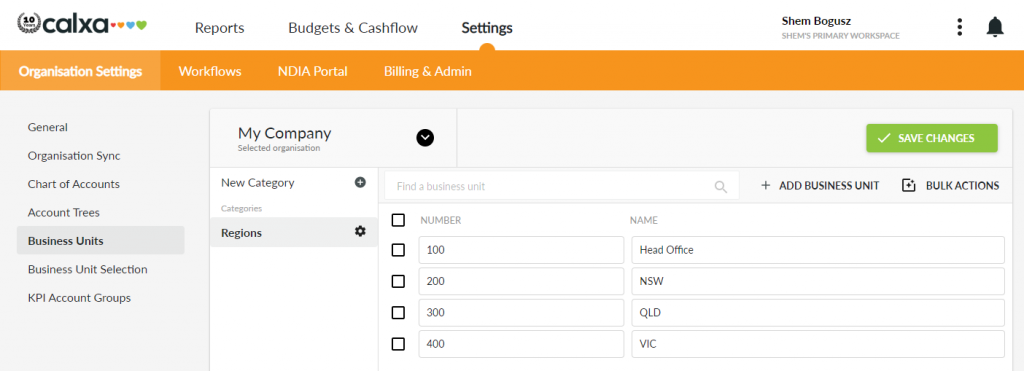

- Add your business units if you need them

- Now, import your Actuals from a spreadsheet. If you can export those Actuals from the other system and transpose them to the Calxa spreadsheet template, you can then easily update Calxa monthly and run your reports.

Our import process is very flexible. You’ll just need a column for your accounts, one for your business units (if you use them) and one or more for the monthly amounts. Those amounts can treat numbers as positive according to the account type or you can choose to import debit and credit values.

Once you have the export setup from your accounting system, it then becomes a simple export-import step. Enter opening balance sheet values for the earliest period you are reporting on, and monthly movements from there on.

2. Changing Accounting Systems

Have you recently switched from MYOB to Xero or from Xero to MYOB or QuickBooks Online? You can mostly get some year-by-year reports by consolidating your old organisation with your new one in an Organisation Group. This has problems though if there is any overlap in transactions entered into the 2 systems and you can’t get a consolidated balance sheet report at the changeover date. This is because you’ll have closing balances in the old system re-entered as opening balances in the new one.

The solution is to add a new organisation using our Excel integration option.

- Create the chart of accounts using either the old or new account structure.

- Enter monthly actuals from your old system for Profit & Loss accounts.

- Work out monthly movements from your old system for Balance Sheet accounts but adjust them in the last month to bring the balances to zero.

- Add this organisation with your new one into an Organisation Group.

You can then run reports for multiple years incorporating both the historical and the current financials.

3. You Are a Start Up

Whether you are starting a brand-new business or buying an existing one, creating a simple, stand-alone organisation in Calxa can be very useful. You can test out different scenarios before you commit to an accounting system.

To use Calxa with spreadsheets, your new organisation does not need a complex chart of accounts. Calxa will give you a basic accounts list. You can then add other accounts you need from there.

Before the business starts you won’t even need Actuals so just add budgets and review the cashflow settings to get going.

Create multiple budgets and review the possible cash flow outcomes so that you go into your new venture well-prepared. Or you decide that the venture does not look so attractive after all. It is better to make that decision earlier than later.

4. Inter-Company Eliminations

When preparing group consolidation reports, the easiest way to eliminate inter-company transactions is to take out entire accounts using an Account Tree. This works well if you have an inter-company sales account in one company and a matching inter-company cost of sales account in the other. By moving them both under the same header in an Account Tree, you can eliminate the entire line.

Often however, you will want to partially eliminate an account. The inter-company sales are allocated to the same income account as sales to external customers. In the olden days you would have recorded a manual elimination journal against those accounts.

Now, the solution is:

- Add a new organisation in Calxa with just the accounts you need for eliminations (though we do create some basic accounts for the cashflow settings as well).

- If you have complex elimination entries, consider creating business units within the elimination organisation to match your entity structure and add the elimination entries against them.

- Add budgets and actuals each month for the elimination amounts.

- Then include this organisation in your organisation group.

One benefit of using this method for inter-company eliminations is that makes reporting easier. You can use the comparison reports – the ones that show each entity side by side – to clearly document the eliminated amounts.

5. Acquiring a New Business

When you acquire a new business, especially if it’s in a different country, it’s quite likely that they will be using a different accounting system to you. You may have plans to align accounting systems in the future but that takes time. It also may not make sense for a foreign entity because of local rules.

The solution again is to use Calxa with a spreadsheet like Excel for the new company.

- Add an extra organisation setting up the accounts (and business units if necessary) to match the other system.

- Each month you can then export a trial balance from the other system, copy that to your Calxa input template and bring it in.

- You can set the currency of the new organisation and enter exchange rates each month (or just use the automated rates).

For examples of reports to use across your group, see our Top Reports for Multi-Company Consolidations.

6. Testing a New Project

Sometimes, in the journey of your business, you get a bright idea and you want to test it out with some numbers before committing too much time and effort to it. This could apply to various scenarios which could be:

- A New project

- Opening a new branch

- Or, applying for a government grant.

There’s considerable uncertainty about whether or not it will proceed so you don’t want to add new accounts or business units to your accounting system at this stage.

The solution here is the following:

- Create a new manual organisation within Calxa.

- Enter some budgets

- Set up your cashflow settings

Now see how it looks. To combine it with your existing business and see how it would affect your overall results, simply create an Organisation Group to consolidate the old and the new.

If the project goes ahead or you get that grant funding, then it’s worth setting things up properly in your accounting system. If the answer is a no, save some reports to document your research and then delete the organisation when you no longer need it.

7. Budget in a Different Currency

When we introduced multi-currency consolidations, we thought we had considered all the places people might want to set a currency but we missed one. You can set a base rate for your workspace and define other rates against that. Each organisation has its own currency and, when reporting, you can set a reporting currency in the Organisation Group.

But what if your organisation is in GBP or AUD but you want to set the budgets in USD? The solution is quite simple with Calxa:

- Add an extra organisation in Calxa with the same chart of accounts as the one you want to budget on.

- Set the organisation currency on this to USD

- Add this company to your Organisation Group.

- Now, your reports will take Actuals from your original company and budgets from the new one.

Simple, right? Click here to watch this short video or play it below.

Using Calxa with Spreadsheet

We are sure that once you get the idea of this feature, you will find creative ways to use independent, stand-alone organisations in Calxa.

We’d love to hear how you are using them and how they improve your reporting.