Building and growing a successful bookkeeping business in a modern world involves having a good set of apps. It is all part of becoming a modern bookkeeper.

We’re often asked by our bookkeeping clients what software they should be implementing in their practice. They are curious as to what their peers are using. So, we have put together this list to help in your practice. It is a starting point to help you grow your bookkeeping business. We have harvested thoughts from our many discussions with bookkeepers over the past couple of decades.

How Apps Enhance Your Bookkeeping Business

When looking at apps, it is important you understand how the technology will amplify your bookkeeping business. So, drill down to which tool is useful to you, you could categorise them in these 3 ways. What will help you:

- Better manage your practice.

- Improve your client experience.

- Support your business growth.

Some of our suggested apps may fit in more than one category. So, here are 5 apps that will help you make your own practice more efficient and remove some of the manual processes you may still have. They are not the only options in each category, but they are widely used and well respected.

Ignition – Client Management

The professionalisation of the bookkeeping industry has increased the processes and documentation required to start a new client and manage them. Clients need proposals so that they understand the scope of work you are proposing and the cost of that. A growing bookkeeping business, needs to produce engagement letters so the terms of the arrangement are clear and well-documented.

Ignition, formerly known as Practice Ignition, automates much of that process of onboarding a new client. You start by creating an online proposal by selecting services from a template. Your prospect can then comment on the proposal and eventually digitally sign to accept it. This includes your terms of engagement and forms your contract with the client.

You can send invoices directly to Xero or QuickBooks Online and collect payment by credit card or direct debit. And this doesn’t have to be just a one-off invoice. Once you set up recurring monthly billing, you will be reminded to refresh the engagement letter with the client each year.

Practice Ignition might be overkill for a solo bookkeeper (though pricing starts at AU$39 a month for up to 20 clients so it’s worth considering). For any small practice it doesn’t make sense to spend time doing this work manually when there are tools like Practice Ignition to automate and simplify the process.

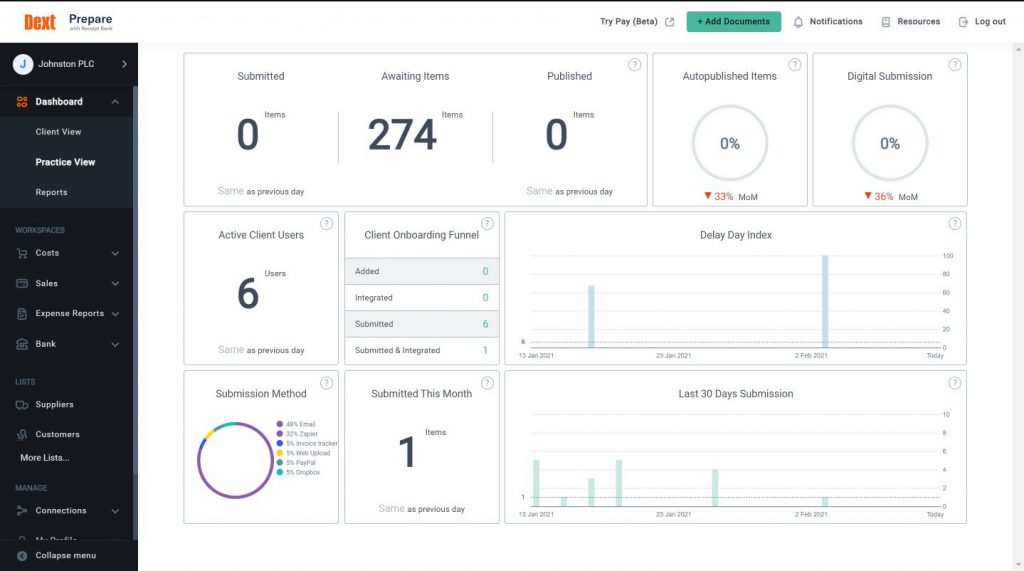

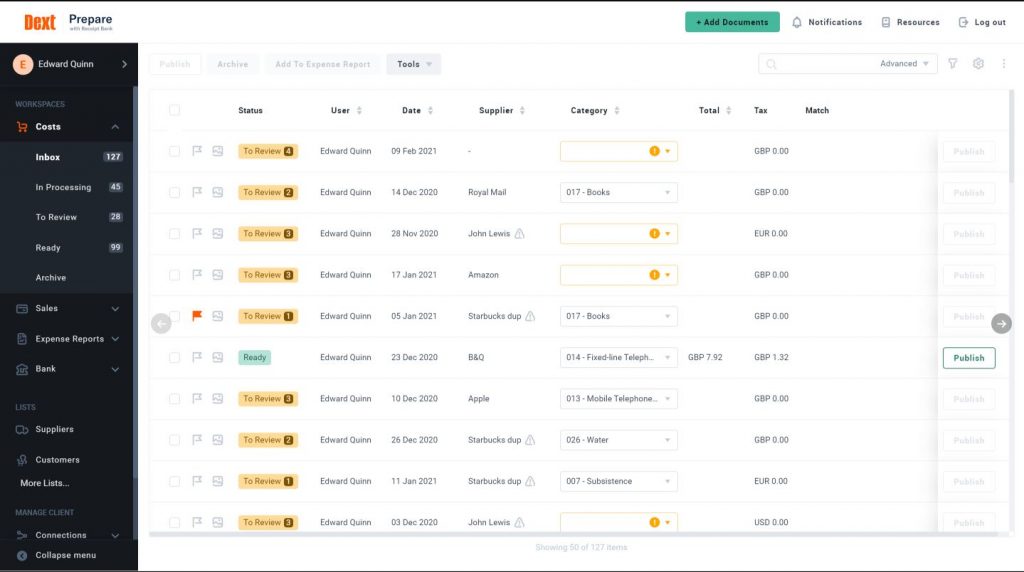

Dext

You have likely come across Dext as it is one of the most popular tools for importing invoices and receipts to Xero, QuickBooks, ReckonOne, Sage or MYOB. This app offers multiple options for importing invoices:

- using their mobile app,

- scanning from your computer,

- emailing them or importing from PayPal or Dropbox.

Dext has a good reputation for the quality of its scanning and OCR technology. The app can split out invoice lines and post them to the right codes depending on the rules you have set up. It will add new suppliers if necessary. And, you can choose to import some transactions as bills or supplier invoices and others as Spend Money type transactions.

Most of the accounting systems are now offering some sort of invoice capture functionality. The advantage of Dext Prepare is that it will work with a variety of accounting systems and you can use the same process across all your clients.

Dext doesn’t just import documents and one of the most interesting additional options is auditing and quality-checking the accounting data. Effectively, it audits your Xero or QuickBooks Online data, helping you to quickly find errors and problems. As a result, you will save time when you start with a new client. Foremost, it will give you a Health Check, so as a bookkeeping business you know exactly what you are working with.

GovReports – Lodgement Management

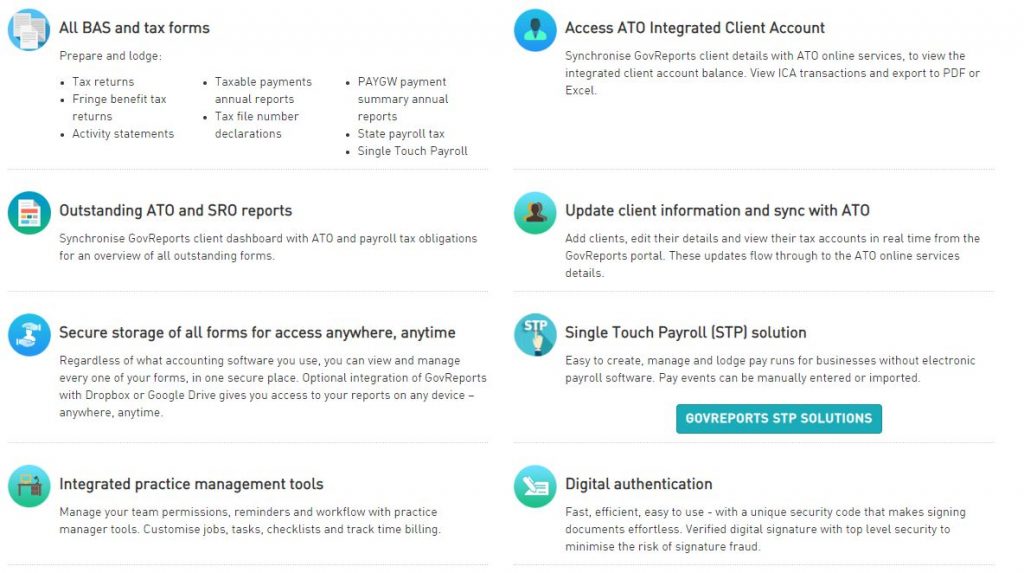

Starting out with BAS lodgements many years ago, GovReports now offers much more. It provides a full range of tax lodgements for Australian Tax and BAS Agents. As well as lodging ATO BAS and tax forms, it includes company and individual tax returns. Furthermore, it also covers TPAR and Tax File Number Declarations.

One of the key features favoured by many a bookkeeping business is the ability to keep working offline even when the ATO system is down. This has proven a big boost to productivity as the tax office has struggled with its systems over the last few years.

Beyond lodgement, the agent dashboard gives a comprehensive history as well as reports of outstanding lodgements. As a result, there is quick access to Integrated Client Account information and details can be updated.

For those clients without online payroll systems, GovReports provides an option for Single Touch Payroll reporting, keeping those clients compliant.

Additionally, GovReports includes Office Practice Manager. While not as fully featured as Ignition, it can meet the needs of many smaller practices. For example, it maintains a list of clients, produces engagement letters and manages regular tasks and jobs.

Debbie Innes of Get A Life Accounting Solutions says,

“I love GovReports. The best thing about it is that it always works, even when the tax office is down and I can keep working. Secondly, the Outstanding Lodgements reports keep me up to date on what BAS and ATO tasks are left to do. I’ve been using it for years and wouldn’t consider changing.”

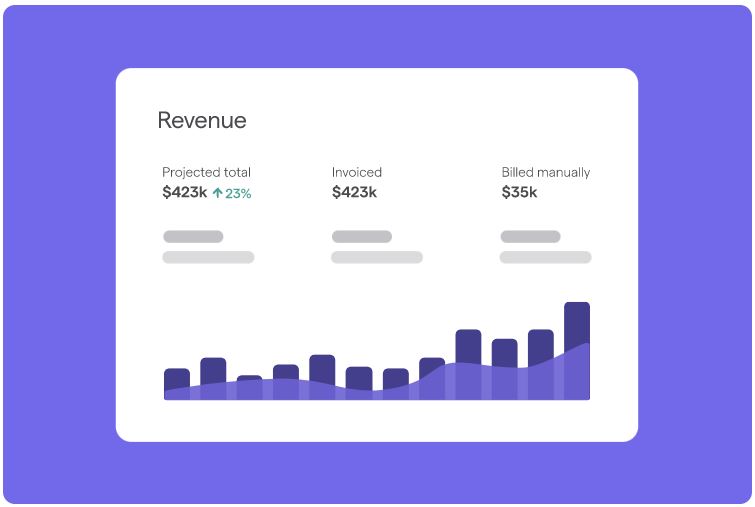

Calxa – Client Reporting

As a bookkeeper you need a good reporting solution for their clients. Unless, of course, you are still stuck solely in compliance work. Clients often need something more meaningful than the standard P&L reports available in the accounting system.

The consummate advisor will get a kick out of the automation. You can use Calxa to tailor bundles of reports for each client and schedule delivery of them each month. Once the initial setup is done, your time is then free to spend on analysing the reports and discussing the content with your clients. We have found the most successful bookkeepers use management reports, cashflow forecasts and KPI charts as catalysts for good conversations with their clients. It is a driver to grow their bookkeeping business.

Providing a reporting service to your clients with Calxa helps you create that sticky customer. It is the client who won’t go elsewhere because you’re providing them with something unique and valuable. Much of that uniqueness is you, asking the right questions and making them think. But sometimes you need the tools to produce the reports. It’s the foundation to deliver the information in an understandable format, to provide the topic of that conversation.

Uncat – Syncing Uncategorised Transactions

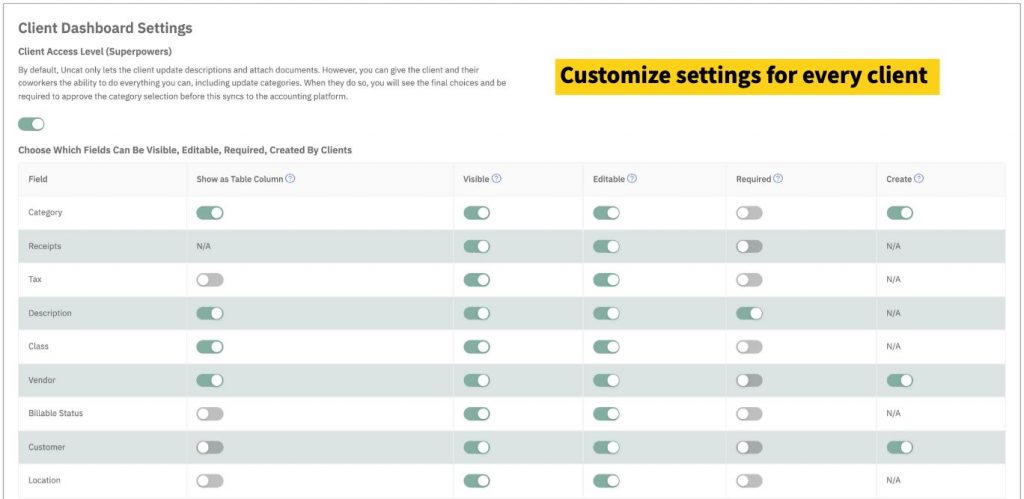

Uncat is an app built for accountants and bookkeepers to help you avoid constantly exporting spreadsheets and chasing down clients for information to categorize uncategorized transactions.

Uncat syncs uncategorized transactions from QuickBooks Online, QuickBooks Desktop, and Xero, automatically notifying your client when there are transactions that require answers.

Your client, through a one-click access Magic Link, will go to their Uncat dashboard and enter descriptions, upload receipts, and fill out any other information you might need from them. It then notifies you—the accountant or bookkeeper—when your client updates their transactions. This will allow you to review, edit, and categorize them in your Uncat dashboard. Then, Uncat syncs your selections into your accounting software. Now you can close the books faster and prioritize your energy on tasks worthy of your attention.

Working in the accounting and bookkeeping industry, you often need reporting and analytics apps. These apps focus on analysing your client’s data, design reports, and advise your clients to help them make informed financial decisions. However, uncategorized transactions severely disable your reporting and analytic abilities. Essentially, this is where Uncat comes in. Uncat gathers information from your clients about their uncategorized transactions so you can generate accurate, meaningful reports to advise your client.

Summary of Apps for Bookkeeping Businesses

Our recommendation on starting to explore apps, is to take it one step at a time. Initially, start with setting a plan. Make sure you look at the apps from different angles. For example, how they help you manage your practice, improve your client’s experience and support your bookkeeping business growth.

And lastly, start testing some of the apps out there. It will improve how you do bookkeeping business.