Running a small business is challenging enough already without over complicating cash flow forecasting. After all, what is cashflow forecasting? A lot of businesses know they should monitor their cash flow and have a forecast. However, it can be daunting to get started with it.

Your Cash Flow Projection should be part of your regular management tasks. This article 12 Must Know Bookkeeping Tips for Businesses gives you a great starting point in setting up your check list.

For now, we break down the key information you need to know about Cashflow Forecasting. Hopefully, you will quickly absorb these bite-size chunks and master cashflow forecasting.

What is Cash Flow?

Before we get started with what is cashflow forecasting, it is important to start with the answer to what is cash flow?

Cash flow refers to the amount of money moving in and out of your business.

Money can be flowing in from customer payments and out when bills need to be paid over a period of time.

What Does Positive and Negative Cash Flow mean?

When discussing cash flow, you will frequently hear the terms ‘’Positive Cash Flow” and “Negative Cash Flow’’.

Positive cash flow is when the amount of money coming into the business at a point in time is more than the amount of money going out.

Negative cash flow is when more money is going out of the business than into it.

Positive cash flow is vital to any business. If you are not regularly seeing positive cash flow, it could be an indication that your business is struggling.

What is a Cash Flow Forecast?

One of the best ways to monitor your cash flow and to ensure that your business stays afloat is with a Cash Flow Forecast.

A forecast often starts with the information in your financial data for a past period. Usually a year’s worth of financial history is enough for a decent forecast.

This historical information on what’s coming in and going out of your business forms a solid basis for a budget for the future periods. Furthermore, the budget is then adjusted for the timing of payments and receipts to turn it into that most valuable of financial documents, the Cash Flow Forecast. Essentially, it projects future cash for your selected forecasting period.

Note: a Forecast is quite different to a Cash Flow Statement. Here is how you would run a Cash Flow Statement.

What does a Cash Flow Forecast Look Like?

A cash flow forecast can be in two forms.

- A table with rows and columns

- Or, a chart.

A table is great for seeing the detail and a chart is perfect for an overview.

What Do You Include in a Forecast?

There are a handful of components you need to make sure form part of your Cash Flow Forecast:

- Bank Balance at beginning of the month

- Income

- Expenditure

- Cost of Sales

- Expenses

- Balance Sheet movements

- Increases or decreases in Assets

- Changes to Liabilities

- Bank balance at the end of the month

Cash Flow Forecast Table: Explained

Looking at this report, you simply focus on three sections:

- At the top of a cashflow forecast table you will see your starting bank balance at the beginning of the month.

- The section below that covers the money coming into your business. Or what is called the Cash Inflows.

- Whilst the next section shows the money going out of your business. Also known as Cash Outflows.

After that, you compare the inflows and outflows to give you the net movement at the bottom of the table. Furthermore, the last row shows your predicted bank balance at the end of the month.

Essentially, the table breaks down the cash inflows and outflows into separate lines. This gives you a level of detail that is not included in the chart.

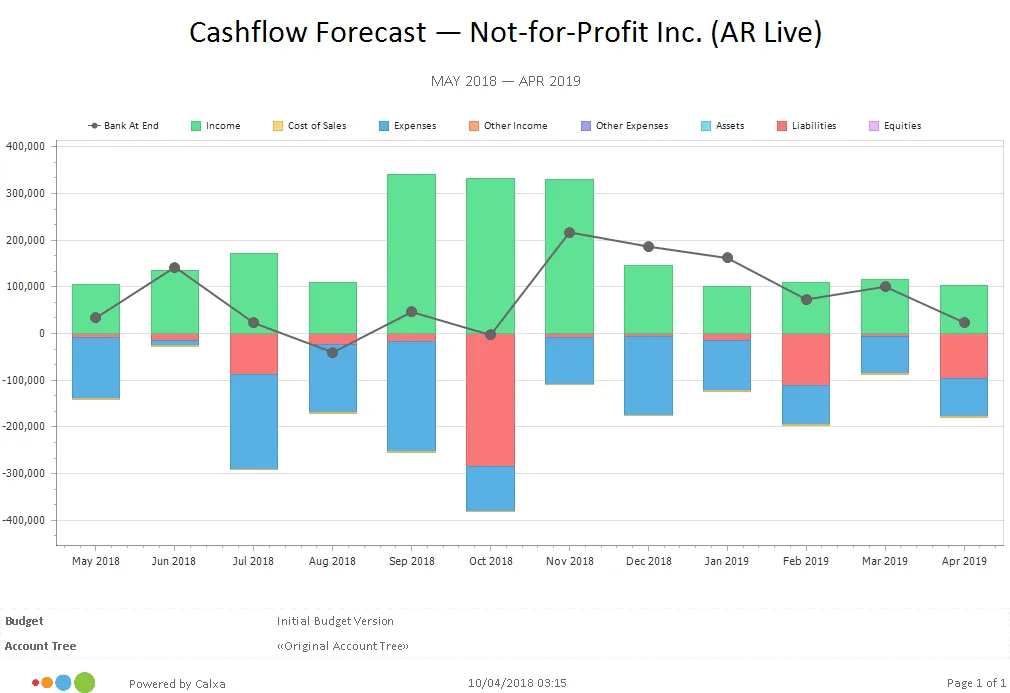

Cash Flow Forecast Chart: Explained

A cashflow forecast chart is a great way to visualise your cash flow. With a chart you can see at a glance whether your business is cash positive. In essence, the chart is a summary of the table above. All money going in is above the zero line and all money going out is below the zero line.

The black dot represents the bank at the end of the month.

- If the black dot is above the zero, then that indicates a positive cash balance at the end of that month. It means that the business is trading solvently.

- On the other hand, when the dot is on the zero line, then it is predicting that there will be no money left in the bank that month.

- Finally, if the dot is below the zero line, it indicates negative cash flow and some sort of action is required.

How Often Should I do a Cash Flow Forecast?

Generally, you will run a cash flow forecast every month. It forms an important part of your monthly reporting. On the other hand, if your cash flow varies widely from week to week, or funds are very tight, you should prepare a weekly forecast. That would be ideal.

Is there Such a Thing as a Cash Flow Forecast Template?

It is possible to create a cash flow template using a spreadsheet.

- Put the months along the top row.

- Then list out the income and expenses in the first column.

- Next you insert the data, copied from where the information is stored or type it manually.

Alternatively, you can make it easy for yourself and use a tool like Calxa that automatically creates a forecast for you. Calxa creates a cash flow forecast based on information from your accounting system. It just takes a few steps:

- You’ll need both, a Profit & Loss and Balance Sheet budget, but Calxa helps with that.

- Either import existing budgets or use the Budget Factory wizard to build a budget quickly from the previous year figures and then fine-tune them.

- The accounts that are difficult in a spreadsheet, such as Bank Accounts, Accounts Receivable, Accounts Payable and Taxes, are all calculated for you . So, even the Balance Sheet budget is easy to set up.

- Timing of payments and receipts is calculated from the actual payment history from your accounting data, not from theoretical terms of trade.

- You can select the appropriate schedule for your GST/VAT payments and ensure timing is accurate for all major inflows and outflows.

Needless to say, you won’t have to handle complex formulas or spend ages creating a chart in Excel. Calxa can do it all for you – just follow this Step-by-Step Cash Flow Projection Checklist.

Why Is a Cash Flow Forecast Important?

There are many reasons as to why it is important. Ultimately, the core reason is that it is vital that you manage your cash flow to keep your business running.

You can’t manage the flows of cash in and out of your business if you aren’t monitoring it. But that’s exactly what a cash flow forecast helps you to do.

By analyzing your cash flow, you can then plan accordingly to keep your business afloat and growing. Read some other reasons for a cash flow forecast here.

Advantages of a Cash Flow Forecast

1. Helps you Plan ahead

A forecast empowers you to make decisions about the future of your business. Armed with the evidence that you are predicted to see positive cash flow, you can then consider growing your business.

Check out our tips on how to manage your cash flow for growth and cash flow implications for growing businesses.

2. Makes sure you can pay your suppliers

By analyzing your predicted cash flow for the coming months, you will know how much money will be coming into the business. Essentially, you can then determine that you have enough to pay suppliers, tax liabilities and of course, your employees.

If your cash flow forecast looks like it will have negative cash flow coming up, then you need to reduce the amount of money going out soon. Or, increase what’s coming in.

There are a number of actions that can be taken to ensure that you can pay your suppliers and employees. Find out more in our article on how to respond to a revenue crisis.

Disadvantages of a Cash Flow Forecast

1. A forecast can be wrong

It can be wrong if there wasn’t enough data to make an accurate prediction. Or, there were other factors that made the forecast totally useless.

Factors that could affect your cash flow position could include the unforeseen loss of a major customer, major weather changes impacting harvest or the opening of a new competitor down the street.

It is difficult to predict the future but the best way to manage this is to regularly run a cash flow forecast based on the latest data and check it regularly.

It’s good practice to prepare alternate budgets to anticipate problems. This makes you think in advance about how you would manage them. Being prepared will help you take action quickly when you need to.

2. You need to run a Forecast Regularly

A cash flow forecast needs to be regularly updated and reviewed, which could be seen as a disadvantage. It may feel like a lot to manage at first but once you start regularly updating your forecast, it will feel less difficult. It is even easier to manage if you set up a Forecast Report to automatically run every month in Calxa.

How to Improve Your Cash Flow

You now have all the info you need about what is cashflow forecasting, so how do you take it to the next level?

To improve your cash flow, have a read of 23 Ways to Improve Cash Flow by the Queen of Cash Flows, Tracey Loubster. If you want to level up your forecasting using Calxa, then watch our web chat on Step by Step Cash Flow Forecasting.

Find out more about Cash Flow Forecasting with Calxa.