Securing a business loan can be daunting but it is one of the more important functions when needing capital for growth or survival. When preparing financials for the bank, you must demonstrate to your lending institution that your business can generate a profit and have a positive cash flow. This requires substantiating your position which you can do with a series of reports. To do this, include the preparation of a 3-Way Forecast and Key Financial Ratios.

Be Prepared with good Financials for the Bank

Taking the time to prepare accurate budgets and forecasts is critical in being successful in any loan application. Going the next step by providing further analysis in the way of key financial ratios can only help improve your chances of getting over the line. Here are the relevant Key Financial Ratios you should include to help your Bank Manager make an informed decision.

Being prepared with your financials will show the bank your professionalism and create an excellent first impression. And, that’s still important. By using a reporting tool like Calxa you can bundle the information you need into one report. Then add a nice cover and some notes to explain your assumptions. But first let us look at what you need to include.

Prepare 3-Way Forecast

Financials for the bank has to include a 3-way forecast. Banks want to see a 3-way forecast. This is sometimes referred to as a 3 Statement Model. You will find a profit forecast alone not enough for the bank manager to mitigate their risk. A true 3-way forecast includes a Profit and Loss forecast, Cashflow forecast and Balance Sheet forecasts.

Thankfully Calxa takes the headache out of preparing these reports by taking your budgets and making all 3 reports work and balance together. If you have multiple entities in your group, it is important that you prepare these reports at the group level and consolidate all the entities. Tip: use Account Trees to simplify the elimination of inter-company transactions. This article 7 Uses for Advanced Account Trees will explain this in more details.

Once you have created a Profit & Loss budget and a Balance Sheet budget, review the Cashflow Settings. This way you can make sure you have the timing of payments and receipts right. Then you can use the pre-built Report Bundle Kit to produce your 3-way forecast. Simply go to Reports, Bundles, Create a Bundle and you can then select your company (or organisation group) and budget and you’re done. The bundle creates both reports with numbers and matching charts. These often tell a story much quicker than the numbers.

For a comprehensive guide on preparing 3-Way Forecasts watch our Web Chat recording Web Chat: How to prepare 3-Way Forecasts.

The Key Financial Ratios

Three ratios are commonly used by bankers when assessing loan applications. It is important to understand these:

Debt Service Coverage Ratio

Why this is important?

This tells the banker how many times you could make the loan repayments with your net income. If the ratio is 10 or more, the banker will feel pretty comfortable. If it is just over 1 then they will be very nervous. Especially in the event of a profit downturn which could reduce your ability to repay the loan from your net profit.

Calculation

Create an Account Group for the Debt Service Amount to include both the income and principal components of your repayments. Net Profit is a standard Account Group so you don’t need to create that.

Debt Service Coverage Ratio = Net Profit / Debt Service Amount

The debt service amount is your loan repayment, the sum of the principal and interest amounts.

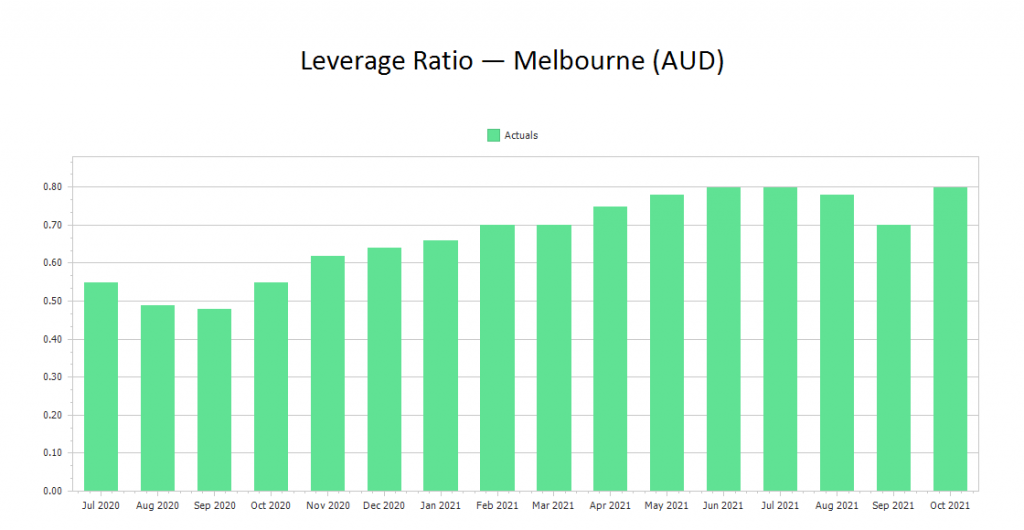

Leverage Ratio

Why this is important?

This ratio is a way for the bank to determine how much of their money versus your own money is being used to grow the business.

Calculation

Leverage Ratio = Total Business Liabilities / Total Equity

This ratio is a standard ratio in Calxa, which we call the Debt to Equity Ratio.

Loan to Value Ratio

Why this is important?

In this ratio the banker is determining how much wiggle room they have in the event of the business defaulting on the loan. If the bank ends up with the collateral, they will want to make sure they can sell this for a value high enough to recover the outstanding loan balance. A value of 0.6 is a common ceiling for business borrowings (that represents $100 worth of collateral or security for $60 worth of borrowings). Use a Metric to record the value of the security provided as you’ll want this at the current market value, not the book value.

Calculation

Loan to Value Ratio = Total Loan Amount / Collateral (Security) Provided

Now to Polish Up your Financials for the Bank in Calxa

Now you can do all these calculations separately in a spreadsheet or you can add these KPIs to your Calxa reports. There are just a few simple steps.

First: Customise KPIs to Perform the Calculations

Whilst Calxa does come with a set of default KPIs commonly used in business, you can also Create your own KPIs. These can provide further detail and insights into the financial information that is being presented.

When creating KPIs for specific purposes, it always pays to group and sort them in a logical sequence. This way, they will appear in the preferred order on your reports.

Second: Now add the Ratios to your Calxa Budget Reports

Once these KPIs have been created, they can be easily added to the bottom of your budget reports.

The Profit & Loss and most of the Actual vs Budget reports give you the option of including KPIs in the Additional Information section. You could also insert them into an Account Tree but in this case, it is often clearer to separate them at the bottom of the report.

What’s more, you can present your new customised Bank Ratios in graphical format by any of the KPI charts. To do this, simply go to the Report Builder, filter for KPI and the chart type you prefer. Alternatively, you can put them on a dashboard and include that in your report bundle.

Third: Bundling it all Together

Creating a Report Bundle for all of your loan application reports can not only save you time but help you deliver a professional loan application. Start with the 3-Way Forecast Kit described above. Now add your KPI charts (or your dashboard) as you create them. Alternatively, you can add the KPIs to the Profit & Loss forecast in the bundle.

You will now be able to produce the whole set of reports at one click. Consider sending it to your accountant for feedback before presenting it to the bank. They generally have much more experience of seeking finance than those of us in business.

Ongoing Management

Back in the olden days, this exercise would have been over once the loan had been approved. However, that is not so common these days. Your bank is more likely to want updated reports on a quarterly or a monthly basis. Use the same bundle as the basis for this. Or, even better, make a copy of it if you need to make changes. They might ask you to add in a report comparing actuals to budgets or there could be covenants attached to the loan. These could require you to maintain a certain debt to equity ratio or a minimum level of earnings before interest and tax (EBIT). Don’t be afraid of these. Most of them can be managed and reported on with a simple KPI. If you get a tricky one, ask our team for help!

So here you have it. A quick way of preparing financials for the bank and getting some meaningful reports to your Bank Manager. Impressed? Your Bank Manager will be.