We live in a global economy and it’s common for businesses to operate in multiple countries. We’re going to focus here on multi-currency reporting for multiple entities in a group and the many challenges that need to be resolved.

What is Multi-Currency Reporting?

Small business accounting systems like Xero generally do quite a good job of multi-currency reporting within one company. However, what if you have 2 companies, or 20, operating in different currencies?

As an example, some of our European customers might have their French head office trading in Euro. To add to this, they also have subsidiaries in the UK (using GBP), Switzerland (CHF) and Iceland (ISK). In these cases, you will need a tool like Calxa to get true multi-currency reporting across this group. While our focus is on management reports, you can use the P&L and Balance Sheet reports produced by Calxa as the source data for your statutory reports in most cases. Simply prepare financial statements to report in any currency and combine multiple currencies.

Overview of Multi-Currency Reporting Setup in Calxa

Our Consolidation Guide is the place to get all the details but here’s the quick summary on what you need to consolidate your multi-currency group in Calxa:

- Get the Company Data: Link Calxa to each company. As well as Xero, this could be QuickBooks, or MYOB if you are in Australia or New Zealand. It could be a larger system like NetSuite, Acumatica or Business Central. Use a Manual Organisation and import actuals for other accounting systems.

- Set the Base Currency: Do this for each company in Settings, Organisation Settings, General. We will detect it automatically most of the integrated systems.

- Create the Common Account Structure: Use Calxa’s Account Trees to generate a common layout and to eliminate inter-company accounts. One Account Tree covers all the companies, making it simple to set up.

- Set Up your Group: Create an Organisation Group and nominate your reporting currency and year-end date.

- Build Budgets: At this point, add budgets if you’re doing management reports and 3-way forecasts. You can use almost every report template in Calxa for an Organisation Group. You’re not limited to the basics.

- Generate Reports: Now, start running your multi-currency reports and add to your report bundles.

Nominate your Reporting Currency

Each organisation group has a nominated reporting currency. This is usually the currency of the parent company or head office location. You’re not limited to just one reporting currency though. By copying the organisation group, you can quickly create another with an alternate currency.

This is useful where you have major investors who want to see the group accounts in their home currency.

Alternatively, you can set up an organisation group to have just one organisation in it. Use this where you are running a subsidiary company and need to report to your head office in their currency. They may be using some big ERP system, but you can keep your accounting simple while still giving them the information they need in the way they want it.

Currencies Supported in Calxa

When we developed multi-currency reporting for users, our ambition was to be the best possible in this field. For that reason alone, it makes sense that you can access all currencies recognised by the United Nations and currently used for trading. This gives you a list of 180+ currencies.

Apparently, there are other reporting solutions that don’t give you that much flexibility. We’ve had customers come to us needing to report in Congolese Francs (CDF), Icelandic Kronor (ISK) and Algerian Dinar (DZD). We’ve not yet had to say no and don’t intend that to ever happen.

How Does Currency Translation Work?

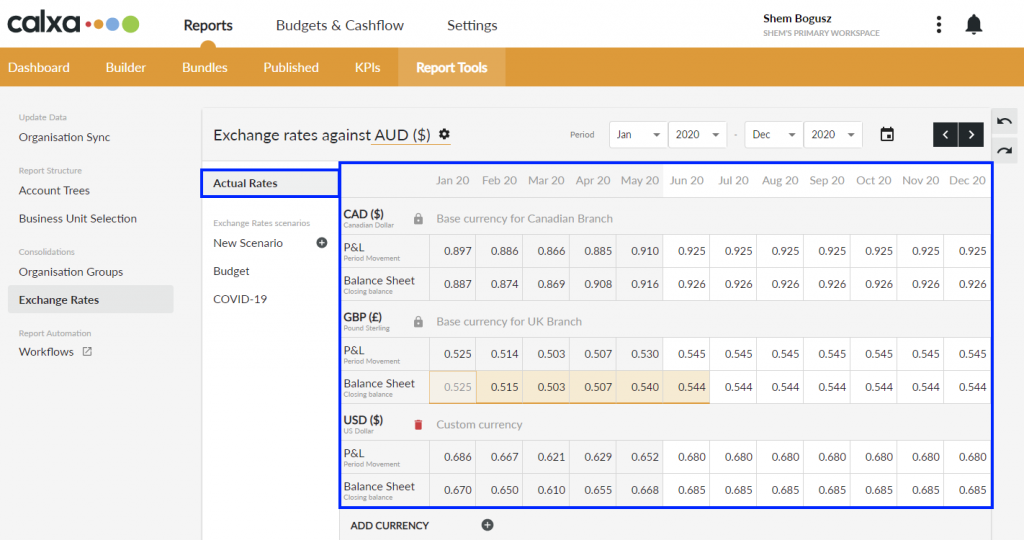

There are international accounting standards that guide us in our implementation of multi-currency reporting. With Calxa, you have access to exchange rates daily from our provider.

It will calculate monthly averages for P&L accounts and month-end rates for Balance Sheet accounts. On any of these, you have the option to override the imported rates and specify your own.

For budgets, our default rate is to extend the latest rate into the future, assuming no changes. We realise that’s not always what you need though, so you can create as many scenarios as you like to model future rate changes. This helps you answer questions like:

How would my cashflow change if my currency appreciated or depreciated compared to some other currency?

There are also times when you want to permanently fix the exchange rate used on an account. This mostly relates to balance sheet accounts such as fixed asset purchases or capital investments. Set the rate and Calxa will always use that no matter how other rates have changed.

For the Retained Earnings, we don’t use the current balance sheet rate, we use the rate at the end of last financial year so you know the accounting is right.

Managing Multi-Currency Reporting

What multi-currency reports does Calxa provide? Essentially, the short answer to this question is that almost all the reports in Calxa, all 200+ of them, can be run for a multi-currency group.

If you need data for statutory reports, you can choose from a range of Profit & Loss, Balance Sheet, Trial Balance and Statement of Cashflow reports. Report in your home currency or any foreign currency you need.

Management reporting is the focus of many of our customers and there Calxa really comes into its own. You can use it for key things like:

- Build budgets in each entity and combine them in your chosen reporting currency to compare to actuals.

- Easily create a bundle of reports to produce a balanced 3-way forecast for your entire group. Sometimes it makes sense to look at the consolidated reports for your group. Use the Create a Bundle option and the standard bundle kit to make this easy.

- However, there are times when you need to look at each entity side by side. We provide both a P&L Comparison and a Balance Sheet Comparison report for this purpose. The same style is available for the Cashflow Statement and the Cashflow Forecast.

- These comparison reports are especially useful for troubleshooting and you can choose to display Actuals, Budgets or a Forecast at a future date.

Currency Translation Differences

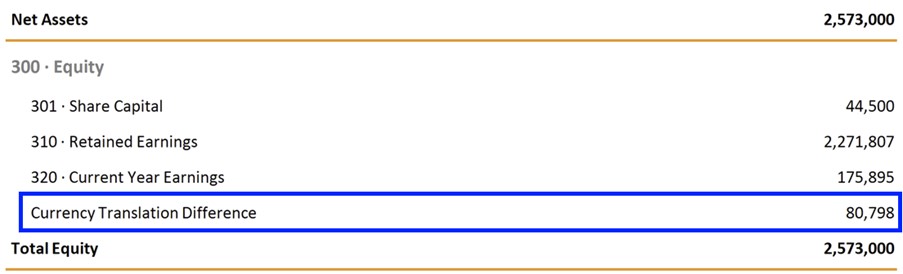

The use of different exchange rates will inevitably give rise to Currency Translation differences. Calxa will report these in the Equity section of the accounts.

We provide 2 reports to help you identify the source of these differences so you can understand and have full confidence in your reports. Use the Currency Translation Difference report to compare values using the actual rate and compared to the closing balance sheet rate. The Currency Translation Comparison breaks down the differences between the entities.

We understand that accounting is about transparency and you need to know how your reports are built. There’s nothing secret about it!

What Are the Limitations?

We are confident that our multi-currency consolidation for Xero (and other systems) is the best there is. You are welcome to check the accounting integrity of our calculations and assure yourself that our 3-way forecast truly does balance, but we’ll be very surprised if there’s a problem.

With our range of reports and support for all available foreign currencies, we give you the flexibility you need within your reporting. So, once you’ve done the setup and created a handful of report bundles, production and delivery is simple each month.

We don’t have hard limits on the number of entities you can consolidate. We know that it will work well for several hundred and we’d love to hear your stories if you have more!

Getting Started with Multi-Currency Reporting

If you’re ready to try Calxa’s reporting, start with our Consolidation Guide and a free trial. Remember that our team is available to help when you need it!