Calculating the Lifetime Value of your Clients is the key here. Traditionally, the value of a bookkeeping business has been based on recent profits. Maybe it’s time for the bookkeeping industry to take a lesson from the software industry. OK, not every lesson from the software industry is applicable (remember the dot.com crash anyone?) but there are some lessons to learn, including those of valuation.

At Calxa, we don’t run a bookkeeping or an accounting practice. A few members of the team have experience working in bookkeeping or accounting, but that was very much back in the olden days. However, we think we have an insight or two that may help our colleagues in valuing their practices.

Back in the olden days

Long ago, (OK, so actually not that long ago) the formula used in may circles was:

Price = Net Profit before tax x 100/ROI

What’s ROI? Theoretically, it’s the buyer’s desired return on investment but in practice, business brokers tend to have a sliding scale based on the net profit of the practice using a high ROI percentage at low profit numbers, and lower percentages as the profit increases. What gets counted as Net Profit is generally some variation on EBITDA (earnings before interest, tax, depreciation and amortisation), though some want to also exclude “non-declared cash sales”. Who would have thought a bookkeeper would have those?

What’s the result?

The purpose of this valuation method is to reward you for making a big profit in your final year of operation. In the days when bookkeepers sold time this made some sort of sense – it rested on the assumption that the same amount of time could be charged for the following year(s) and at the same margins. But the buyer never trusted the seller and would always seek to discount that value (especially in a small practice where the future revenue was uncertain once the principal was gone).

The world of bookkeeping has changed

Many bookkeepers no longer work at hourly rates. They work on fixed-fee or value-based pricing. And this is where we think our insight may help you. At Calxa, we work on what is effectively a fixed-fee business – our clients pay a monthly subscription for their software, much as yours pay a fee for their bookkeeping (and this doesn’t mean that every client is paying the same).

We don’t claim to have special insights. Some people explain this much better than others. Have a look at how Matt Paff explains the valuation of Xero and then have a think about how this might apply to your bookkeeping practice.

It’s not about last year’s net profit (Xero didn’t have one) but about the lifetime value of your clients. What are your clients worth to your business? What we’re asking is, what’s the value of the future revenue from your clients?

Calculating Lifetime Value

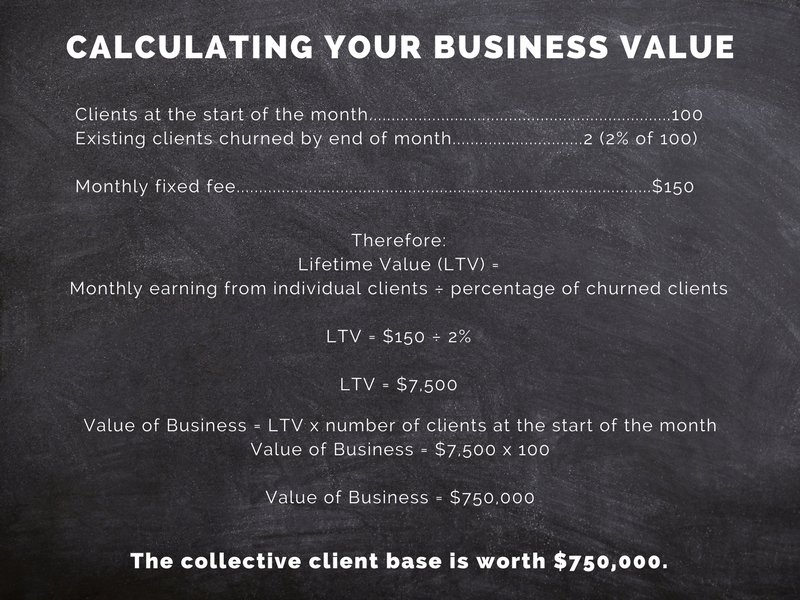

How much is a client worth to your practice? First you’ll need to determine the gross profit per client and then your churn rate. What’s a churn rate?, you ask. What percentage of your clients do you lose each month? It’s natural for any practice to gain clients and lose clients. Obviously, you try to minimise losing clients, but in some cases it’s beyond your control. So is your churn rate 2%? 3%? Whatever it may be, divide your average profit per client by your churn rate and you’ll have a good estimate of the lifetime value.

If you know the lifetime value of the average client, you will know the number of clients you have. That makes it easy to calculate the overall value of those clients to your business (for those who are having trouble keeping up, it’s the average value per client x the number of clients).

So, if you have 100 clients, each earning a gross profit of $150/month and churn rate of 2%, what does that give you? $150÷2% suggests each client is worth $7,500. You have 100 clients so that suggests they are collectively worth $750,000. When you sell your practice, that’s what you’re selling.

Measuring performance alongside value

Once you have worked out the lifetime value of the average client, you can use this as a key performance indicator (KPI) to regularly monitor the progress of your practice over time. Find out more about other KPIs that enable you to measure and monitor your practice’s value in our article about KPIs for a Bookkeeping Practice.

Increasing the value of your practice

In the traditional model, you increase the value of your practice by (a) increasing profit and (b) increasing turnover (as this lowered the ROI applied).

Valuing your practice based on the lifetime value of the clients changes that. It actually doesn’t matter anymore whether you have made a profit in your final year or not. It now makes sense to invest in marketing your practice, adding more clients, and investing in retaining those clients (reducing churn and increasing lifetime value).

What would you rather buy? A practice where clients are charged on an hourly basis, or a practice where all or most are on some fixed fee arrangement and have been educated to love the practice (not just one individual), and have been happy clients for a long time? We know what we’d choose.

Buying and selling any business is a matter of negotiation. If there is one thing that can attract a buyer, it’s a steady income stream. Are you building yours?

If you are looking for inspiration on getting started as a bookkeeper, we recommend reading about award winning bookkeeper Chelsea.