Revenue, Profit and Cash Flow – which one is more important? The question as to the significance of prioritising Revenue, Profit and Cash Flow crops up for every business at some time or another. Focusing on the right financial strategy can make or break your business. But which is the important one? Simply put, they all are! Just not all at the same time.

But it is worth exploring the difference. The importance of each may be as simple as a timing question. Ask yourself when does your business need to focus on:

- Increasing Revenue

- Turning a Profit

- Maintaining Positive Cash Flow

Different times ask for different solutions. And with these three focal points, there is a marked difference on when each is more important in the life of a business

Firstly, you want to understand what each of these financial models does for your business.

What is the difference between Revenue and Profit?

Let’s clarify our terminology first. Think of revenue as the total income your business generates. This can be income from goods sold or services invoiced. It refers to income directly earned from your core business operations. For example, you would not count:

- Insurance claims

- Interest paid on savings

- Tax refunds

Whereas Profit is the amount of income leftover after you deduct the expenses and operating costs.

What is the difference between Profit and Cash Flow?

Essentially, profit is what remains after deducting all the expenses from your incoming revenue. In turn, cash flow, is the actual cash that moves through your bank with a focus on what comes in and what goes out. It is important for forecasting the available cash in your business so that you know in advance if there are problems on the horizon.

To look at cash flow, is to look at what is happening in your business now and in the future. In contrast, you usually track profit over time and review the past trends before looking to the future projections.

When do you go for Revenue, Profit or Cash Flow?

Now that we better understand the difference between Revenue, Profit and Cash Flow, we can look at the appropriate timing of each.

Increasing Revenue

Growing your income is not an easy task. It requires finding more customers to buy your product or existing customers to spend more. Often this growth is dependent on economic factors beyond your control. For example, on developments in your industry or, sometimes, on the results of your focused marketing strategy.

Whatever the situation, the reasons you want to increase revenue could be:

- Wanting to grow your business

- Covering more core costs like staff and inventory

- Facing increased direct costs like freight or fluctuations in raw material

Especially in the early days of a business, you may want to focus on revenue first. If you haven’t got customers, you can’t make any profit at all. Some businesses, such as Amazon and Xero, focus entirely on growing revenue for years but that’s not an option for most of us. That requires cashflow funded by investors (with deep pockets).

Turning a Profit

Profit is essential to the long-term success of any business. Unless you can fund the business by making a profit, you’ll be constantly looking for loans or investors. Yes, you’ll pay tax on your profits but consider that a sign of success. Failing businesses don’t pay tax.

Bear in mind too, that there are important times in a business life cycle when showing a profit is everything:

- At the time you want to sell the business

- When you are actively seeking investment

- While applying for a bank loan

- As part of building a succession plan

It is important to understand that making a profit does not mean necessarily that there is cash in the bank. But on a profit and loss statement you will show the profit as a positive number. You can manage for a short while without profit by drawing on savings or by borrowing. You can’t do it long term unless you can get cash from investors or lenders.

Profit will be the first port of call when an investor or the bank are looking at your books. They will need a lot more convincing that their money is safe if you’re not making a profit.

Maintaining Positive Cash Flow

Cash flow is really all about the now and the future. There is a reason why we say ‘Cash is King’. It is the lifeblood of a business. Cash flow problems will hinder business operations and stop all plans in their tracks. Having cash in the bank is important when you expect uncertainty from:

- Increased customer churn which will affect your revenue turnover

- Upcoming difficult economic times like depressions and recessions (or a pandemic)

- Anticipated cost escalation like supplier price increases or market fluctuations

To focus on maintaining positive cash flow is about looking at a forecast and predicting where the bank balance may be in one month or two years. Essentially, it is about looking forward and detecting hotspots so you can better manage any surprises.

Again, your business can survive short-term cash deficits. You can draw on savings, take out short-term loans and keep going. No business, however, can survive long-term cashflow problems. If you haven’t got the cash to pay your bills, you’ll be insolvent.

What is more important – Revenue, Profit or Cash Flow?

We are back to the eternal questions we opened with. They all are equally important for different times in your business cycle. To summarise:

- Revenue is more important than profit if you want to grow your business quickly but that requires adequate cash reserves. That’s why people recommend having adequate working capital before you start a new business. Then you can focus on customers and growing the revenue.

- Profit is more important than Cash Flow if you want to show the potential of your business and is necessary for long-term success. There may be seasonal fluctuations in your profitability but you should aim for an annual profit. In the early days of a business, it will take time to reach profitability. You need to spend on finding customers before you start earning enough revenue to cover your costs.

- Cash Flow is always important. Without positive cash flow you are at risk of trading insolvent. And, at some point you will not be able to pay your suppliers nor cover payroll costs. It is unlikely a bank will finance any future capital purchases nor will an investor or potential buyer look at your business as a viable proposition.

Tracking Revenue, Profit and Cash Flow

Once you have identified which financial model suits your business at this time, the next step is to track this. Here are some suggested management reports that will help you.

Tracking Revenue

The reports to help you follow the trend in your revenue growth outline the core business income as individual line items or as a combined value. The simplest report to look at is:

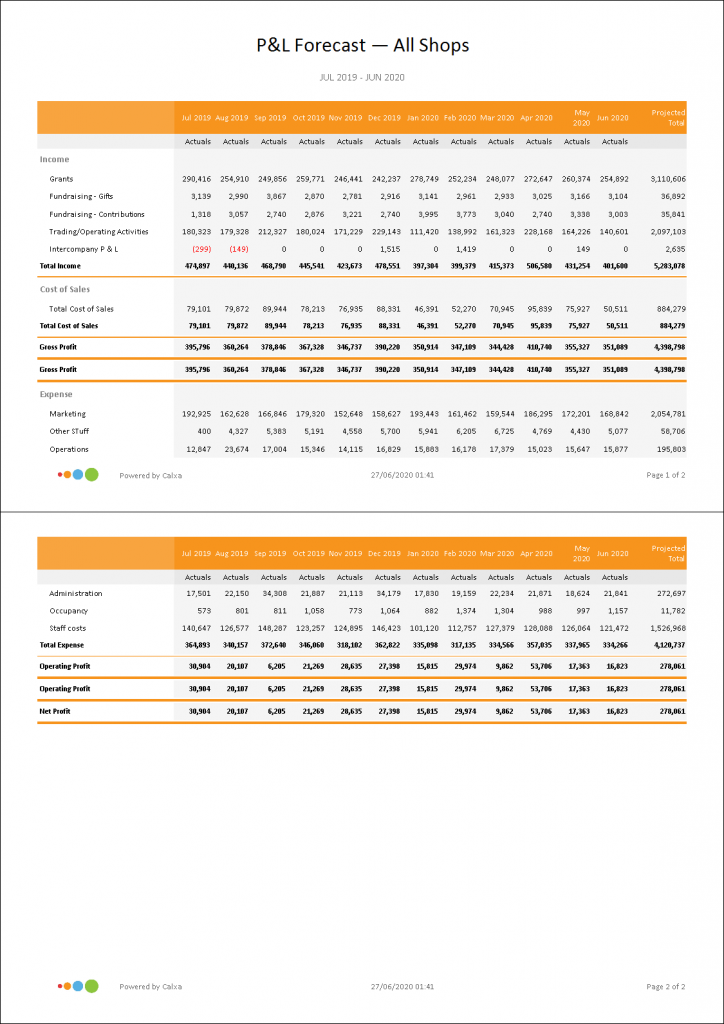

- P&L with Projected Total, showing Actuals for past months, budgets for the rest of the year.

- Account Analysis bar chart that shows total income as a trend over time.

Tracking Profit

To look at profit in this context, make sure to identify ‘Operating Profit’. This is the profit before other ‘non-core’ income and taxes. The best report for this is:

- P&L with Projected Total run at level 1 or 2 (summary, not detail)

- Operating Profit KPI. You could show this KPI as a trend line for months or years on the KPI Analysis Line Chart (Multi-Period).

Tracking Cash Flow

The only way to see your true cash flow into future is a forecast. The variants here include:

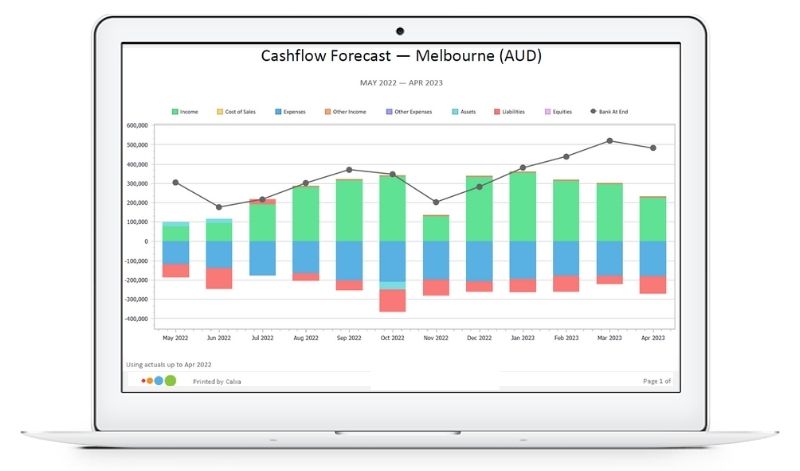

- Cash Flow Forecast 12 months or more into the future. Either the report with numbers report or a chart will give you the expected ending cash balance each month.

Revenue, Profit and Cash Flow Strategy

Now that we have identified the difference between Revenue, Profit and Cash Flow, it is up to you to figure out which is more important for your business right now.

Read up on Storytelling with Numbers to give you some ideas on how to prepare your management reports. You can also try some Scenario Building for your Business Plan to test some of your strategies.