Everyone loves a checklist to help with regular recurring tasks. This is no exception when it comes to an end-of-month process for consolidated groups. Whether you use an old-fashioned pen and paper for yours or a modern app, checklists are vital to ensure that the job is not only done well but also completed consistently from month-to-month. Above all, it ensures nothing is missed.

What is a Consolidated Group?

Firstly, let’s set the scene on group consolidations. Here, we are talking about organisations combining various company data for management reporting purposes. These are always run as separate entities and can include:

- Head Office with numerous branches

- Franchisor reporting on all franchises

- Holding Company with multiple subsidiaries

In any of these scenarios, the accounting, and in particular, the month-end process can be time-consuming.

Using a tool like Calxa to automate the financial reporting for the consolidated group makes sense as it saves time. It will help you to:

- Consolidate cost centres across entities.

- Handle inter-company eliminations.

- Manage partial ownership.

- Create a common account structure.

- True multi-currency consolidation.

- Report showing companies side-by-side or row-by-row.

Consolidated Group End-of-Month Checklist

This checklist is aimed at the finance teams that do these consolidated group reports using Calxa. Firstly, before getting to the reporting side of the process, there are a number of month-end closure tasks that you need to take care of. We are assuming you have a process for these already and won’t detail them here. However, to give you an idea, you can read of up on some of these activities here.

If not checked, these can affect your final output.

1.Business Unit Lists

This is a simple check. If you have added new cost centres throughout the month to any of the companies you are about to report on, make sure to allocate these in your Business Unit List that you use to report on your cost centres across the companies.

2.Account Trees

Like the Business Unit Lists, you need to allocate new accounts created in your accounting system to their relevant header. To do this, you look out for those accounts marked with ‘New’ and move them to the relevant header. This does not take much time at all.

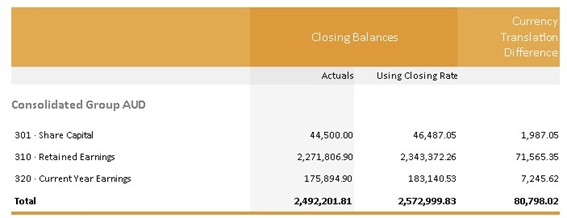

3.FX Translation Difference

If you are using multiple currencies for your consolidated groups, Calxa may report a currency translation different for a variety of reasons. In these cases, run the Currency Translation Difference Report to identify these discrepancies.

Now, compare the differences to the Currency Translation Comparison Report to track which company is affected by this.

This help note will guide you.

4.Inter-Company Recharges and Eliminations

Almost every multi-entity group has some sort of recharge from one company to another. This can be for a variety of reasons, for example:

- Overhead allocation across multiple companies within the group,

- Sales transactions between the companies,

- Or, payments made by one entity on behalf of another.

From an accounting perspective, these consolidated group transactions are necessary, but they are also an easy source of error. Essentially, when you manually process these items, the transaction starts in one company and is then replicated in the other company or companies.

The only way to ensure the accuracy of the task at hand, is to then reconcile relevant inter-company loan accounts in each consolidated group entity. Not doing this task risks having distorted financial reports with transactions in one company and no corresponding item in the other.

Luckily there’s an app for that, Mayday, which you can read more about below.

5.Review Actuals to Budgets in Calxa to confirm allocations are correct

You want each transaction to be allocated to the right account and automations only go so far. A human eye running over the variance column can uncover problems that are otherwise missed. The simple Actual vs Budget report is good for month and year to date but the Budget Analysis % Variance may be better as it shows both the amount and percentage difference from the budget. When configuring the report, you can highlight rows that exceed your variance tolerance levels.

6.Using the Comparison reports in Calxa

The comparison reports in Calxa give you a view of your companies side by side and that’s very useful for checking and troubleshooting. Viewing your P&L, Balance Sheet or Trial Balance gives you that ability to compare any account across the group and spot anomalies. In Reports, Builder, simply search for “comparison” and you’ll find the full range.

Here is a selection of the top reports for multi-company consolidations.

Use Mayday for Consolidated Groups to Save Time

For Xero users, there is a way of performing some end-of-month tasks with a more streamlined approach using an app called Mayday. Mayday is Xero’s Emerging App Partner of the Year 2023 for a reason, offering three products to super-charge your consolidated group end-of month.

Mayday Recharger

Recharger helps you run your inter-company recharges in 98% less time.

- Set a rule based on an account, tracking category, customer or supplier.

- Specify what proportion of value should be recharged or add a markup.

- Nominate how the recharge is recorded in the originating company and then how it is treated in the receiving company.

What is really cool is that in Mayday you can post these recharges as sales and purchases or as a journal. Using this method, you automatically create a corresponding transaction in the relevant company file. Time involved in the setup is minimal and the then automated process ensures consistency and accuracy every time, regardless of who does the processing.

Mayday BRAG (bank reconciliation across the group)

Even with the benefits of bank feeds, someone still needs to reconcile the bank every month. Add more companies and more bank accounts and you increase the complexity. Particularly as time is already being taken up by other end-of-month tasks.

Mayday’s BRAG works as a browser extension that adds functionality to Xero’s own bank reconciliation screen, enabling you to reconcile all or your bank accounts in one place.

So if you have payments in one entity relating to an invoice in another, you can match that, and the necessary inter-company transactions are posted for you.

Mayday Balancer

Balancer is the simplest of the Mayday tools, but it does what it says on the box. At a glance, you can see if any of your inter-company loans are out of balance. If they are, Mayday will show a list of transactions to make it easy to spot discrepancies. Then you can quickly create a journal in Mayday for any adjustments. It will also handle FX adjustments and auto-calculate interest on intercompany loans.

A Special Offer from our Friends at Mayday

It’s not often we recommend other tools but when we come across something that we find useful, it makes sense to share that knowledge. When we told the Mayday team we were writing this article on end-of-month tasks for consolidated groups, they offered a promo code: Calxa50.

If you want to try Mayday, sign up for a 30 day free trial and then simply use the code to receive 50% off a monthly Mayday subscription until April 2024. Or, for the first year of an annual plan. Have a look and see if it will make your life easier. You can even sign up with your Xero login.