Calxa can help adding value to your Practice. More and more accountants and bookkeepers are starting their “advisory” journey with Calxa. Start on one organisation at a time. Simply, use one of the shortcuts to create budgets and then one of the pre-set report bundles. And you are off and running with minimal effort.

Management Reports Adding Value to your Practice

Start simple! For your first client or two, create some quick and easy budgets, cashflow forecasts and management reports at the organisation or company level. You can choose from the full range of reports and bundle them to automate delivery. You can even add a cover with your logo (or your client’s), choose your own report style to make them yours. But the key thing to make this advisory and not just a set of reports that gets ignored, is to talk to your client about the reports. Ask them questions to get them thinking about what needs to change in their business. We have some suggestions here to get you started on that process.

Calxa for Small Business Clients

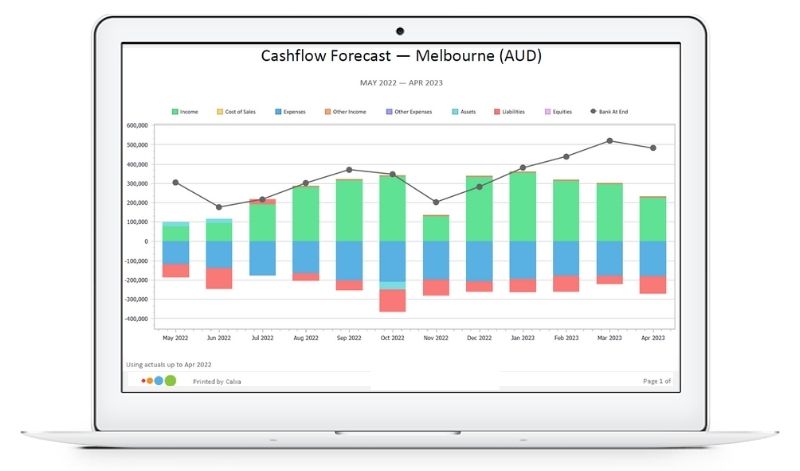

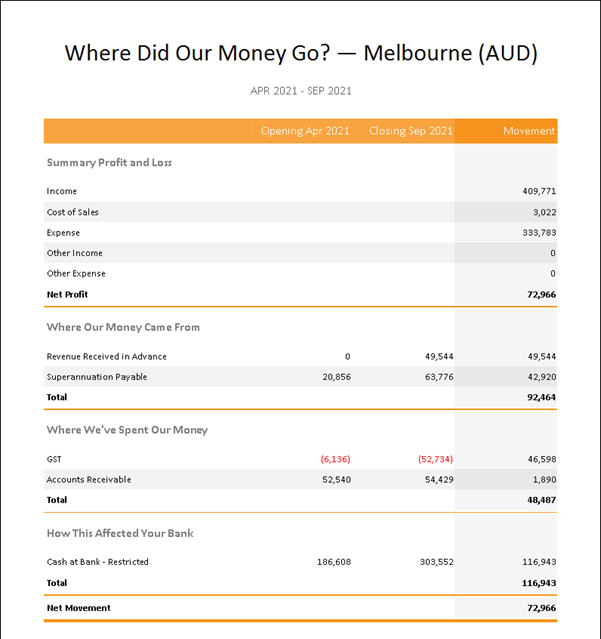

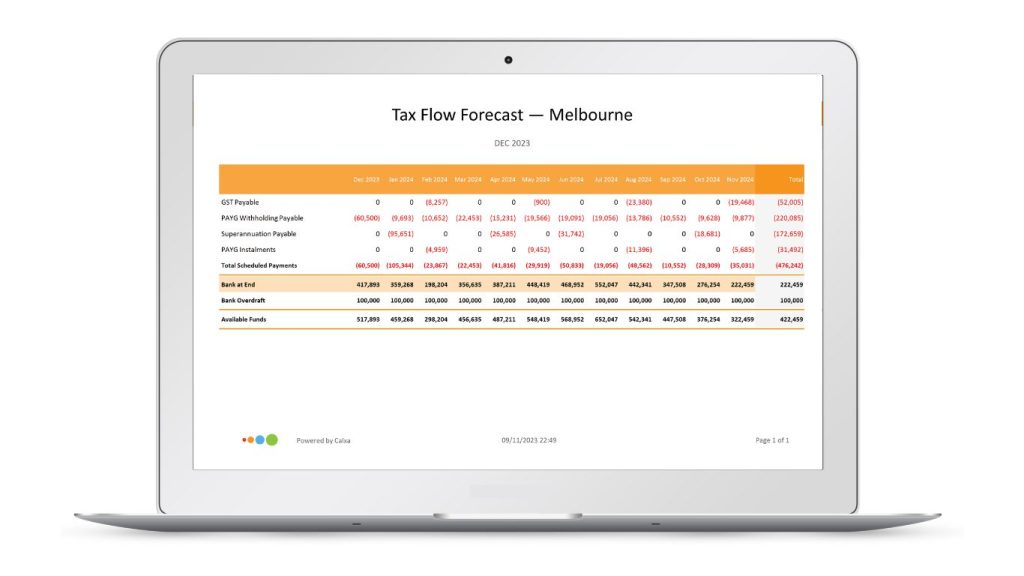

If you’re looking for some reports to help your clients, our pre-set Report Bundle Kits are a great starting point for most of your small business clients. Choose the full 3-way forecast if that’s important. Alternatively, use the Small Business Management Reports for a selection of reports and charts to compare budgets to actuals. Treat these as a quick-start tool and then tailor them to suit the needs of each client. Here are a couple of examples.

Managing your Advisory clients in Calxa

Understand the way workspaces function in Calxa and use them to get the right setup for your clients. A workspace is a container for multiple organisations.

Mostly we would recommend one workspace per client for these reasons:

- Each client’s data and reports are completely separated from the others

- If you ever want to invite the client in, you can give them permission on just that workspace and they’ll see nothing else

- You could easily transfer the workspace directly to the client if they want their own subscription in the future.

Use a single workspace for multiple clients if:

- You never, ever want to give the clients their own access. If you do, they will see the names of the other organisations at least

- You only have a small number of clients on Calxa (less than 10, say)

- The clients are all in the same industry and you want to reuse the same KPIs and account trees and copy report bundles from one to another.

Choose the right structure early to make your life easier later.

Easy Start in Adding Value to your Practice

The trial sign-up process steps you through connecting to your accounting system, asks a couple of questions for your basic cashflow setup and then creates your first report bundle. After that you can set up budgets using the Budget Factory wizard or import existing budgets from a spreadsheet. If you’re in a hurry to present something to your client, skip this and use the Auto-Budget, based on last year’s actuals. It will give you numbers that are reasonable and you can fine-tune them later.

Create a bundle of reports for your client using one of the pre-set Bundle Kits and schedule delivery of it each month. Make it early enough in the month to give the client timely information but allowing you to complete your normal checks and balances. Then, and this is the most important part, schedule a call with your client to start a conversation about what’s in the reports.

Once you’ve discussed your first bundle of reports with your client, you can modify it to more closely suit their needs. Take out any reports they don’t need and add in charts or reports that suit them better. Remember you can use any of the built-in KPIs and they make great charts to show progress towards goals.

Pricing

For AU$242 a month (US$155, NZ$242, GB£120, €140, respectively), you can run as many reports as you wish for a single company. Each additional organisation is only AU$25 extra. For a bookkeeper or accountant wanting an easy entry to the world of business advice, Calxa is the perfect tool.

There is no minimum term to your subscription and you can add unlimited users. Add organisations whenever you need them. If you lose a client, remove that organisation and stop paying for it.

How to Get Started with Calxa

Getting started to adding value to your Practice is easy: Start with a free trial so that you can fully evaluate the application and make sure it does what you need. The sign-up process will guide you through connecting to your MYOB, Xero or QuickBooks Online. It then asks a few questions about the timing of your GST or VAT and other payments.

Lastly but most importantly, it then creates your first bundle of reports. Now, spend some time exploring, edit your budgets, look at the range of reports and find the ones that suit you best. You get choice and flexibility in setting up your reports but once you’ve worked out the best fit for your client, add the reports to a bundle and then schedule delivery every month directly into their inbox.

Once you are trying Calxa, use this evaluation checklist to help you make a decision on the best add-on tool for you practice.