Xero is a world leading online accounting software. Many businesses are quite satisfied with their Xero reporting tool in itself. Especially for compliance purposes and daily management of your business, it does a decent job. When it comes to financial reporting though, you’ll want something more.

There’s a plethora of Xero reporting add-ons listed on the Xero Marketplace. These are apps that integrate with Xero directly to enhance the capabilities. Of course, choosing the right one depends greatly on your needs.

Let us guide you through a few different Xero Reporting Tools. This will help you better understand which one will help you make good business decisions to run your business.

Reporting Against Budgets for Xero Users

We recently reviewed the capabilities of Xero budget reports. While they’re fine for small businesses, there are serious limitations. Here’s a quick roundup of the main contenders in the Xero reporting apps.

Spotlight Reporting

The granddaddy of Xero reporting add-ons, Spotlight Reporting were there pretty much from the beginning.

- The Xero reporting app will give you a budget and a forecast (that uses actuals to date).

- And then you can add scenarios.

- It works best for budgets at the organisation level with limited options for tracking category budgets.

Fathom

Another one that’s been around forever. Fathom were with Calxa and Spotlight Reporting at the first Xerocon many years ago. For a long time, they didn’t do budgets at all but that’s changed lately. They now have some clever features such as:

- Using linear regression analysis to create budgets.

- You can create driver-based budgets

- And, micro-forecasts.

This works well at the organisation level but tracking categories have to be treated as a separate entity and consolidated.

Calxa

We shouldn’t forget to mention Calxa in the context of Xero reporting tools. This is the solution for those who want:

- Power and flexibility in their budgeting. Calxa does budgets for tracking categories. In addition, it can budget at the intersection of the 2 tracking category types. Then you can roll these up to the organisation level.

- Drivers, scenarios and multiple layouts are all provided, making it easy to build budgets for up to 20 years.

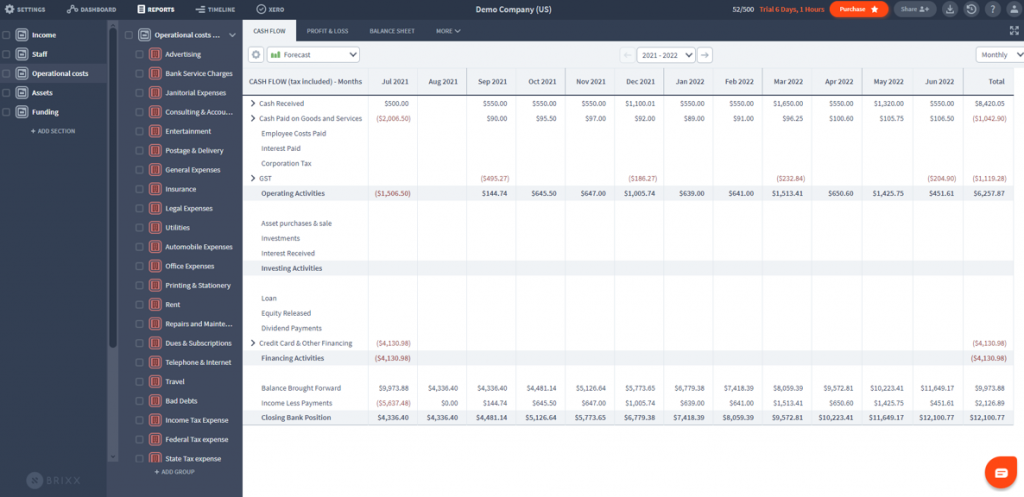

Brixx

UK-based Brixx are old hands at budgeting:

- Their user interface is conservative and maybe even shows their age.

- They are relatively new to Xero integration.

- Again, reporting is just at the organisation level but the budgets do include different components for calculating loans, wage deductions, etc.

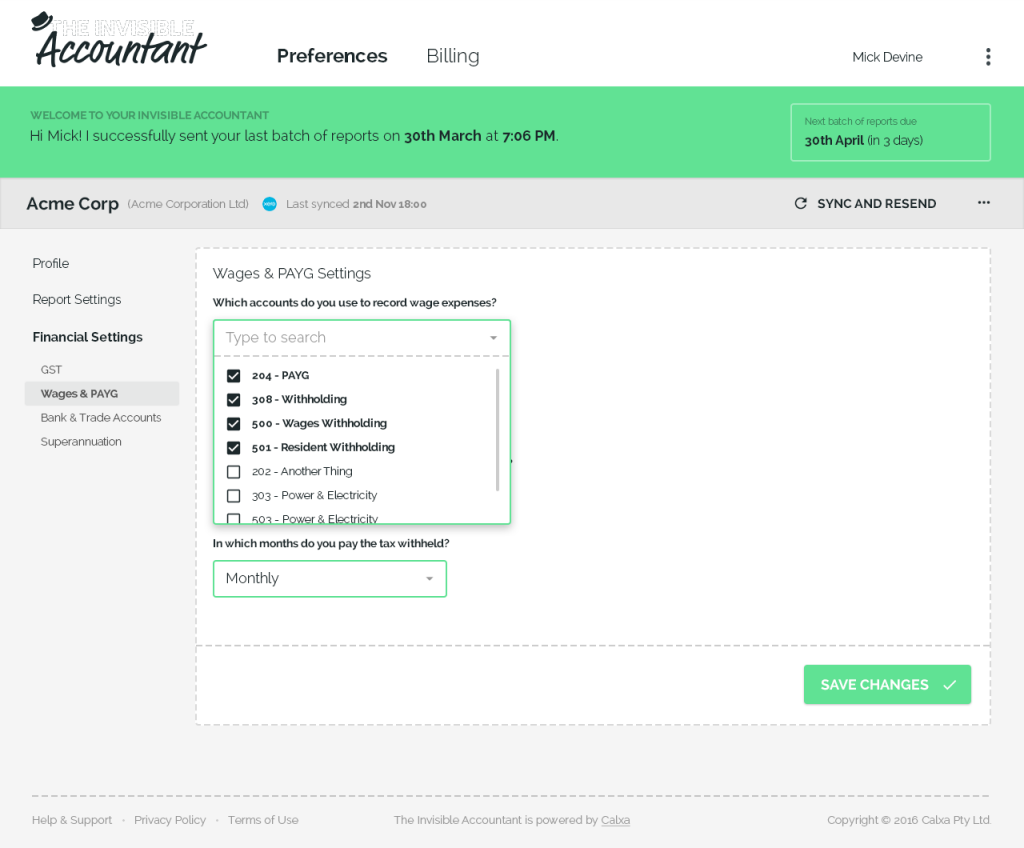

The Invisible Accountant

As the baby of the group, The Invisible Accountant is quite a different proposition to the other Xero reporting tools. Essentially, this solution is for those who want something very simple and automated.

- It uses the budgets from Xero, at the organisation level only.

- And then produces a fixed set of reports each month.

Perfect for those who want ease and simplicity at a very low price.

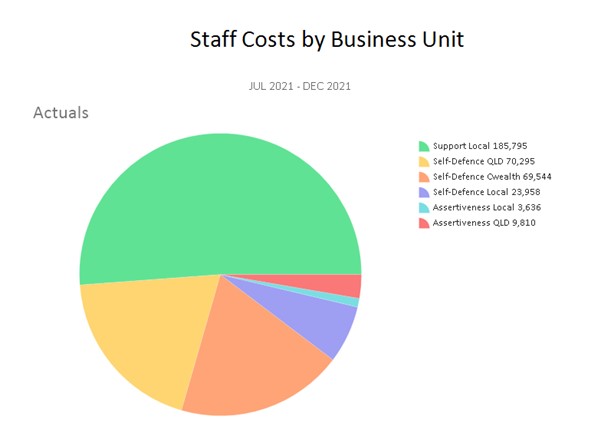

Tracking Category Reporting with Xero

All of the Xero reporting apps will give you reports at the company or organisation level. Not so many work with tracking categories and that limits them for larger businesses and not-for-profits.

Fathom, as we noted above, deal with tracking categories by treating them as an organisation. This can work for a very small number of divisions or programs but soon gets clunky. Brixx doesn’t integrate tracking categories at all and neither does The Invisible Accountant.

Spotlight Reporting will import budgets from Xero by tracking category but doesn’t give you the ability to edit them further. In other words, you must continue to maintain the budgets in Xero. However, you can filter reports by tracking category but there are no comparison or summary reports.

Calxa was built from the ground up to do budgets by business unit. It really shows in the depth and breadth of the budgeting features.

For reporting, the standard options of selecting one or all suits many people. But Business Unit Trees offer the ultimate in power. They give you the ability to group and summarise the tracking categories any way you want, including across multiple entities. You could easily report on your Operations department in 5 companies in 5 different currencies if you wish.

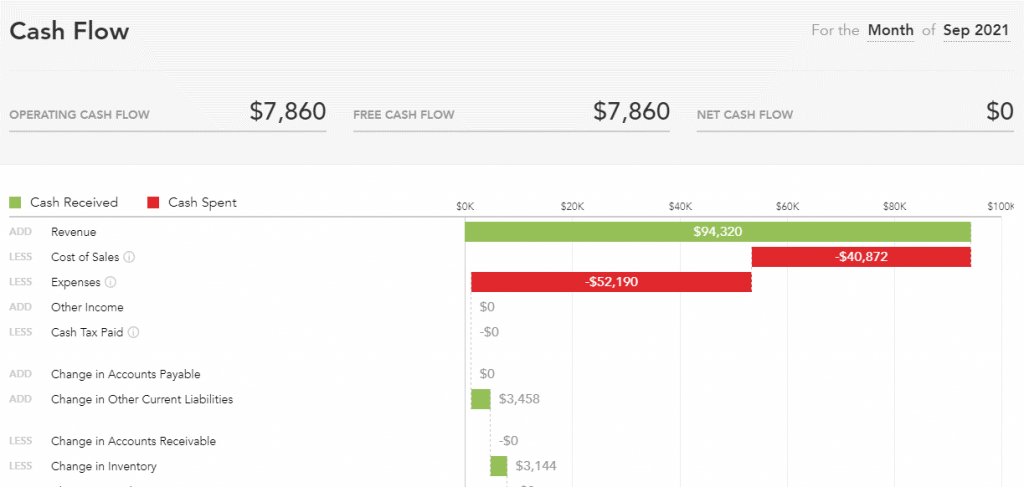

Cashflow Forecasts in the Top Xero Reporting Tools

Forecasts warrants a whole article to itself but we’ll start with a brief overview here. One of the first challenges is understanding what type of forecast you’re getting.

Xero, for example, focuses very much on short-term, transaction-based forecasting.

For those wanting a full 3-way forecast with good accounting integrity, look at:

- Fathom: Long-time Xero reporting app, more recently have ventured into cashflow forecasting. Some of it is a little cumbersome but the micro-forecasts are very useful.

- Spotlight Forecasting: A different product to Spotlight Reporting with no integration between the 2 so you need to create budgets separately. However, it does do a 3-way forecast reasonably quickly and comprehensively for a single company.

- Calxa: For those who want a fully-integrated 3-way forecast for one company or many, in any currency.

- Brixx: A UK-styled 3-statement model. Most notable is the cashflow. It is formatted in the style of a traditional Statement of Cashflow, split into operating, investing, financing and taxation.

Consolidations with Xero Reporting Add-Ons

Not everyone works with just a single company. You may have a small group of businesses, or you could have multiple entities spread across the globe. There’s a small number of Xero Reporting Apps that do consolidations though. Again, it pays to read the fine print as some will:

- Consolidate reports such as P&L and Balance Sheet only

- Others will include budgets,

- And then, there are some that will give you a full consolidated 3-way forecast across currencies.

- There is only one Xero reporting tool that will consolidate tracking categories across companies.

Spotlight Reporting

For consolidations, you can use the Spotlight Multi, Spotlight Reporting or Spotlight Forecasting product. Note, however, they all work slightly differently.

- Each will give you options to eliminate entire accounts. However, partial eliminations are handled either by importing an elimination organisation from a csv file or by adding adjustment accounts.

- While there’s an option to edit the exchange rates used on multi-currency consolidations, there’s no option to fix this for individual accounts. This is important if you need to manage asset and equity accounts in accordance with IAS 21, for example.

- The focus is very much on reporting for actuals with no consolidated budget or cashflow forecast reports.

Fathom

Consolidations is handled differently in this Xero add-on.

- The consolidated reports in Fathom do include budgets and variances as well as the standard Profit & Loss reports.

- However, the cashflow forecast doesn’t directly consolidate. The workaround is to save the forecast from each subsidiary as a budget. Then use the budget reports at the consolidated level.

- It has the ability to consolidate reports for up to 50 entities when using the multi-currency option. As with the other solutions, you can over-ride the automatic exchange rates. You’ll need to add your own foreign currency translation calculations though. Ultimately, this is not done for you.

Calxa

This may sound a little predictable, we know. But, there is really only one Xero reporting add-on that does everything in the world of consolidations! Calxa has a holistic approach for multi-company reporting. For example:

- Consolidation of any number of entities

- Run and consolidate all 180+ reports, including the full 3-way forecast

- Compare P&L, Balance Sheet or KPIs company-by-company, side-by-side

- Multi-currency consolidation with automatic calculation of FX adjustments and ability to fix exchange rates by account to comply with IAS21.

- Create exchange rate scenarios for future periods

- Set the year end for the group, independently of the entities

- Select departments (tracking categories) and consolidate across the group.

Brixx and The Invisible Accountant just do single-entity reporting and don’t attempt consolidations.

Report Packs

Delivering reports each month can be a tedious and time-consuming exercise. Doing it directly from Xero, you need to configure each report, export it and then send to your audience. Unless you are a Xero Accounting Partners who has access to special features.

Most of the Xero reporting apps we’ve discussed so far have some method of batching your reports. This makes it easy to deliver them.

Spotlight Reporting and Fathom have some variation on this. In Spotlight you group them into a customisable report. Whilst Fathom has report packs. Each will export to a PDF or spreadsheet.

Brixx does not provide any bundling.

In contrast, Calxa goes one step further with its report bundles, including workflows to schedule delivery each day, week or month.

Customisation Options in Xero Reporting Apps

It doesn’t matter how many choices you give someone. There will always be someone who wants something different. Whether it’s changing colours or rearranging columns.

Ultimately, flexibility is important to many people. Not all of the Xero reporting apps we’ve discussed give you these options. So check carefully before you buy if this is important to you.

Flexibility for one person, is of course, complexity for another. Some apps have chosen to prioritise ease of use and simplicity. Brixx, for example, are in this group and that obviously works for many users. If their reports suit you as they are, why would you want to change anything?

On the other hand, Spotlight Reporting have options to choose the columns within each report. This is in contrast to Calxa which has a fully-fledged report designer. It gives the user some powerful features including calculated columns, at the expense of a steeper learning curve.

Similarly, Calxa and Spotlight give the ability to add a logo to each report and choose your own colours. Fathom, Brixx and The Invisible Accountant just include the logo on a cover page.

Getting Help and Support For Your Xero Reporting Tool

With any app, there are times when things don’t work the way you expect them to. Or you want to use a new feature and need to learn how to do that. Sometimes you’re just stuck!

All of the Xero reporting add-ons we’ve mentioned here have some kind of help centre. That’s pretty standard in the 21st Century. They all have some combination of words and pictures or videos. Fathom seem to favour guides in a document format, whilst Calxa and Spotlight Reporting deliver a mix of guides and videos.

Some sort of live chat or in-app messaging system is common amongst all of these reporting apps. This is often the quickest and easiest solution both from the user end and the vendor perspective. Today, this is the most popular form of communication.

You will find that Fathom, Calxa, Spotlight Reporting and The Invisible Accountant still have an email support option. For example, this is often useful when you need to explain something in detail or attach examples.

For those times when you need help in a hurry, there’s no substitute for just talking to someone. That’s not easy with the big accounting software vendors these days. However, the good news is that both Fathom and Calxa share their phone numbers freely. Call them and get a real human to help with your questions!

Which of the Xero Reporting Apps is best for you?

The answer, of course, is that it depends. We’ve tried to give you some guidance here but the starting point needs to be your requirements.

- What sort of reporting do you need?

- Do you want something simple or complex?

- How do you report, for one company or many?

- Are Tracking Categories important, or are reports at the organisation level sufficient?

We’ve given you some comparisons above. But here’s a quick summary for you. It will help steer you in the direction of the solution that suits you.

| Xero Reporting Tools | Brixx | Calxa | Fathom | Spotlight Reporting | The Invisible Accountant |

| Company Budgets | Yes | Yes | Yes | Yes | Yes |

| Tracking Category Budgets | No |

Yes | No | No | No |

| Tracking Category Reporting | No | Yes | Yes* | Yes | No |

| Cashflow Forecast | Yes | Yes | Yes | Yes | Yes |

| 3-Way Forecast | Yes | Yes | Yes | Yes | Yes |

| Consolidations | No | Yes | Yes | Yes | No |

| Multi-Currency Consolidation | No | Yes | Yes | Yes | No |

| Report Packs | No | Yes | Yes | Yes | Yes |

| Customisation | No | Yes | No | Yes | No |

| Phone Support | No | Yes | Yes | No | Yes |

* requires an additional organisation.

Note from the Calxa Team

It is not uncommon for our new and existing Calxa customers to ask us how we compare to other apps. This prompted us to have a closer look at a number of Xero Reporting Tools.

The review was split across various members of the Calxa Team. We then collected this data and summarised it to create a series of comparison style content. These articles are designed to be helpful when you are evaluating functionality of a Xero Reporting App.

We want to acknowledge that the world around us moves fast and changes are inevitable. Of course, technology developers make improvements to their apps all the time. This means, that some of our recount may be outdated by the time you read this.

So, please, keep this in mind when you digest this article. It simply reflects our point of view at the time of evaluating these Xero Reporting Apps.