Budgeting in Xero has come a long way since the early days. There’s a lot you can do, more than in some comparable accounting systems. Join us as we explore how to prepare Xero budget reports and understand where the limits are.

Table of Content

Tracking Category Budgets in Xero

Xero Tracking Category Budget vs Actual Reports

The Limitations of Xero Budget Reporting

How to Do Xero Budgets

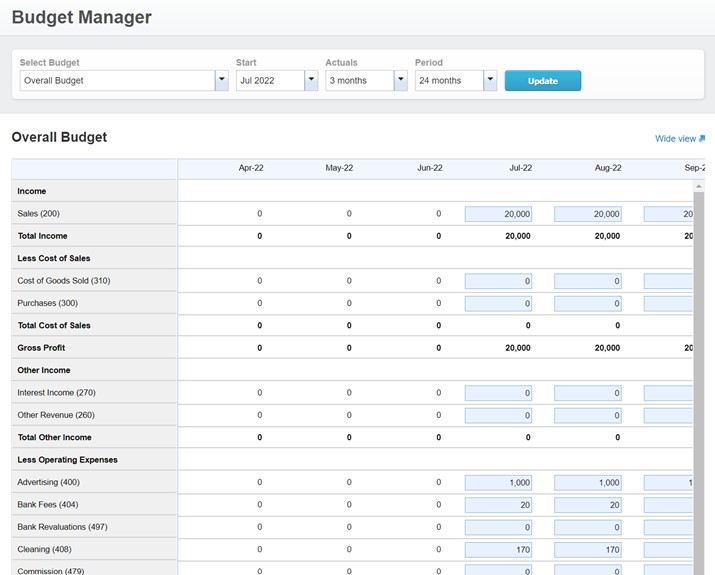

When you first go looking for them, Xero’s budgets are a little hidden away. You’ll find them under Accounting, Reports, Budget Manager. You can enter monthly budgets at the organisation level or by tracking category. Some of the features we like about Xero budgets are:

- Monthly budgets for up to 2 years into the future (plus the current year)

- Display the last few months actuals while entering the budget

- It’s easy to copy a value across to future months

- Add multiple versions of a budget in Xero. For example, an initial or approved budget plus a reforecast.

- Budget by tracking category

- Export and import the budgets to update from a spreadsheet

Tracking Category Budgets in Xero

As you can see, it’s possible to enter budgets by tracking category into Xero and, as with the overall budget, you can have multiple versions or scenarios. One thing to be cautious of here is that there is no logical connection between the budget for one tracking category and that for another. Be careful with how you name them so that you can find them easily afterwards. Use a standard naming convention such as:

- North – Original

- North – Revised

- South – Original

- South – Revised

The other mistake we see from time to time is forgetting to actually filter the budget by the tracking category option. Thus it ends up sitting at the company level and you may be confused when your reports don’t work as expected.

If you don’t do this, it’s easy to end up with a collection of Xero budgets and not know which one to add to your reports.

Who Should Use Xero Budgets?

Xero budgets will work well for you if your needs are simple. If you are reporting at the company level, and you don’t mind manually retrieving your reports each month, Xero budgets work fine. You can compare actuals to budgets for a month or the year-to-date. There’s a little bit of effort in getting the reports the way you want them but that’s mostly a one-off, or once a year, effort.

For those of you using tracking categories in Xero, there’s a bit more work to set things up. You need to take care with naming your budgets to identify them easily, especially if you are working with more than one Xero budget version. This can work fine for a small number of tracking categories, but becomes onerous when you have more than a handful. It’s impossibly labour-intensive if you have dozens.

If you value your time, those of you with anything more than simple budget needs, will appreciate the simplicity and automation achieved with a Xero add-on like Calxa.

Xero Budget Reports

Looking at the list of reports in Xero, you’d be forgiven for thinking that there are only 2 budget reports:

- The Budget Summary

- And the Budget Variance.

The good news is that, with some customising of the report layout, you can do much more flexible reporting with the Profit and Loss report.

The Budget Summary is good if you want to print your budget, or send it to someone for review. With the Xero Budget Summary report, you can display your budget by month, quarter or year for multiple periods. You don’t get the layout options you do with the newer reports but you can use the summary option to add notes.

When using it for tracking categories, you can only select one at a time. Again, this is fine in a small business with a handful of categories. It’s onerous for a charity or anyone with more complexity.

Xero Budget Variance Report

The standard layout of the Xero Budget Variance Report shows month and year to date Actuals, Budgets and Variance. There are filters for your tracking categories. However, given that the standard layout uses the Overall Budget, they are not very useful out of the box. To get the best out of the Xero budget reports, you’ll need to get familiar with the Layout Editor.

Xero Budget vs Actual Report

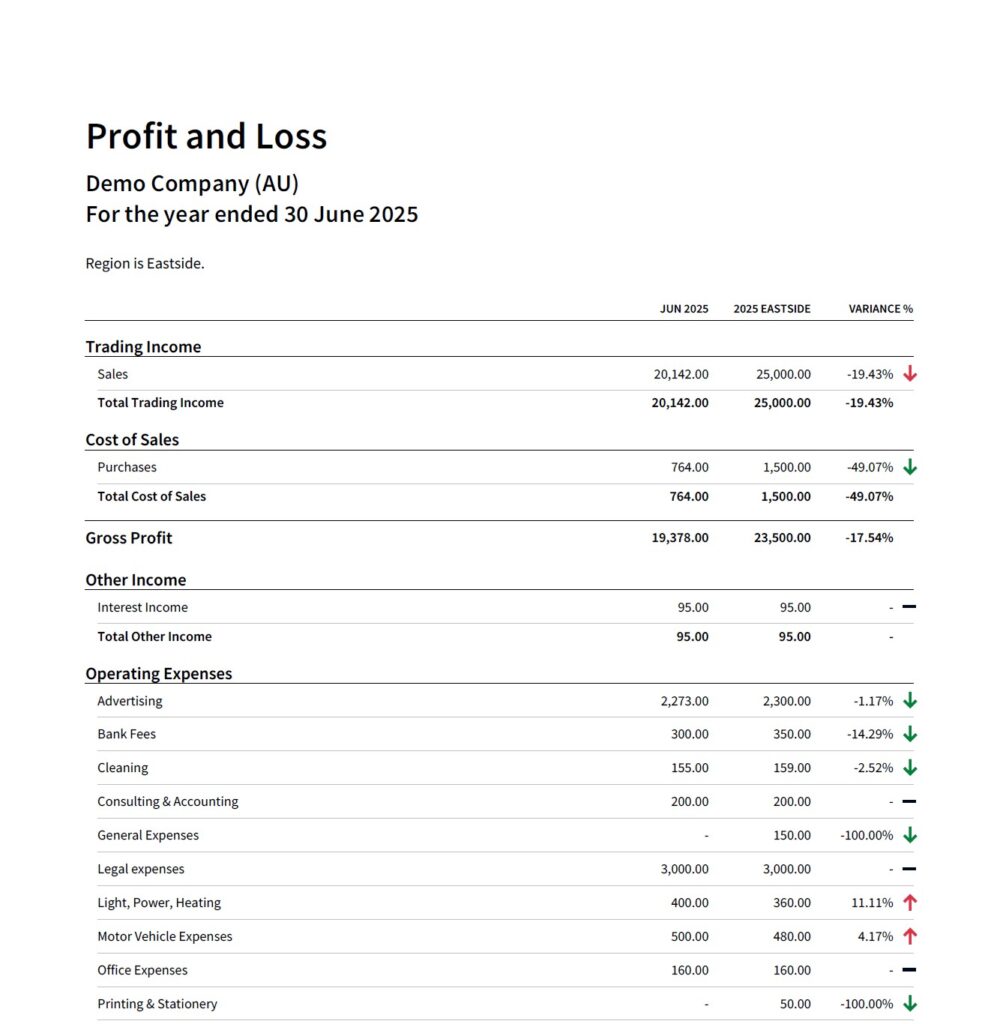

The Edit Layout options are much more flexible in the new versions of the Xero reports. So use them if you can. You will be able to set your columns (almost) the way you want them, choosing the actuals and budget for tracking category and calculating variances.

When you have shaped the report the way you want it, save it as a custom report. This way you can re-use it each month in the future.

Xero Tracking Category Budget vs Actual Reports

When editing the layout of the Profit and Loss or Budget Variance reports, you can choose the columns you need for your tracking category budget reports. You will need to create a new custom report for each tracking category but that’s fine if you have a small number of them.

You need to be careful that the columns you select actually make sense. It’s quite possible to create a report with actuals for the month from one tracking category, year to date budgets from another and a variance calculated from a third. We’re sure you wouldn’t make that mistake but it has been done.

The Limitations of Xero Budget Reporting

Xero budgets are fine for a small business but anyone trying to do anything complex will soon get frustrated by the limitations. That’s not a criticism of Xero. Ultimately, their focus is on giving you the accounting system to manage your compliance needs. Here’s a few of the limitations of Xero budgeting you are likely to experience:

- There’s no quick way of creating or updating budgets for many tracking categories. Even the spreadsheet import has to be done one-by-one.

- It’s hard to manage the nexus between budget scenarios and tracking categories. They require careful management to avoid mistakes.

- Apart from copying values to future months, there are no formulas in the budgets. You can’t build a budget from drivers like the number of customers or the products you sell.

- You need to customise each report to get the layout you want. The standard Xero budget reports are fine if you only use the Xero Overall Budget. Anything more than that takes effort.

- You can’t, unless you are an accounting practice, package up reports to send out each month. You need to run each report individually and save it before moving on to the next.

- If you want to style the reports in your colours, you need to export each to a spreadsheet and make the changes there. There is no simple branding option like Calxa’s Report Styles.

- Budgets are only for Profit and Loss accounts so you can’t use them for a cashflow forecast.

Are Xero Budgets for you?

Use Xero budgets if your needs are simple. If you run a small business and just want to compare actuals to budgets, use the Overall budget and the standard reports. You will most certainly get most of what you want with minimal effort.

Update your budgets every year and run your reports every month. You’ll be managing your business better than some of your colleagues!

Look beyond Xero budgets at something like Calxa if you need:

- Better tracking category budgets and reports

- Flexibility in entering budgets, including formulas and different views

- More choice of pre-set report templates

- Automated delivery of report bundles each month

- A full 3-way forecast including balance sheet and cashflow

We donate Calxa to small and medium charities and not-for-profits. There’s a no-obligation 30-day free trial and we are confident you’ll enjoy the budgeting experience in Calxa.