So, how do you streamline grant acquittals? Firstly, let us clarify the term ‘Grant Acquittal’. Essentially, the term “Grant Acquittals” seems to be uniquely Australian. Our friends in the UK and New Zealand are often puzzled by it. Don’t be! It’s simply reporting back to your funding provider on how you have spent the funds they gave you. Secondly, we can all agree that funding reports to the grant provider can be hard to do and are mostly very time-consuming. To add to the frustration, no two funding providers have the same reporting requirements. Sometimes, not even within the same Government department. Calxa has many uses for not-for-profit organisations and can help you streamline grant acquittals.

Grants to Bulk Funding Programs

Bulk funding such as grants come in all shapes and sizes. Often, they are issued by Governments – local, state and federal. Sometimes funding contributions can also be delivered by philanthropic donors. They all have similar goals: To deliver a service or program that will see minority groups or the community at large as the main beneficiary.

Operating in a bulk funded environment looks pretty much the same with each grant. The same process applies:

- There is an application process first. This quick checklist has some good tips.

- Then you enter a period of running the program.

- On long-running programs you may need to submit interim reports on progress to date.

- And, finally, there is the acquittal or accounting for how you have spent the funds.

These reports usually involve reporting back what has been spent and the results that have been achieved. A comparison to the initial budget is essential Some funding providers will allow requests for variations during the running of a program and these are best managed in a separate budget.

The Application Process

Whilst Calxa isn’t going to write your grant application for you, it can be useful in preparing a budget. If you’re managing your grants through Business Units (Tracking Categories, Jobs, or Classes) in the accounting system, you will need to add a new one for the new grant. If this is just a proposal and you aren’t certain of success, add the Business Unit to Calxa first and then, if you’re using Xero or MYOB, you can push it to the accounting system later when it’s approved.

During Program Delivery

Calxa will help you greatly during the program delivery. In particular, it will assist you in tracking unspent funds diligently across the program period. Your program manager will be able to see each month how they are progressing and be able to act quickly on any variances.

Funding providers often want expenditure grouped and summarised in a specific format. Use an Account Tree to create that format and then you can view the results as your funder would.

Use Metrics and KPIs to track the non-financial outcomes of the project. The days of reporting just the finances are long gone in most places. Funders care about how many people you’ve helped, how many meals you have served.

The Final Acquittal

In this final stage, Calxa brings additional value So, here we will focus on the final reporting to the provider and show you where the gains are made. Furthermore, it will help you streamline grant acquittals and the process behind it.

Anatomy of the Acquittal

Most grant acquittals need to report outcome data relating to the activities or services the grant was issued for. Usually, this is a combination of financial results and non-financial statistics focusing on the activities delivered. There are a couple of main parts:

- The report needs to show how the funds were allocated. It needs to prove the funding was spent as agreed and where over or under spending occurred.

- It must demonstrate the success of the program and the value the funding provided. You can include care hours delivered, participation rates, improvement percentages, social proof and anecdotal evidence. Now, not all of this data can be extracted from your accounting system. Calxa comes into its real effect here.

Streamline Grant Acquittals and Final Reporting: the How-To

The key ingredients Calxa brings to the table are summed up by three features. As a result, it will help you streamline grant acquittals.

- Account Trees to summarise the numbers

- Metrics to include non-financial numbers

- Document Editor to add notes and docs

1. Account Trees are the Key to Streamlining Grant Acquittals

The trees simply give you the functionality to re-arrange your account structure. Whilst the regular chart of accounts in your MYOB, Xero or QuickBooks Online is useful when you do the books day-to-day, you probably find it awkward during financial reporting.

The Account Trees are simply a re-grouped list of your accounts.

The way it works is that you create new headers and then map your existing chart of accounts under each header. Now, when you run a report, you simply select the Account Tree in your filter and set the appropriate reporting level.

- Firstly, level 1 will give you a high-level Income, Cost of Sales, Expense;

- Then, level 2, the first set of headers;

- Whilst, level 3 gives the next set and so on.

This way you can produce a summarised report to match the requirements of your funding provider.

Some users have many trees to solve different problems. Account Trees help summarise board reports. Essentially, they can form the common structure for multi-company consolidations and of course, they are the key to acquitting grants. You can find out more about Account Trees in 7 Uses for Account Trees.

2. Non-financial Metrics

This feature lets you add additional data not included in your accounting figures. In the Budget Builder, switch the Layout to Metrics. Then create new metrics for what you need to record. Add a budget of what you need to achieve and then each month you can add the actual results. Keeping track of this information throughout the project will ensure you have all the information to hand when it comes to the final acquittal.

To use your metrics on reports, just create a KPI for them. Sometimes it’s sufficient to just report the raw metrics you’ve collected. Other times you want to combine them with the financial information. Create some Key Performance Indicators (KPIs) by dividing a group of accounts by the metric. For example:

Individual Investment = [Total Funding Amount] / [# of Participants]

Hourly Cost = [Total Expense] / [Care Hours Provided]

Once these KPIs are set up, you can either add these to your budget reports or simply run them on their own as a trending chart.

3. Document Editor

The third important element is the Document Editor. This feature is great for all types of reports. It allows you to:

- Add notes and annotations,

- Insert images,

- And, include Word docs and tables.

As you prepare your financial and non-financial reports in Calxa you simply add these to a report bundle. It’s important to name your bundle something descriptive like ‘Grant Acquittal X’. Now add a document to the bundle for a cover page and another for a summary so you can add the words to describe the results of your project.

If you have data from other systems to combine with your financial data, you can also include a PDF document in the bundle.

Suggested Reports for Grant Acquittals

Your funding provider will often prescribe the format of the final (or interim) reports they need on the project. You will find that often these are simply Actuals, Budget and Variance. The Budget Analysis (% Variance) report is ideal for this purpose.

It’s also important to track your project internally during its lifetime. Key reports here are the:

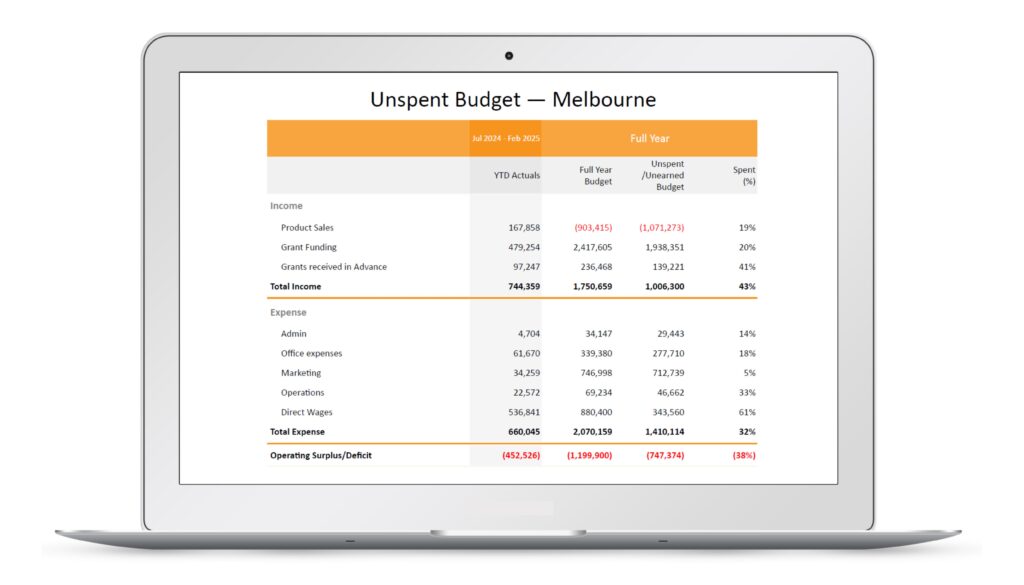

- Unspent Budget report

- And, Unspent Budget with Current and YTD Variance.

These will show you what has been spent on the project so far and also what is left to spend.

Tip: These reports normally work off your standard financial year. If you have a grant that runs for a different year end, create an Organisation Group (it only needs one organisation) and you can set the year end there.

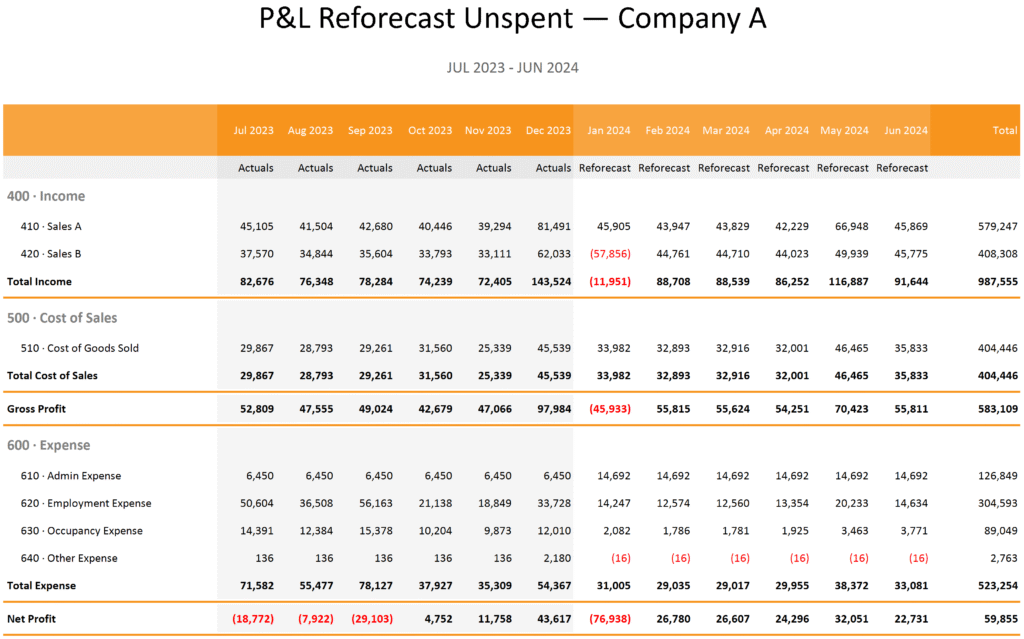

The other popular report for this purpose is the P&L Reforecast Unspent to meet Budget. That sounds like a mouthful. But, it is a useful report to show what you can spend for the remaining periods of the project. In short, it shows you:

- Actuals by month for the completed months of the year

- Then, for the remainder, adjusts the budget proportionately to show what you need to do to meet the final budget.

If you’ve underspent early in the year, there will be more to spend later and vice versa.

A great report for program managers to understand where they are up to and maintain good control of the project.

Summary on Streamlining Grant Acquittals

If you set up this structure from the beginning, you can monitor the grant performance as you go. To automate it simply create a workflow to send you and the program manager this report each month. Keeping an eye on the outcomes is a great way to stay on target with the grant expectations. Calxa will help you streamline grant acquittals.