We’re not very good at keeping secrets. Over the past 20 years we have spent our time delivering monthly, long-term, cash flow projections to our customers all over the world. We have helped many to better understand the cashflow implications of a growing business. The one thing we get regular requests for is daily cash flow forecasting that helps with real-time cash flow management.

Accounting Software vendor Xero, has identified a similar business problem. They are currently piloting a simple short-term cash flow feature. The Calxa team has been working on a project of a somewhat more advanced nature. It will also forecast a short term cash position and be available early in the New Year.

Why Daily Cash Flow Forecasting?

From a business planning and strategic perspective, monthly cashflow forecasts make most sense. Even quarterly or annual projections if you’re looking more than one year ahead. There are many reasons you need a cash flow projection and we have many resources on how to prepare a step-by-step cash flow projection. That’s been our focus and our strength making us a leader in this field. However, as anyone in business knows, there are times when cash is really tight. You don’t know if you’ll have enough to pay the wages on Tuesday or the rent on Friday.

The historical solution has usually revolved around a spreadsheet. A complex, cumbersome spreadsheet that takes time to maintain. And when cash is that tight, a simple mistake can throw out all of your calculations.

Real-time Cash Flow Management

In one sense, this isn’t about cash flow forecasts, it’s about real-time cash flow management. In other words, it’s about how to manage your short-term cash position. You build the forecast with the intention of changing it. You want to predict what cash is coming in next week and what you have to pay out. Then you will use your judgement to decide our next actions.

Collect inflows earlier or, more often, hold off paying bills you can defer for a few days

It’s that art of keeping the bank balance above zero (or your overdraft limit). At the same time, it’s also about maintaining good relationships with your suppliers.

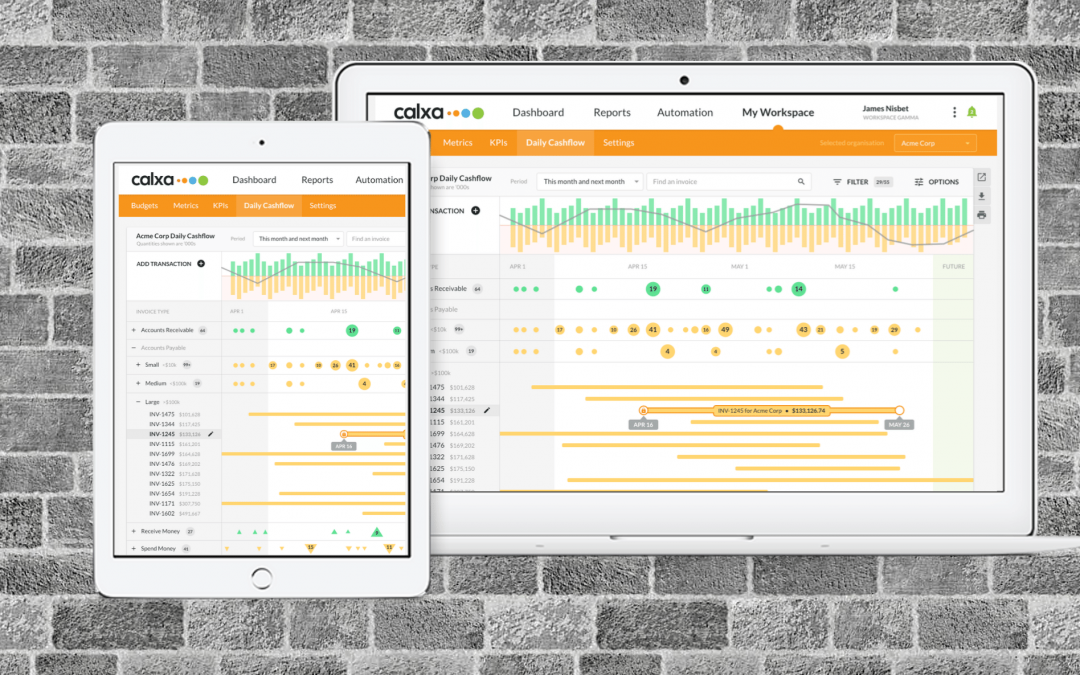

Intelligent Daily Cash Flow Forecasting

When we set out on our daily cash flow forecasting project, we didn’t want to just show outstanding payables and receivables on their due dates. Everyone knows people don’t pay on the due date.

The challenge was to know when they do pay.

With the help of a clever graduate and some mentoring from James Cook University, we’ve spent the last 18 months developing machine learning tools. These help us predict not just invoice payment dates but also recurring patterns in spend money and receive money transactions. So far, our testing shows that gives a very good prediction. The nature of machine learning is that it improves as you feed more data through the system. However, you’ll be able to judge that for yourself very soon.

Project Short-term Cash Position

We’ve seen enough tight cash flow situations to know that to simply project your cash position isn’t enough. That’s just the starting point and from there you need a simple way to make adjustments. We’ll give you a graphical interface where you’ll be able to slide and drag payment dates and see in real time how that affects your projected bank balance.

Keen to See This Feature?

Let us know if daily/weekly cash flow forecasting is what you are looking for. We will add you to our list and let you know when this feature is ready to go.