For many accountants, how to forecast tax liabilities for their clients, is a regular challenge. But it is an important task that is part of their bread-and-butter services.

The certainty of paying taxes is often ascribed to Benjamin Franklin, but he was in many ways, just the most famous of his day. But regardless of who said it first, most of us are obliged to pay taxes. That’s not all bad, who would willingly be in a situation where you didn’t earn enough to pay taxes? Paying tax is a sign of business success!

Generally, it is not the payment of taxes that’s the problem. It is making sure you have the funds available when the payment is due. Let us look at how to best manage that in Calxa.

How to Forecast Tax Liabilities?

There are a few components that affect the overall tax debt. Let’s look at how you can handle this in a cash flow forecasting app like Calxa.

GST and VAT in Calxa

This may or may not be relevant in your country. If it is, we take the default tax code from your chart of accounts and use this to estimate the tax to apply to each budgeted amount. If you need to, you can override the tax codes in the Advanced Cashflow Settings.

We take these tax codes from your accounting system when you first sync but don’t automatically update them later as you may have manually over-ridden them in Calxa. In the Advanced Cashflow Settings, you can select all of your accounts at any time and choose the Match Xero or Match QuickBooks option to reset them.

The timing of payments to your government is managed in the Cashflow Settings. Look at the GST/VAT section. The most common schedules of monthly, quarterly and 2-monthly are provided for Australia, the UK and New Zealand. If you need a different schedule, it’s simple to customise your own.

PAYG/PAYE and Deductions from Wages

This is the tax you deduct from the wages of your employees. The budget for wages should be the gross wages. Ultimately, that is the cost to the business. In Cashflow Settings, you can nominate the average amount of tax withheld in Wages & PAYG/PAYE. We recommend running a payroll report for 12 months or longer if you can. Now divide the tax by the gross pay to get a good average for your organisation. We use this to split the budgeted wages into the net amount that is paid out each month and the tax that is paid later.

Make sure the right liability account is selected and the appropriate schedule. Save your changes on each section as you go.

Provisional Tax

This includes similar arrangements like PAYGI in Australia. Most countries tax companies and similar structures on the profits that they make. Even though the final calculation is done after the end of the financial year when all the facts are known, there is often a requirement to pre-pay an estimate of the tax payable.

If you don’t have to pre-pay tax, your accountant will generally calculate the tax payable at the end of each year. They will post a journal to debit Income Tax Expense and credit Provision for Income Tax or some similar accounts. In this case, in Calxa, you would simply budget for the predicted payment in the payment month.

You have choices on how to manage the pre-payments. These are known as Provisional Tax in some countries, and PAYG Instalments in Australia. If you are paying a fixed amount, manage this through the Balance Sheet budget against the appropriate account. Enter it as a negative amount if it’s against a liability amount as you are reducing the liability.

In Australia, you can calculate the payment as a percentage of your income and this option is available in the Cashflow Settings for Company Tax. Similarly, in New Zealand, there is an option to pay based on a percentage of profit.

When you have worked out the end of year tax you’ll normally post that to Income Tax Expense and a Provision for Income Tax or similar account. In the Balance Sheet budget, add the balance payable in the month it’s due.

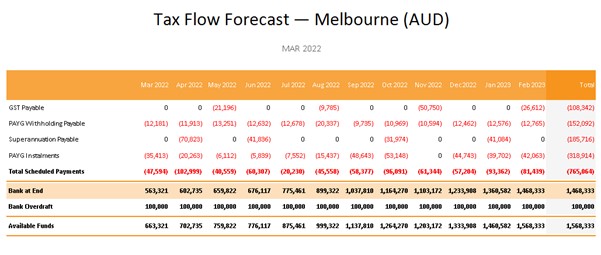

Presenting the Tax Flow Forecast

Besides running a cash flow forecast, you can generate a Tax Flow Forecast report in Calxa. This takes the relevant tax accounts from your forecast and combines these into one. It’s a good report to focus your client’s attention on the tax and superannuation payments that they have upcoming. The Tax Flow Forecast is the ultimate result when you’re asking how to forecast your tax liabilities.

Tax Payment Arrangements

Now, we know that everyone hates tax collectors. Even the Bible references the Tax Collector. But, if you talk to them nicely, you can usually reach an amicable arrangement for the payment of outstanding tax debts. If you need time to pay, they have a job to do to ensure the debt is paid at some point, you just need to agree on what is reasonable.

Once you have that arrangement, we suggest a journal in your accounting system. You would move the amount owed from the normal GST/VAT/PAYG accounts to a separate liability account. Use that to track your repayments and reconcile it regularly against the tax man’s statements. Enter the agreed payment plan to the Balance Sheet budget so you manage your cash flow well. The simplest way to do this is:

- Filter your budget for the date range of your arrangement

- Click the account name to select the entire row

- Click the formula button to add a formula

- For a monthly amount, enter a number on the left side for your commitment. Enter it as a negative number to reduce your liability.

- For a weekly or 2-weekly arrangement:

- Set the formula to Repeating

- Enter the (negative) amount

- Set the start date and payment frequency

Yes, we all need to pay our share of taxes. Most governments are tolerant of the small mistakes we make in business. As long as we have the right intentions.

Summary on How to Forecast Tax Liabilities

In closing, tax payments are deferred liabilities. This means we must be vigilant not to spend the funds set aside for these payments. This is not always easy in either a growing company or a downturn economy. The best way to manage this, is to forecast your tax liabilities. This way you can prepare ahead of time. But it all fails, talk to your tax man and negotiate a payment plan.

When you finally do pay the tax, rejoice that you are earning money. Not every business is in this position.