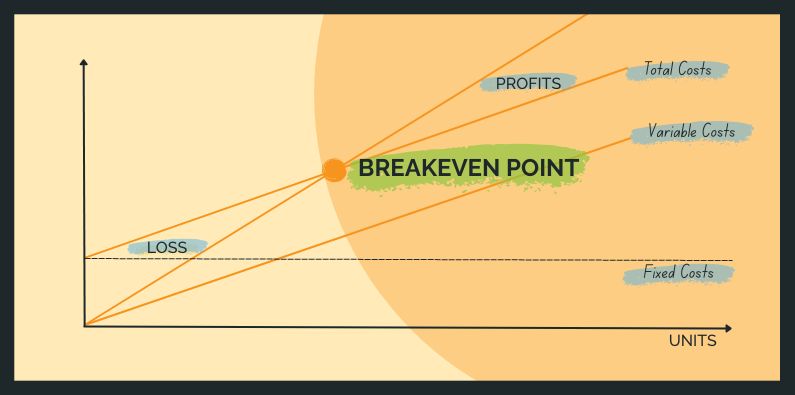

How do you find the breakeven point? This is an important question when planning ahead. Understanding your breakeven point is important in planning budgets and cashflow forecasts. Essentially, it is the revenue you need to make to cover your fixed costs.

There are two types of costs:

- Some of the costs of your business such as rent, insurance, utilities and the likes are relatively fixed. This means they don’t go up if you earn more or sell more.

- Other costs, especially the buying costs of the things you sell, are directly proportional to your income. If you sell more, you need to buy more.

Simply put: If your revenue is greater than the breakeven point, you will make a profit. If it is less, you’ll lose money.

Variable Costs

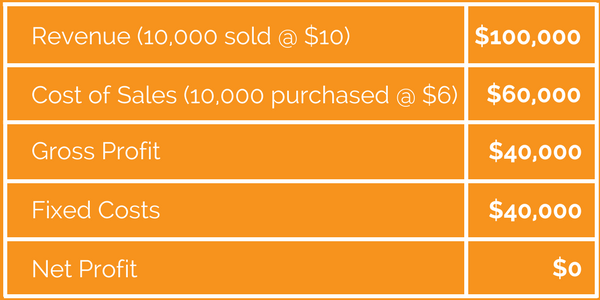

The key to understanding how much profit you’ll make once you’ve passed the breakeven point, is to understand your gross profit margin. That’s the percentage you make on the goods or services you sell. For example:

If you sell something for $10 and it costs you $6, you have a gross profit of $4 and a gross profit margin of 40%. Once your sales are above the breakeven point, 40% of each extra sale adds to your net profit and that is where you’ll start to notice the difference it makes.

Fixed Costs

The fixed costs of your business must be paid whether you sell something or not. You are still committed to paying rent, salaries and other costs. If nothing else, at least in the short term. Costs are rarely completely fixed in the long term. But generally, for the time periods we are reporting on, we can treat them as fixed.

Wages

Not all costs fit neatly into the fixed or variable categories. Wages is one that could be fixed (finance and admin staff, for example) or could be variable (commission-based salespeople). In these cases, it makes sense to use 2 wages accounts to track them. Simply have one in the fixed and one in the variable group. Sometimes you may have to make a judgement call. For example, if a salesperson has a base salary and commission on top of that, is their pay mostly fixed or mostly variable? As sales increase, will their salary increase?

How Do You Find The Breakeven Point?

If we take the same example of our $10 products and assume that we have fixed costs of $40,000 a month, we need to sell 10,000 products and achieve revenue of $100,000 to break even. At this point, we have a Profit and Loss statement that looks like this:

Now, most of us have more complex businesses with more than one product. But you get it, the general principles still apply. Understanding where your breakeven point is, is vital to setting sales targets and budgets. Naturally, these then flow into your cashflow forecast.

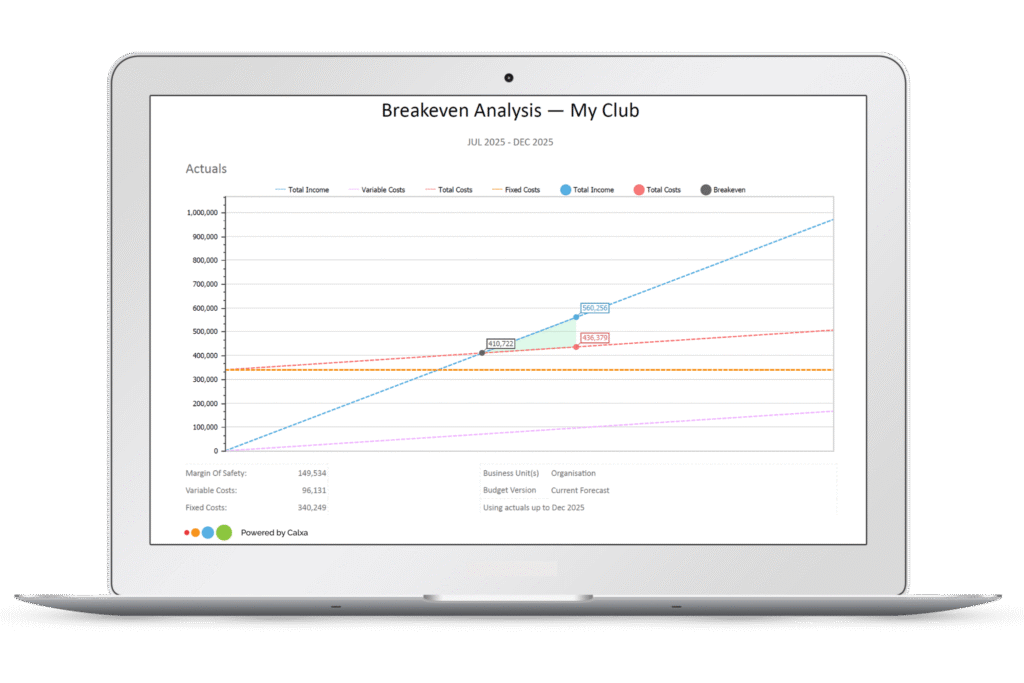

Have a look at the Breakeven Analysis chart in Calxa for your business to see what it shows.

It initially assumes that anything defined as an Expense account in your accounting system is fixed and Cost of Sales accounts are variable. Of course, you can change this in Calxa Premier by editing the account groups in the KPI Editor.

Why Do You Need To Find The Breakeven Point?

Knowing your breakeven point gives you a target to reach. If you are a new business, that first profitable month when you exceed the breakeven revenue is definitely one of the champagne moments in the journey of your business!