Cost Centre reporting can be complex. This guide will help you manage reporting on cost centres, projects or departments, especially if you’re using Calxa for your reporting. Whatever you call them, they are the subset of your organisational reports. They are reporting on parts of your business, sometimes individually and sometimes in combination.

Whether your reporting needs are simple or complex, Calxa can help you manage your requirements and get the information you need to run your business better.

Table of Contents

Difference between a Cost Centre and a Profit Centre

Planning out your Cost Centres

Cost Centre Reporting in Calxa

Managing Many Cost Centres In Many Organisations

Which Reports to Use for Cost Centre Reporting

Who Needs Cost Center Reports?

Not-for-Profit organisations are frequent users of cost centre reporting. Sometimes they use them for reporting on departments and sometimes for projects or programs. They’re also important for many businesses of all sizes.

Why Not-for-Profits use Cost Centres

On one hand, as a not-for-profit you will use some cost centres for internal management to ensure each project or department contributes to the organisation’s goals. On the other hand, cost centre reports are often required by funders who want to hold you accountable for the funds they have provided..

- Firstly, grant providers typically require some plan or budget before the grant is allocated.

- Secondly, you will need to deliver an acquittal showing actual to planned expenditure.

Smaller grants often just need a single acquittal report at the end. In contrast, other funding provider will demand you show monthly or quarterly reports. Essentially, this is to confirm that the project is on track and to ensure that they can be accountable to their stakeholders in turn.

Importance of Cost Centre Reports for Businesses

But cost centre reporting is also important to many businesses. For smaller businesses it tends to be for managing jobs and projects. Larger companies will use them for departments or branches. Whatever the structure, Calxa, especially with Business Unit Trees, will help you make sense of your cost centre reporting.

Advisors Need Cost Centre Reports

We shouldn’t forget accountants and bookkeepers. Often, they are the ones preparing the cost centre reports. They’re involved from researching the initial reporting requirements to setting up both the accounting and reporting systems to make sure you get the information you need.

What Is A Cost Centre?

There are all sorts of names for what we’re discussing here. Cost Center is the term you’ll find most in traditional accounting textbooks. It comes from the days of large manufacturing companies where divisions with the company were managed solely based on the costs and performance against budgets.

In the 21st century, those divisions within a company or organisation have a broader range of uses and of names. That’s why, within Calxa, we refer to them as Business Units. Basically, it’s a generic term that covers cost centres and profit centres. It covers departments, branches, programs and projects.

To add to the complexity, different accounting systems also use their own terminology.

- Xero uses Tracking Categories (and, technically, Tracking Category Options though few people use that term);

- MYOB uses Jobs and Categories;

- QuickBooks uses Classes, Locations and Customers/Jobs.

Whatever words you use, in Calxa you can change the terminology to suit your needs. This is simply done in Settings, Organisation Settings, Business Units and then set up the Configuration. If you are a Xero user, check out our article Unleash the Power of Xero Tracking Category Reporting.

Difference Between a Cost Centre and a Profit Centre

The difference between cost centres and profit centres is indicated by their respective names. So here is a quick comparison that explains Profit Centre vs Cost Centre.

Cost Centre

An organisation’s cost centres are centred around, you guessed it, costs. Often, the focus of company using cost centres is on reducing costs and managing expenditure effectively.

There will typically be one department that manages revenue but many that look after the expenses. Generally, you can assume, there is less complexity in managing one cost center, rather than the whole organisation.

Profit Centre

In turn, profit centres are concerned with revenue as well as expenditure. They will track income as well as costs and thus profits. When managing profit centres, you tend to have a longer-term view which aims for a profit as the end result.

Planning: The key to good Cost Centre Reporting

Some people build complex structures for their cost centres. Sometimes, the motivation is just in case they might want to report on some detail, some day in the future. At this point, someone else has to do the data entry for that complex setup.

Dedicating some time to planning out your cost centre structure, is a wise move. Along the way, ask yourself a few questions.

What are your reporting requirements?

Start with the result you want to achieve.

Do you need to report on Budgets, Actuals or both? For example, in smaller organisations reporting on actuals compared to the previous year is sufficient. Larger, or better managed, organisations will usually set a budget based on their strategic plan for the year and then want to measure performance against that. Sometimes business units are one-off projects or events that don’t recur from one year to the next. In that case a budget is a must if you want to evaluate them at all. Generally, it’s useful if budgets accumulate from the cost centres to the organisation budget.

To whom do you need to report?

Some good questions here are:

- Who needs these reports on business units?

- What is the audience that will read them? Is it senior management or a board wanting to ensure each part of the organisation is on track? Or is it the manager of that business unit who wants to keep an eye on what’s working and what’s not?

- Or is it an external funder who wants accountability on their donation?

Ultimately, knowing the audience for your reports is a key to understanding the level of detail they will require. The closer to the action the reader is, the more detail they are likely to want. A board may just want an overview to know which business units are on track and which might be in trouble.

Cost Centre Reporting in Calxa

Now that you have read the introduction, find out how to deliver cost centre reporting using management reporting software like Calxa. You will find Calxa one of the best cost centre reporting tools as an alternative to spreadsheets. The flexibility is rich and it enables you to do many cost centre report styles. Here is a list of Calxa’s business unit report functionalities:

- Singe-cost centre reporting

- Report on many cost centres – individually, consolidated or both

- Combine cost centres across multiple companies and entities

- Create cost centre combinations to report on their intersection

- Add budgets for each cost centre and roll it up to an organisation budget

Reporting On One Cost Centre

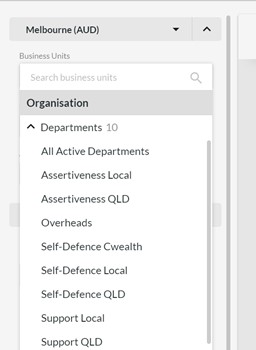

In Calxa, reporting on one cost centre is simple. When filtering your reports, simply select the one you want from the Business Unit list at the top left of the criteria. They will be grouped by type (Departments, Projects or whatever you have called them) and you just choose the one you want.

Reporting On Many Cost Centres

Often you want to report on more than one of your business units. A manager may be responsible for more than one, senior management may want to look at all of them. Calxa has options to suit all your needs.

The simple method is to select All Active Departments/Projects. That will give you everything from your accounting system that hasn’t been archived or deactivated. It’s a useful option for reports like the Business Unit Income & Expense Summary.

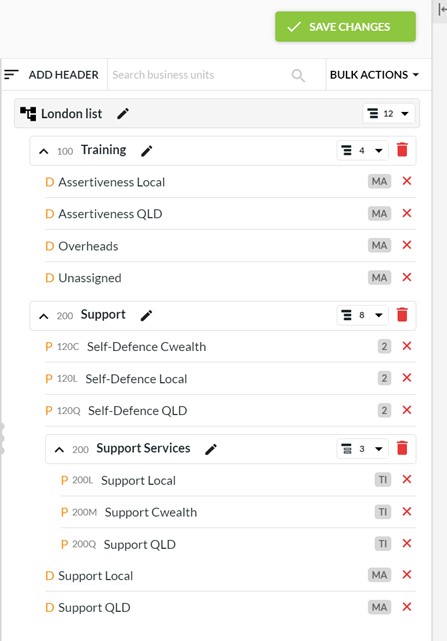

When you need something more complex than one or all, use a Business Unit Tree to select the cost centre you need. These business unit trees give you the ultimate flexibility. You can create Headers to group related business units and then report in detail on those, consolidate them or report on both the detail and the summary.

With a business unit tree, you can even combine departments and projects. This isn’t a common way of reporting but we’ve designed Calxa with the flexibility to handle some of the unusual requirements too. You might, for example, have a manager who is responsible for one department but also is involved in some projects in a general area. In this case, you could combine these into one Business Unit Tree so that you can easily give this manager the information they need.

In the example above, the headers for Training and for Support are set to Detail & Consolidated so the business units will be summarised at each of those levels. The header for Support Services is set to Consolidated so the reports will summarise the 3 projects under that and not show the detail.

Business Unit Trees give you the choice over how to manage your reporting.

Reporting On Many Cost Centres In Many Organisations

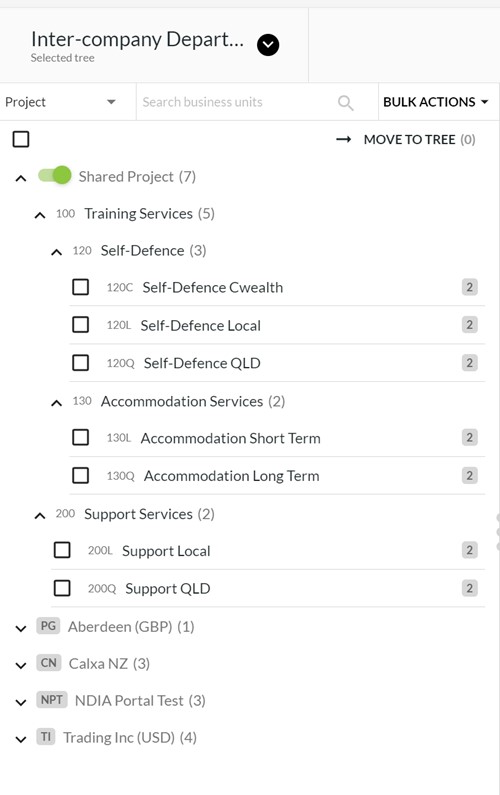

Up until now, we’ve focussed on reporting on cost centres within one entity. But what if you have more than one? What if you want to report on your Sales & Marketing division across 12 companies in your group?

![]()

With Business Unit Trees, it’s actually quite simple. The Shared Project section in the example below shows projects that are common to more than one organisation.

These can be simply selected and moved under a common heading in the Business Unit Tree to unify your reporting. Where the projects have different names in each organisation, you can still select them under the company and move them to the same heading. If they exist, you can report on them!

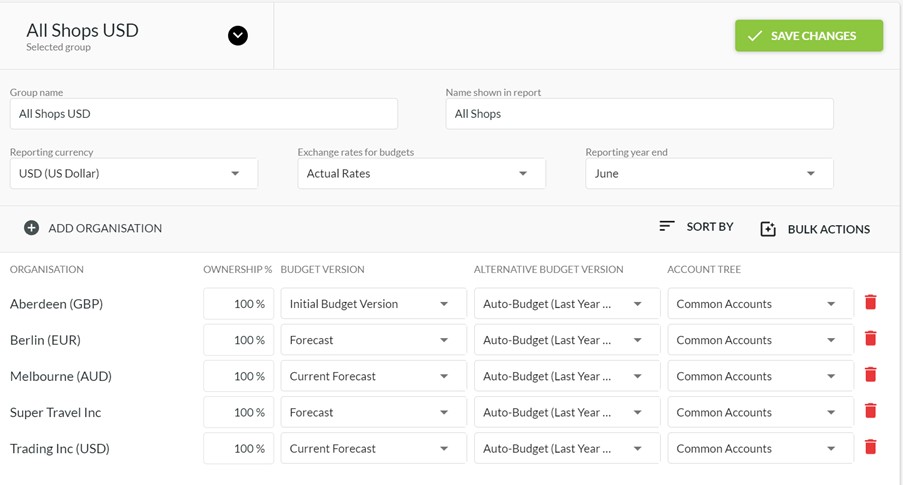

Organisation Groups for Cost Centre Reporting

The second part of reporting across companies is to set up an Organisation Group. You’ll find this under Report Tools and you can nominate which entities to include. Sometimes you want to report on all your entities, sometimes just some of them.

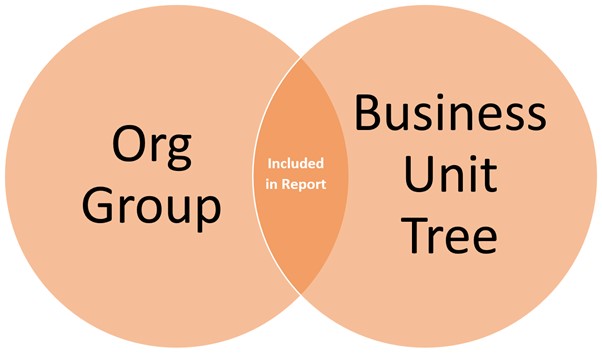

And then, when filtering your reports, select the Organisation Group and the Business Unit Tree to get the results you need. The report will include all cost centres included in the Business Unit Tree that belong to the entities in the Organisation Group.

You could use a Business Unit Tree containing departments from multiple companies but filter the report for just one organisation. In this case it would show just that one organisation.

Your report will include any projects or departments in the Business Unit Tree and in the Organisation Group.

Reporting on Combinations of Cost Centres

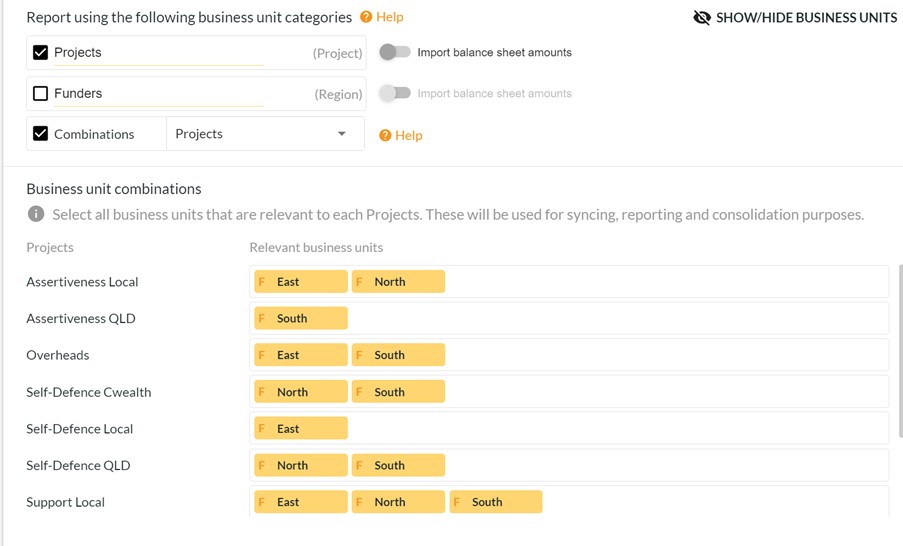

Some accounting systems, notably Xero but also QuickBooks Online, allow you to attribute more than one cost centre to a transaction. In Xero, you have 2 lists of Tracking Categories and you can add one value from each to a transaction. Reporting and budgeting on the intersection of these greatly increases your options but can add complexity.

If you have your Tracking Categories set up as Projects and Funders, for example, this can be very useful where you have a many-to-many relationship between them.

An example would be where one funder could fund multiple projects but equally, each project could attract funds from multiple funders. It’s much more common to have a simple one-to-many relationship where one funder may fund multiple projects, but each project only has one funder.

But, as we said earlier, Calxa is here to help you with the unusual and the complex structures.

Combinations: An Example

In this example, we have 4 projects and 3 donors so potentially there are 12 possible combinations.

In a scenario where you had 100 projects and 100 funders, there could be 10,000 combinations. To minimise complexity, we don’t automatically import data for all possible combinations, only the ones you choose.

In this case there are only 8 actual combinations of donor and project.

![]()

Even then, Project 1 has just one donor so we could easily report and budget on this just at the Project level.

Using Combinations for Cost Centres in Calxa

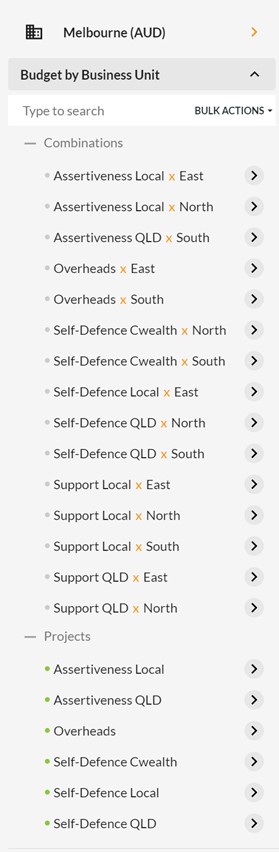

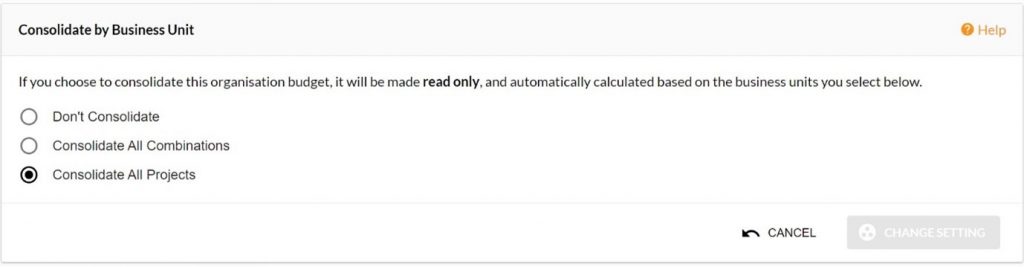

The first step is to choose which combinations you want to import to Calxa. Do that in Settings, Organisation Settings and choose Configuration under Business Units. Tick the check box next to Combinations and then choose one as your primary business unit. You can change this at any time.

Select the matching combinations and save your changes. Then sync with your accounting system to bring in actuals for those options.

Once you’ve done that, those combinations will behave just like a single business unit. You can budget on them, you can report on one or all, you can add them to Business Unit Trees. If your business is complex, we can help you simplify the reporting.

Budgeting for Cost Centres

While discussing reporting on cost centres or business units, we should also briefly mention budgets. Budgets are a core part of reporting for many organisations, so here’s the quick overview of how Calxa can make that easier too:

You can enter your budgets at the cost centre level. Do this for projects, departments or combinations, depending on your needs.

The organisation-level budget is then consolidated from these.

You don’t need to enter it separately and it is always automatically updated when any of the subsidiary budgets are changed.

If you’re using Combinations and everything is allocated to one of those combinations, you don’t necessarily need to have budgets at the Department or Funder level. Consider this a reporting requirement and summarise them with a Business Unit Tree. You can have as many trees as you like to meet all your reporting needs.

If you do want budgets at the Department level, select all your months (Ctrl-A will work too) and then add a Formula. Set the Data Source to Combinations and select all the combinations that are in this department. At the bottom left, choose Selected Accounts. Set the formula live and you’re good to go. Just remember to update the formula if you ever add a new combination.

Budget Layouts for Cost Centre Budgets

The traditional layout of accounts down the left, months along the top works well for most scenarios. This is where Calxa, offers immense flexibility in building your budgets. There are many ways of adding a budget, for example:

- In the Options you can choose to show or hide empty rows and this is very useful for budgeting at the business unit level as you often only use a subset of the accounts.

- With Filters you can limit the rows further to show just Income or just Expense.

- Pick an Account Tree to group your accounts the way you do for reporting.

- Contract any of the headers to edit at the summary row level to do quick updates.

The coup de grace though, as the French would say, is to change the Layout to Business Unit.

To do this, select Accounts in the left hand column and see all the business units in the next column with their budgets. Now you can edit that account for all business units in one go.

Need to reallocate wages from one project to another? Just increase one and decrease the other, checking that the total remains the same.

Want to apply a formula to this account across all your projects? Simple! Just select them all and add your formula.

Which Reports Should You Use For Cost Centre Reporting?

Most of the reports in Calxa can be run for a Cost Centre. The exceptions are mostly the Balance Sheet and Cashflow reports. Any of the Profit & Loss or budget reports can be used for one, some or all of your business units. Having said that, there are some that will give you extra value. Have a look at these to get some ideas.

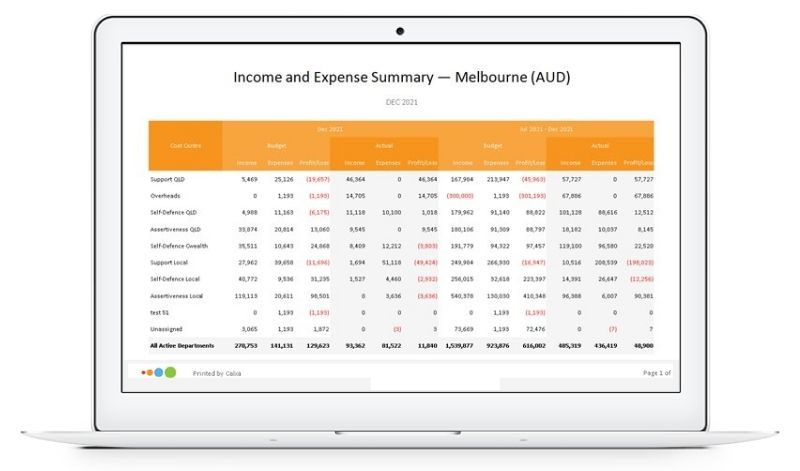

Big Picture with Business Unit Income & Expense Summary

This is a great report for senior management or a board who want a quick overview of the performance of each department without going through detailed reports.

You can see at a glance which cost centres are on track and which have problems that may need investigating.

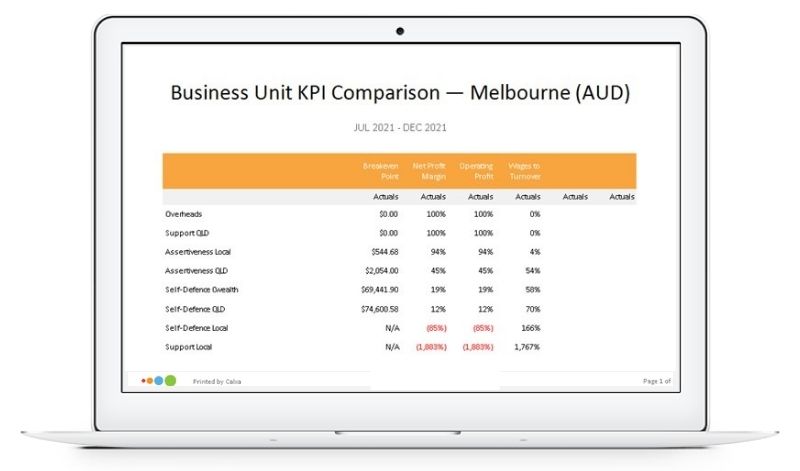

Compare and Rank Cost Centres with the Business Unit KPI Comparison

Use this to compare KPIs across departments.

You can sort by any of the chosen KPIs so you can easily rank your cost centres by your chosen measure.

Contribution by Cost Centre with the Accounts by Business Unit Chart

Use this chart to see where your revenue is earned or your resources are consumed.

Filter it with a Business Unit Tree (or All Active). Use an Account Tree to run it for a group of accounts, such as Staff Costs in this example.

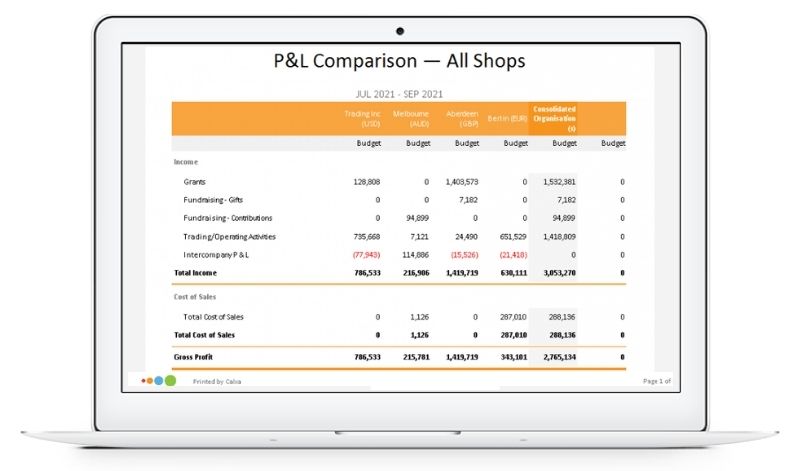

Track Performance with the P&L Comparison Report

This cost centre report will display your business units across columns, for a side-by-side comparison.

Dashboards for Cost Centres

Reporting often needs to be visual and our dashboards are perfect for that. Just create a Custom Data Source to include the cost centres you need and then filter your dashboard charts to show the data you want for your audience. Add the dashboard to the cost centre manager’s report bundle to automatically include it in their monthly reports.

Summarising Cost Centre Reporting

Cost Centre reporting is often complex. In building Calxa, we started from cost centres and built it up from there. We have considered handling all that intricacy in order to make your life easier. We’ll bring in your business units from the accounting system and help you report on one, some or all of them. Our quick Calxa tip:

- If you want to report on all of the cost centres or just one, do that in the report filters.

- To report on some or group and summarise just some of them, use a Business Unit Tree.

- For those of you needing to report on the intersection of 2 cost centres, set up Combinations and include those in your Business Unit Trees.

Whether you’re reporting on cost centres in one organisation or across a whole group, there’s a way to do it in Calxa!