Building your budgets back to front means starting with a blank piece of paper and budget for a desired net profit. Many of us start from last year’s results.

Taking a shortcut with our budgets by extrapolating from last year’s results will generally give you a fairly good forecast of what you’ll achieve if you keep doing the same things. But what if you don’t want a repeat of last year. What if you think you could do better? How about starting from the Net Profit and working backwards from there? In Calxa, we’ve designed the Budget Factory to do exactly this for you.

Budget for a Net Profit

What is your Dream? Is it a profit of $100,000? Or $1m or more? Whatever it is, profit is the main measure of success of a business, certainly of its financial success. It makes sense to think about what you want to achieve and then build the budget for a desired Net Profit that helps you develop a strategy to actually go out and achieve it. The Budget Factory will tell you what income you need to earn to achieve your profit goal. That will give you and your team the target they need to hit and an incentive to find creative ways of getting there.

What does it Cost to Run your Business?

Take a look at the fixed costs, the operating expenses, of running your business. We call these fixed costs because they don’t tend to change as the volume of business increases but that doesn’t mean they are locked in.

It’s good practice to review your fixed costs once or twice a year to ensure you are getting good value for what you pay. You don’t have to go to the extremes of Zero-based budgeting where people have sometimes been required to estimate in advance how many staplers and reams of paper they will use, but at least review the major items like rent, motor vehicles, insurance, phone and utilities.

What are your Direct Costs?

Direct costs (also known as Cost of Sales or Cost of Goods Sold) vary as the volume of business changes – things like the cost of the goods you sell, commission payments to salespeople and so on. If you double your sales, your direct costs are likely to double – unless you can negotiate volume discounts. Understanding the ratio of your direct costs to revenue is important in running any business.

Calculate the Revenue you Need

Gross Profit = Net Profit + Fixed Costs. You now have the information to calculate this.

Revenue = Gross Profit + Direct Costs. This will tell you the income you need to achieve. Knowing the relationship between your direct costs and revenue, you can calculate the income you need to reach your dream.

Building your Budgets Back to Front

Calxa’s Budget Factory is the tool you need to simplify building your budgets. You will find it in the Budget Tools menu. It is normally used to create a budget by extrapolating from the previous year actuals or budget, and that’s sometimes a sensible strategy. However, to start from profit, there is a simple change to make.

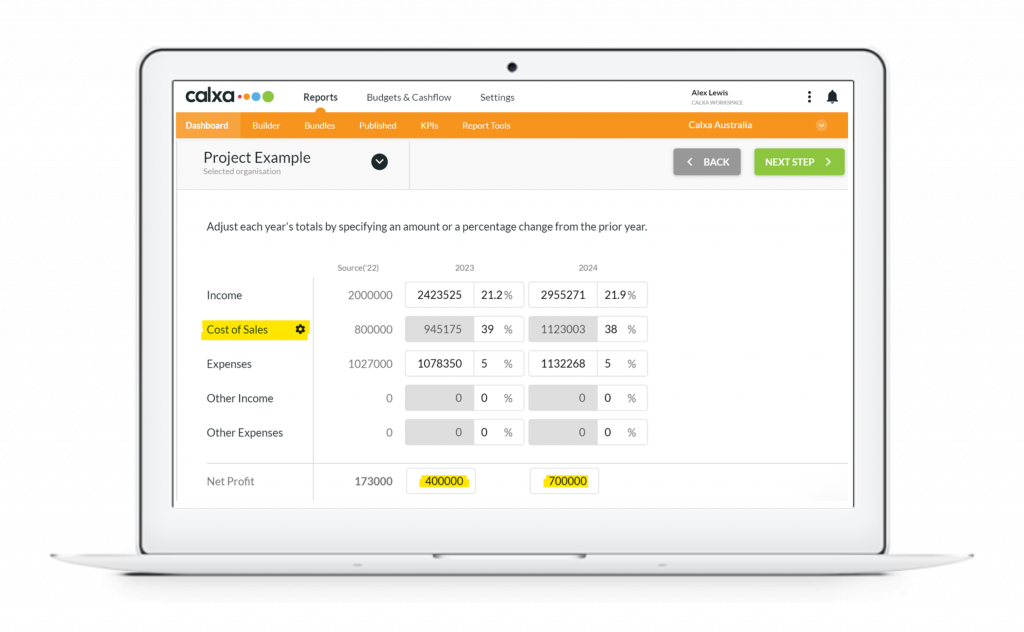

When you get to the adjustment step of the Budget Factory, click on the Settings cog next to Cost of Sales. While the standard behaviour is to adjust the budget as a percentage increase on the previous period, the other option is to set the Cost of Sales as a percentage of Income. When you do this, the Net Profit figure becomes editable and you can start to have some fun.

In the example shown, you will see that we are planning to reduce our cost of sales ratio from 40% in 2022 to 39% and then 38% over the next 2 years. We expect a small increase in our expenses over the same period. Then, if our goal is to lift net profit from $173,000 in 2022 to $400,000 and then $700,000, the factory will calculate the income we need to earn to achieve that. In this case, it will require an increase of 21-22% each year.

Do the Reality Check

The next check is to compare this with what you actually achieved in the previous year. Search for Last Year in the Report Builder and you will find a selection of reports to help with that.

If you didn’t earn anywhere near this amount of revenue last year, what are you going to do differently to achieve it this year? Putting numbers in a budget doesn’t make them happen. But they will make you think!

Add in the Strategy

This is where the fun starts and the real brain power is needed. What would be required to earn that revenue? Would you need more staff? A bigger office? Or just to work smarter? Build the strategy and then revise the budget to incorporate any additional costs. And, remember that is likely to involve revising the revenue target again.

You can re-run the Budget Factory multiple times but don’t start from the source data of last year every time. After the first run, use the first new year as the source. You can then still include that in the destination years and it will update your budget accordingly without losing your manual edits.

Create copies of your budgets using the Budget Manager while you’re considering different scenarios. It’s unlikely you’ll come up with the perfect solution the first time round.

If you are new to this process or short on time, engage the help of your accountant or advisor. They will ask you more hard questions about how you can implement your new plans. But, again, they will help you think of all the angles and come out with an actionable plan.

This method of formulating a budget will make you think hard and deep about your business and how you operate it. But the good stuff never comes easily, does it?