Careful budget planning for Not-for-Profits is critical as it provides a guide to how you intend to use your organisation’s resources. Your budgets also provide you with a mechanism to monitor performance by identifying variations and then deciding what action needs to be taken. In addition, they can also allow your program managers to be responsible and accountable for the performance of their program area.

Tracking Unspent Budgets

One reason why budget planning is important for Not-for-Profits is that often grants are linked to contracted outcomes. For this reason, your budgets need to accurately reflect that those outcomes can be achieved without additional costs.

For example, if you have spent 75% of a grant yet only achieved 20% of the agreed outcomes then you may have a significant problem.

In the extreme, this can threaten the viability of your organisation or adversely impact on other projects as funds may need to be redirected. This can even jeopardise your future funding from grant providers.

Identifying Variances

Even if the funding provider doesn’t require reporting back until the program is complete, it’s good practice for internal management. Your process could look like this:

- Prepare a report that summarises the % of funding linked to the outcomes needed. This helps you identify variations early. You probably want to generate this report monthly.

- If you find variations, you can now investigate these and take appropriate action if needed. This is best done by the program manager at a detail level, and the board at a summarised glance.

- Using the Unspent Budget report to track the financial performance and some KPIs to measure the outcomes, will give you or the program manager the information needed to know if the program is on track, or not.

Managing Cash Flow

This also highlights the importance of the budget for managing the cash flow aspect of unspent funds. Often grants are received in advance and this can give the appearance of an excess of funds in the bank account. However, in reality, they are tied to specific projects and should not be used for other operations. You can’t manage cashflow simply by checking the bank balance when there is this timing variance between the receipt of income and the outgoing expenditure.

A reconciliation of these unspent funds that links them to the actual project is vital. Essentially, it needs to be included in the cashflow forecast to indicate when they are planned to be used.

The Unspent Budget Report

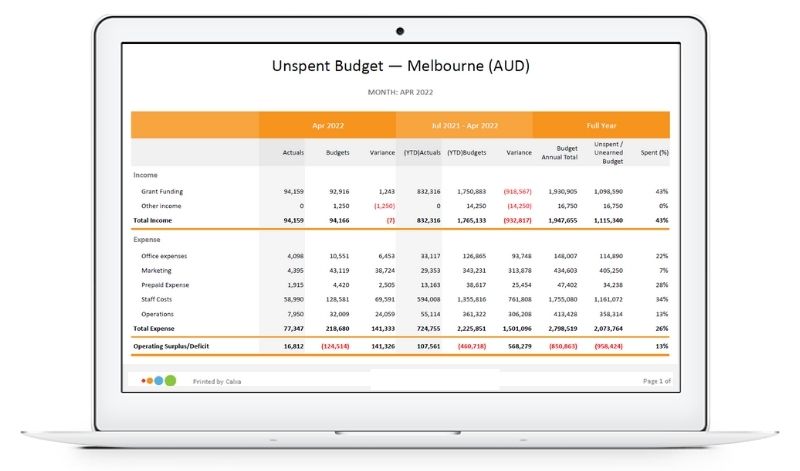

Reports such as Calxa’s Unspent Budgets Report summarise where the project is at. After all, here you compare the unspent funds to total project funds allocated, identifying potential problems early and prompting appropriate action.

Benchmark Future Activity in your Budget Planning

Budget planning also provides you with a benchmark for future activity. When you prepare next year’s budget or a submission for a new grant, the performance against the current budget provides you with a valuable guide. Of course, as long as you understand the reasons for variations.

Setting your budget at the beginning of the year and then locking it ensures you can report back against those expectations at the end of the year. Make sure to use a separate budget version for the forecast you amend during the year. Your board is likely to appreciate a report mid-year on actuals compared to the original approved budget. Don’t forget to also include the current forecast. This way you give them a good overview of how expectations have changed during the year. As a minimum, it keeps the whole team accountable.

Board Reporting and Good Governance

Whether you are on a Board or answering to a Board, reports should be prepared monthly that compare the actual results against the budget. Variations should be identified with an explanation as to why they have occurred. In some cases, they may be due to timing differences. Or, the budgeted item may have been incorrectly calculated. Alternatively, the activity did not occur when planned or there may have been a new activity that wasn’t foreseen.

Variances often are normal day-to-day occurrences. Most importantly, in reporting such variances you allow your Board of Directors to make diligent decisions. As a result, you give them the opportunity to achieve good governance. Calxa has an option to highlight exceptional variances on budget reports. This can be based on a dollar variance, a percentage variance or both. To get to the bottom, it is vital you understand why the variations have occurred. Ultimately, this allows for an appropriate course of action to be undertaken if needed.

Governing for Not-for-Profits

One of the key differences between a Not-for-Profit and a Small Business is that the former is responsible for the management of someone else’s funds. Regardless whether that is a government, donors, trustees or a bequests. As a consequence, this makes budget planning extra critical for charities and Not-for-Profits. Ultimately, they need to be transparent and accountable for the stewardship of those funds.

Company Funds in a Small Business

In a small business, there may be legal technicalities to separate you as the owner from the company or trust or partnership. In practice, many business owners do treat the company funds as something they do have absolute control over. Of course, this is not the case with funds they owe to banks, employees, creditors and so on. In essence, as long as you meet the legal obligations, no-one will stop you changing plans half way through the year.

As a manager and finance team in medium and larger businesses, you are much closer to the Not-for-Profit example in this case. Here too you are responsible for the care of someone else’s money and assets. As a business grows and there is a greater separation between ownership and management, budget planning becomes critical for business managers too.

Where Does Technology Fit in Budget Planning?

Using technology to fast-track the budget planning task makes sense. You will find that Calxa Premier has features that specialise in helping Not-for-Profits to simplify the job at hand:

- Budget Factory: Saves a lot of time with setting up multiple budgets in that initial stage.

- Account Trees: Re-arranges Chart of Accounts helping with acquittal of the various grants and providing reports to boards at the right level of detail.

- Business Unit Trees: Allows reporting on individual projects or groups of projects.

- Templated Reports: Selecting from a list of over 180 reports and charts allows accurate and professional reporting.

The great benefits from using this kind of technology is the time saved. But mostly, the confidence to rely on non-manipulated data pulled directly from your accounting system.

Sign up for a free trial and try this for yourself.