Cloud accounting is all the rage these days – and mostly for good reasons. However, it can be challenging to work out which application is best for your organisation.

In this article we’re going to look at this from the perspective of a Not-for-Profit organisation but some of the advice will be relevant to any business.

Why Cloud Accounting?

There are four main reasons why you should choose cloud accounting:

- Accessibility

- Security

- Automation

- Add-Ons

Accessibility

One of the first benefits is being able to access your accounting data from (almost) anywhere with an internet connection.

This makes it much easier to work with remote bookkeepers, accountants and auditors.

Also, it makes it simpler for your Treasurer if they are off-site.

Security

There are legitimate concerns about hacking, but generally your accounting data is well protected. Signing in requires Two Factor Authentication – so you’ll need to enter your username and password, followed by a code from an authentication app or one sent to a mobile phone before you can access your accounting data.

In many ways online data is more secure than if it was in your office – you don’t have to worry about fire, flood or theft by someone breaking in.

Also, it’s automatically backed up (though the degree to which you have control over restoring backups varies).

Automation

This is what makes cloud accounting worthwhile.

You won’t eliminate manual entries, but you will significantly reduce them and that will save you hours every month.

Bank Feeds bring in data from your bank account and Bank Rules can then allocate those transactions directly to your accounts. With the introduction of Single Touch Payroll in Australia and Payday Filing in New Zealand, it’s essential to have your payroll information online so that you can lodge your reports directly from the software.

Then there’s the plethora of apps that will allow you to scan and upload receipts, invoices and expense claims. Have a look at Expensify, Receipt Bank, Hubdoc or Auto-Entry to see which one might work for your needs.

Add-Ons

As your organisation grows in size and complexity, there can be pressure to move from your current small business accounting system to a fully-fledged ERP (Enterprise Resource Planning) system costing hundreds of thousands of dollars, with the promise that it will do everything for you.

Sometimes that’s necessary but, more often than not, you can achieve the same objective with cloud accounting software and a good selection of best-of-breed add-ons.

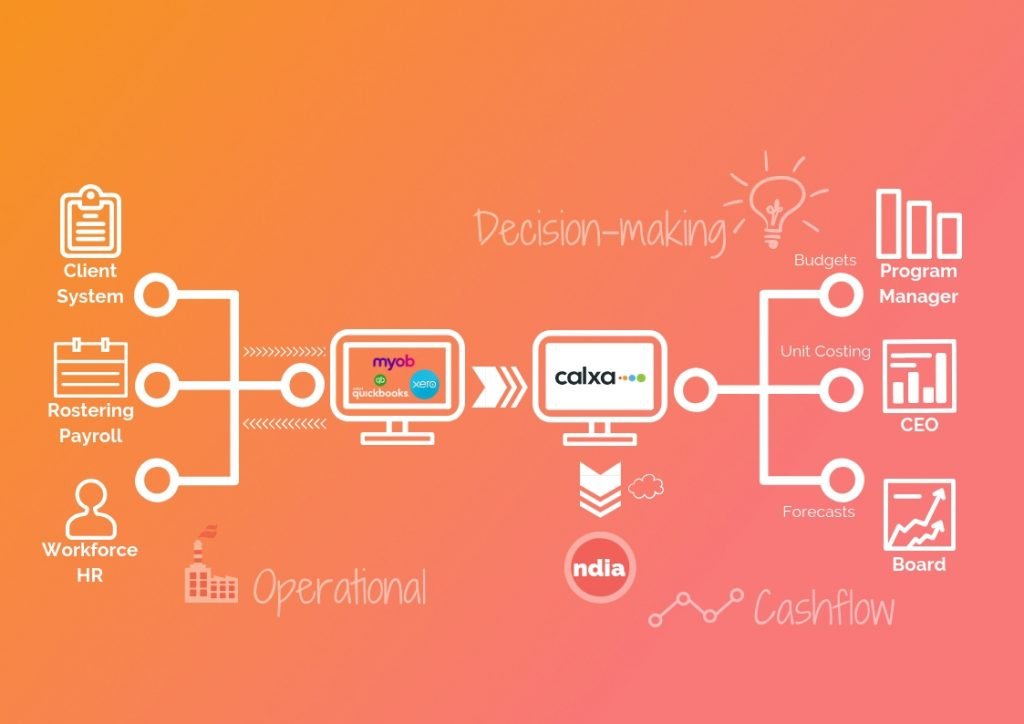

Example add-ons include a CRM or Client Management System to handle your client information (and maybe invoicing), a rostering and payroll system to manage your team and a good reporting solution to ensure your management and board have the information they need to make good decisions.

A Note about Bank Feeds

Bank feeds are a great feature of online accounting systems that bring in data from your bank statements. However, not all feeds are alike:

Direct feeds

The software supplier has formal arrangements with the bank to provide the data electronically. This is the gold standard. The connection to the bank is authorised, it’s secure and almost always free from error.

Screen Scraping

This is the alternative. It involves you handing over your bank username and password (which breaches your agreements with your bank), the software then effectively logs on to your banking software as if it were you, reads the statement on the screen, interprets it as best it can and then transfers the information to the accounting system.

Use at your own risk – because the bank won’t accept any and neither will the accounting software supplier (read the fine print when you sign up).

Don’t forget: In some ways, all accounting systems are the same

While our focus here will be on the differences between the different systems, keep in mind that they all do the basics.

They will all process Debits and Credits reliably and you won’t have to worry about your Trial Balance being out of balance. They’ll all manage Payables and Receivables, so you know who to pay and who owes you money.

All of them have a payroll option and for the smaller Not-for-Profits this will be more than adequate. If your payroll is larger and more complex you may need to move to a stand-alone (but integrated) payroll system sooner than others, but they will all suit anyone with up to 50 employees easily.

What do you really need in a cloud accounting software ?

Requirements Analysis – Don’t Skip This Step

Take some time first to assess what your needs are – and don’t be afraid to engage an external consultant if your requirements are complex.

The most expensive system is the one that is wrong for your needs.

Make sure you consider the needs of everyone in the organisation, not just the finance team.

- Will the board get the information they need to manage the strategy?

- Will program managers have what they need to run their areas?

- Who is inputting data?

- Will the new system save them time?

Structure: Programs/Jobs and Chart of Accounts

How complex is your organisation structure? There are differences in what the accounting systems can do and this is one that has tripped up some NFPs in the past. Know how many programs or jobs you have now and how that is likely to change in the next few years.

The time of moving cloud accounting software can be a good opportunity to review both your job/class structure and your chart of accounts.

Eliminate complexity while making sure everyone still gets the information they need.

Cost

There are differences in the costs of the applications we discuss here but really, this is the least important criteria.

Saving a few dollars on a system that gives you more manual work and complicates your life will cost you much more in the long run.

And, don’t forget to factor in some training and support. If you’re moving to a new system, getting it set up right and learning to use it properly will be a sound investment and save you much more in the long run.

Cloud Accounting Software Options

There are four cloud accounting software options that we are now going to review closely:

- MYOB AccountRIght

- MYOB Essentials

- Xero

- QuickBooks Online

MYOB AccountRight

Some purists will argue that MYOB AccountRight isn’t cloud software in that you do need to install software but, for our purposes, it has the important functionality that online software has. Your data is stored online and you can access it from any computer running Windows and the MYOB AccountRight application and then it has all of the automation and add-on benefits discussed above.

The Good Bits

- It’s an easy upgrade for anyone on MYOB Classic (Premier 19 range). The process includes every single transaction, just as it was originally entered, plus all of your settings and preferences.

- AccountRight will be vey familiar to users of the old MYOB products. While the colours have been updated and new features added, the basic navigation and workflow is the same as it was in 1990.

- It has a hierarchy of jobs with header and detail jobs. You can’t report on them very well in MYOB itself but add-ons like Calxa make good use of the structure to provide very powerful and flexible reporting.

- Searching for transactions and audit is probably the best of the bunch – there are multiple ways to find a transaction within a few clicks.

- MYOB have the best bank feeds. They have always worked only with direct feeds and added to the number and range of them with the purchase of BankLInk a few years ago. Feeds are available for most banks and credit cards in Australia and New Zealand.

- It’s easy to find staff with MYOB experience. It’s been around so long that there are many, many people with experience. They’re not all good and you need to filter them, but you’ll have plenty to choose from.

The Not-so-Good Bits

- You still need to install and update software from time to time. If you work mostly from the same computer at the same desk this is generally a minor inconvenience. If you have a laptop you carry around with you, it’s a minor inconvenience. If you need to get your IT department (or external contractor) to install every update on every computer, it’s a major turn-off.

- MYOB AccountRight is a Windows application so you can’t use it on your Mac or your iPad. For some people that doesn’t matter; for others it’s a deal-breaker.

- Payroll works well for 50-100 employees. 200 would be fine if they were simple and consistent. If you have lots of casual or part-time staff with their time needing to be allocated to multiple jobs in a week, it starts to get unwieldy, so think about adding an external payroll system. It also doesn’t have an employee portal where they can get payslips, request leave, etc.

- Multi-currency has been recently implemented for both exporters and importers – with a few improvements to reporting still to come.

MYOB Essentials

Essentials is MYOB’s browser-based, “real cloud” application. While it’s been growing and improving over the years, it’s currently suitable only for the smallest NFPs.

The Good Bits

- It is browser-based

- Like AccountRight, it has gold standard direct bank feeds

- The Bank Rules that process the bank feeds are flexible and reliable.

The Not-so-Good Bits

- There are no jobs or any sort of departments or cost centres

- Payroll is fairly simple and basic

- It’s not widely used in the NFP sector so it’s a bit harder to find experienced staff.

Xero

Xero has been the trendy accounting system over the past few years and boasts the most online subscribers in Australia and New Zealand. It’s good but there are a couple of things a Not-for-Profit should be aware of, which aren’t necessarily an issue for their main target market of small businesses.

The Good Bits

- It’s browser-based so you can use it from any location and (almost) any device. The phone app is generally a better option than trying to use the browser version on a phone.

- It’s been very popular with non-accountants and is designed to be easy to use for those who don’t understand debits and credits.

- Bank feeds are improving. When they first started, the bank feeds were all screen-scraped but they now have direct feeds from all the major banks. If you deal with a smaller bank or credit union, ask before you make a decision.

- Because of its popularity in business, it’s easy to find staff with Xero experience.

- Multi-currency functionality works well (if you’re on the right plan).

The Not-so-Good Bits

- There is a limit of 100 Tracking Categories in a list. These are the equivalent of jobs in MYOB or classes in Reckon/QuickBooks. If you don’t expect to go over that limit you won’t have a problem but if you currently have several hundred (or thousand) jobs or classes, this will be a deal-breaker.

- Payroll gets clunky after 100 employees and there is a hard limit of 200.

- It’s not totally intuitive on how to find transactions. This is generally only a problem for new users and one that training and experience will overcome.

QuickBooks Online

The new kid on the block (relatively) in Australia and New Zealand but the owners, Intuit, are the biggest accounting software vendors in the world and also the owners of the old QuickBooks desktop software which was licensed through Reckon (but that story is too long for this article!).

The Good Bits

- It is browser-based so access is easy.

- It will be the most familiar upgrade for Reckon users. The terminology and practices are similar, even if the screens and workflows have changed.

- It has a hierarchy of classes to manage programs and cost centres and there are no limits to how many you can have.

- It has probably the best payroll, delivered through a third party app (Keypay) but it’s so tightly integrated you won’t notice that. It has an excellent employee portal for managing payslips, leave and more.

- Multi-currency is built in.

- As well as Bank Rules that you create yourself like the others have, it will automatically suggest rules based on machine learning of other users’ behaviour. For example, if it detects a transaction in the bank labelled “Caltex” and most other users have allocated that to Fuel Expenses, it will suggest that to you.

The Not-so-Good Bits

- Fewer direct bank feeds. This has been an issue for a while with most feeds coming from screen-scraping technology. Over the past 2 years they have improved and now the major banks are from direct feeds but be sure to check before making a decision.

- It can be hard to find transactions when you’re a beginner. Training and familiarity will fix this.

- QuickBooks online isn’t so well known in Australia and New Zealand as Xero or MYOB but you shouldn’t find it too hard to find staff.

Some useful links

Most people will want to move as much of their existing data as possible to their new accounting system and there are tools to help with that. Before rushing to use these tools, take a minute to consider if it’s time to make a fresh start with clean data and shed the detritus of past years.

Migrations tools

A Final Word (or two)

- Define your requirements. Understand what you need before looking at the details.

- Involve all users. Think of the whole ‘eco-system’, including all the data that feeds into the accounting system and all the reporting that needs to come out of it.

- Try before you buy. They all have free trials so spend some time getting a feel for the software before making a commitment. And test their customer support.

- Get expert advice and assistance. Most of us change accounting systems once every 10 or 20 years so we don’t get a lot of experience. Talk to someone who does this sort of things all day everyday to avoid some of the pitfalls and have a smoother transition.

- Be prepared to learn. While all of these systems do the basics, they all do them slightly differently and not in the same way as your old desktop system. Invest in training early and you’ll have a much more enjoyable and relaxed experience.

Good luck!

Mick Devine

About the Author

CPA Mick Devine has a long history of working in the Not-for-Profit sector as treasurer, board member, consultant and advisor. Frustration with spreadsheets as reporting tools led him to develop Calxa, now the most widely used budgeting and financial reporting software in the NFP sector in Australia and New Zealand. Calxa is donated to small and medium NFPs and is proud to be Tech Soup and Connecting Up’s first and only Australian donation partner.

This article was originally published on the Connecting Up site and has been republished here with their permission.