We live in a world which is constantly changing around us, whether it be related to technology, climate, politics, social, or any number of other areas you can think of. Amidst all of this change, the challenge is to adapt, survive and potentially prosper, but this in itself is not that easy. This is no more apparent than in the accounting industry, where traditional ways of engaging and servicing clients are in a rapid state of change, largely driven by technological advancements.

Consider the change that has happened over the past few years; the advent of online and cloud technology has opened up a world of possibilities and productivity driven advancements. Real-time collaboration between the accountant, bookkeeper and the client is now considered the norm. Bank feeds delivered directly into the accounting platform to ensure data integrity and minimise laborious reconciliation tasks is now a no-brainer. Automatic document scanning and linking to accounting transactional data is emerging and is only getting smarter and more sophisticated. With the number of add-on solutions that can be bolted on to an accounting ledger system growing daily.

So where does this leave the accountant and bookkeeper? Well, one thing is for certain, that if all of this change is happening around them, then it stands to reason that they themselves will need to change, and review how they engage and interact with their clients. This is not necessarily a bad thing, but it does require some planning, and an analysis of how they have done things in the past, versus what would be considered best practice in the future. The challenge is to keep moving forward, amidst all of this change. As Albert Einstein famously said; “Life is like riding a bicycle. To keep your balance, you have to keep moving”.

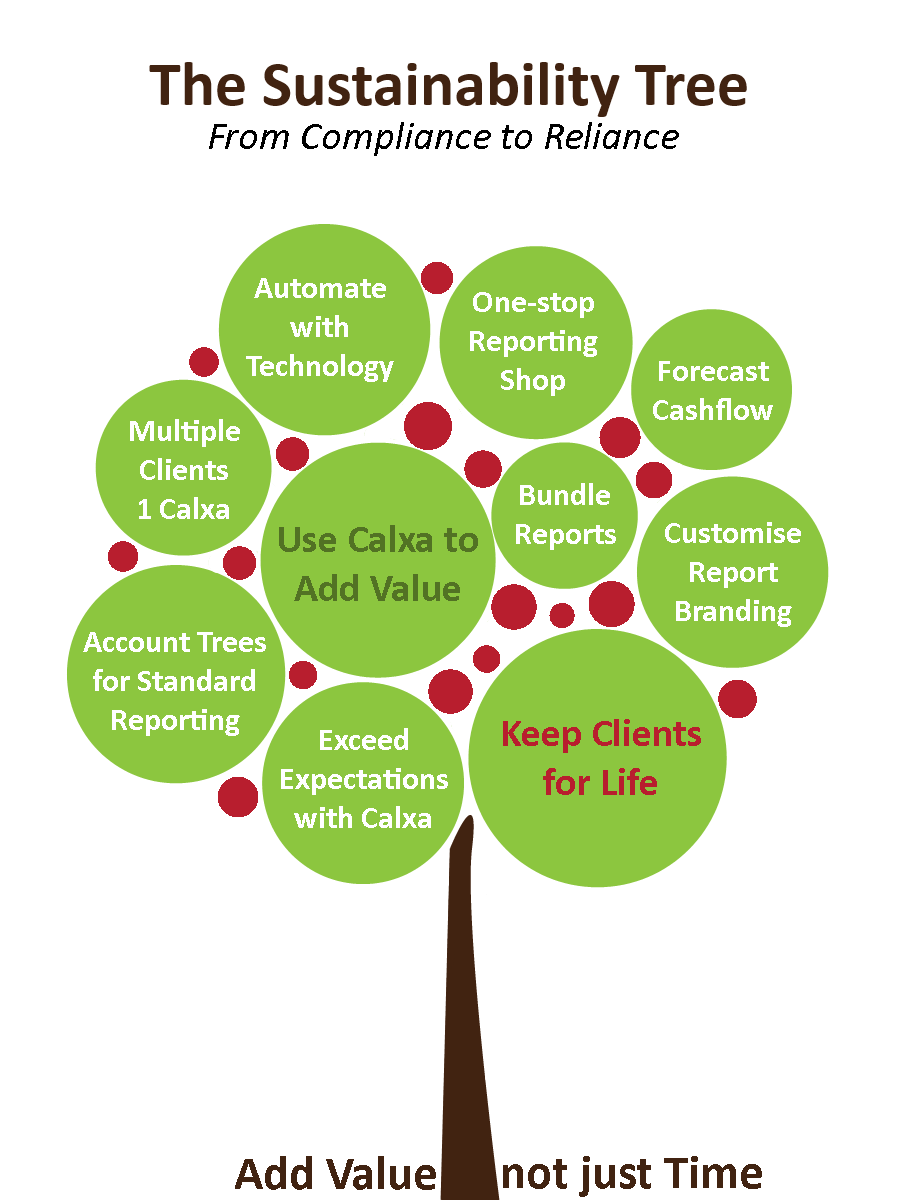

So, what are some of the strategies that can be adopted, to ensure you don’t ‘fall off the bike’? We don’t pretend to be experts in this field, but we can share with you some of the observations we have seen, and appearing to gain momentum in the accounting industry.

- Fixed Fee Billing – Add value with the adoption of technology to gain efficiency and provide a more extensive service, thus being able to charge with fixed fees.

- Increased Collaboration – Join forces in the advisory space. Create relationships between Accountants and Bookkeepers to have a win-win referral basis and quality service to your clients.

- More Client Time – Create strong relationships with your client, to engage clear communication through all channels. This not only benefits you in your work but the client feels more at ease with human contact rather than a robot crunching numbers.

- It’s All About The Future – Look to the future with technology to add substance and save time on the basic things, thus creating more time to add value and earn more.

As technology is at the forefront of this changing environment it is important to note one aspect of this sector that will never change – people. The people aspect of this business is what drives it, the relationships between clients and their Accountant or Bookkeeper will always stay relevant. Technology cannot relate to clients or even mimic human engagement. It can, however, make our lives easier and automate processes that humans find labour intensive.

Here at Calxa we are at the pointy end of all this change, and understand that all of this does not happen overnight within an organisation, small-business and not-for-profits alike. To this end, we endeavour to provide our partners with many mediums for them to efficiently adopt some of this technology. We also like to help you answer many common questions from clients, in an easy and clear way that your clients will understand.We also understand that with change, come challenges. If Calxa happens to be an integral component of your change process, then we will endeavour to assist, empower, educate and support you, and give you the greatest chance of implementing positive change, with the least amount of disruption to you and your clients.