This article will give you useful tips on how to budget for a business loan when using Calxa. After all, borrowing money is something that is necessary and important for most businesses from time to time.

A business loan can get you through a tough patch, it can fund an asset purchase or it can give you the working capital to grow. This Forbes articles lists the most common types of business loans.

But how do you budget for it?

How to Budget for your Business Loan Using the Loan Wizard

Most loans require you to repay principal and interest each month, with fixed monthly repayments until the loan is repaid. Whether it is a hire purchase agreement, chattel mortgage or straight business loan, the process is the same:

- An interest rate is fixed at the beginning of the term

- Regular (usually monthly) repayments are required

- There is sometimes a balloon or residual payment at the end

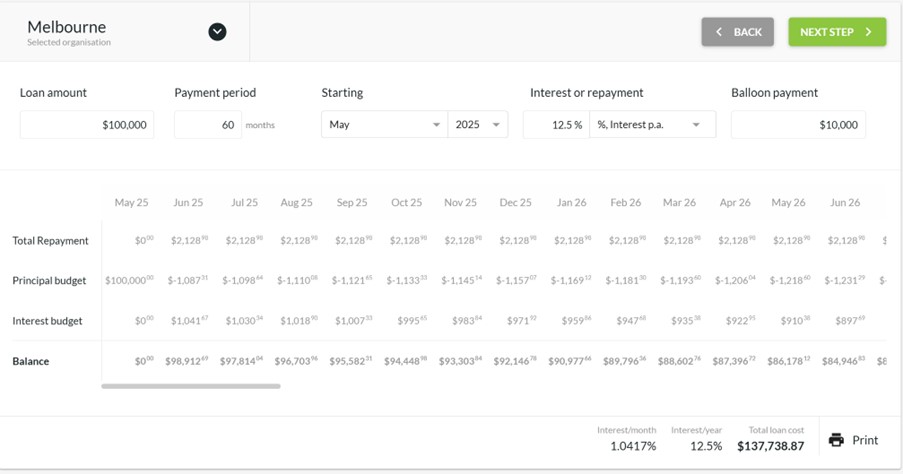

The Calxa Loan Wizard is ideally suited to this type of loan. It will help prepare your budget for the business loan. You provide the loan amount, term, starting month, balloon payment and either the interest rate or the monthly repayment. The latter helps when the loan documentation only gives you the repayment amount, not the interest rate. In this case, either way will work.

The wizard will calculate the monthly breakdown of the principal and interest components of the repayments as well as the total loan cost and the annualised interest rate. Then, simply print the results to get a report of the breakdown month by month.

When you save the results, the budget for the liability account is updated for the receipt of the loan funds and the reduction in principal each month. The interest is then added to the Interest Expense account budget.

Tips on Working with the Loan Wizard

While the loan wizard is a simple way of calculating your budget for your business loan, there are some tips to help you get the most out of it.

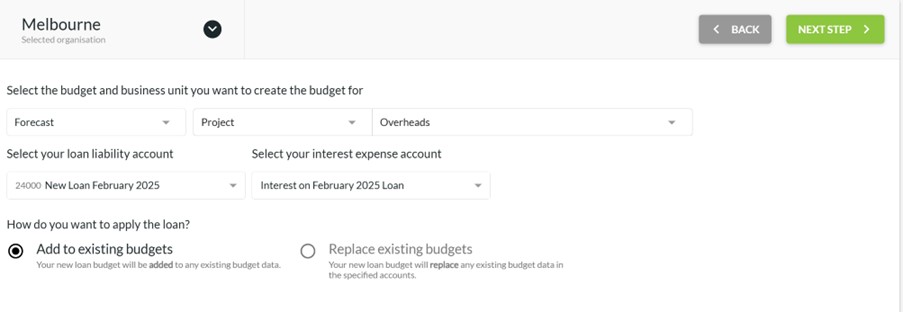

Separate the Liability and Expense Accounts

For each loan, add a new liability in your accounting system if this loan is already locked in or use an Unlinked Account in Calxa if it isn’t. Unlinked Accounts are great for budgets and you can decide to push them to your accounting system when the loan is confirmed. Until then, it just exists in your budgets and it’s easy to make changes. Add a new sub-account for the interest expense. Sub-accounts are just for budgeting and don’t go back to the accounting system. But they allow you to budget separately for each of the components of your Interest Expense. While you can re-use existing accounts and add to the existing budgets in the Loan Wizard, we don’t recommend it.

If you use separate accounts for each loan, it is much easier to make changes later. You might, for example, enter the budget based on the rate you’ve been quoted by the bank. Doing this, you may find it is increased by the time the loan is settled. You might want to repay the loan early. If it’s been allocated to separate accounts, you just budget for the payout figure against the liability and then remove the budgets from future periods. This is much more challenging if the account contains more than one loan.

If you have a separate Account Tree for cashflow forecasts, you could group the principal and interest components on the loan under one header. This will then show the total repayments. Account Trees can combine accounts from different types!

Budget for your Business Loans at the Business Unit Level

If you are doing all of your other budgets by business unit, the loan wizard should be applied to a business unit, not the organisation budget.

Budgeting for Alternate Business Loan Scenarios

Sometimes, when approaching a bank for a loan, it is necessary to show your cashflow forecast both with and without the loan. Simply add the loan to a scenario and then compare the cashflow on your budget with and without this scenario. To do this, it’s best to use the Cashflow Scenario chart.

Using the Loan Wizard to evaluate Short-Term Business Loans

Over the past few years, there has been a rapid increase in the number of non-bank lenders offering business loans. They typically access your accounting data to assess your ability to repay the loan. In return, they provide very quick responses. This speed of decision-making is of great benefit to business owners, but often comes at the cost of high interest rates.

When the rate is clearly communicated, you can make an informed decision on whether or not this is a good deal for your business. However, we have seen instances that are not so transparent.

In such a case, use the Loan Wizard to see what the true annual percentage rate is on your loan. You can do this by entering the amount, term and monthly repayments. If you are happy with that rate, go ahead but if not, shop around for a better deal.

And, this is how to budget for a business loan in Calxa. Simply, give it a go.