MYOB and Add-On Partners have put their heads together to deliver a tech ecosystem for National Disability Insurance Scheme (NDIS) Providers. The collaboration feeds a NFP tech ecosystem to support organisations transitioning to the NDIS.

This week, Accounting Software provider MYOB launched an initiative to assist Not-for-Profits, particularly those organisations affected by the recent roll-out of the National Disability Insurance Scheme (NDIS). In establishing a technology hub for NDIS service providers, MYOB is collaborating with its Add-On Partners and Certified Consultants to bring together effective solutions which will help organisations find answers to some difficult questions.

The Problem to Solve

The transition to a fee-for-service funding model is a challenge for many disability providers. Traditionally they were supported by grants in advance of service delivery. Now funding is going to the person with disabilities and the service providers need to provide the services (and service) which will attract clients to them.

These organisations now need to behave much more like businesses, competing for the participant dollar while delivering good service at an efficient price. This new market-based environment has the potential to deliver much-needed choice and greater independence to people with disabilities but the transition from the current situation to the new future poses many challenges.

Technology and Systems the Key

During pilot programs in various locations across Australia, it became evident that the challenges service providers face are many and varied. However, most of them come back to systems and processes that need to change. This requires an assessment of the current position to identify what needs to be added, changed, adjusted and connected to end up with an efficient customer process.

Libby Mears from Leisure Networks in Geelong, reinforces the importance of streamlining the back-of-house, “Some of the key changes we have seen inside the organisation are very much around systems and processes.” Leisure Network has used the NDIS as an opportunity to grow and is now expanding their services beyond their geographical base.

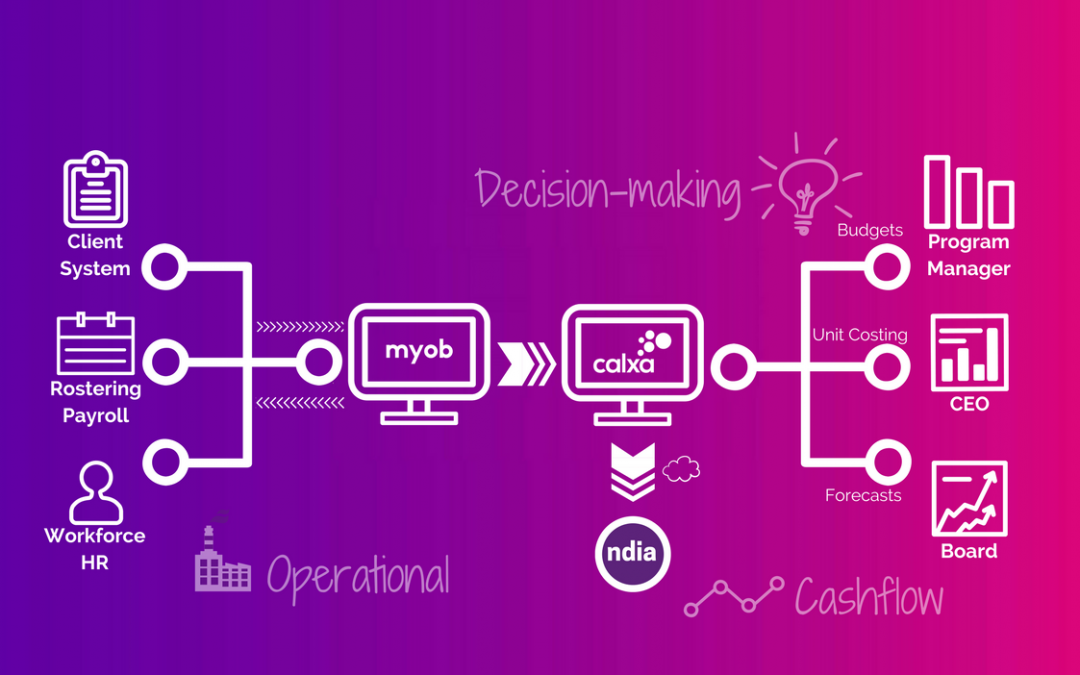

The Technology Ecosystem

MYOB’s ecosystem will provide a starting point for any organisation reviewing their systems, giving access to a team of experienced Certified Consultants and best-of-breed add-on solutions to MYOB for reporting, rostering and complex payroll.

Operational

Accounting

MYOB is well placed to handle the recording of activities and translate this into billing. To manage the increased number of transactions – from bills to payments and payroll – now is a good time to consider upgrading to MYOB AccountRight and take advantage of automation that bank feeds and take out some of the manual process. Elements MYOB will handle:

- Time billing for activities provided

- Tracking client payments

- Processing complex payroll

Casualisation of Workforce

In an expanding health care sector, growth is being handled with an increasing casual workforce. This provides flexibility to the provider and work/life balance to staff. This increase in the number of employees will be better managed with systems such as easyEmployer to assist with:

- Complex rostering

- Tracking work completed

Whilst pre-templated HR solutions like HR Central can handle the legal end of the workforce.

- Maintenance of staff records

- Legalities around work hours and awards

- Feeding workplace culture

Client Management

Becoming client focused is the ultimate goals in this NDIS age. Keeping records on clients such as likes and dislikes alone can be a complicated task. Now, there is a need to link support plans to clients and connect these to the various activities the organisation delivers. A comprehensive Client Management System (CMS) can do this. Infoxchange has developed ‘SRS’ to handle and link all sorts of data.

- Maintaining client records

- Keeping track of support plans and relevant individual funding

- Connecting activities delivered by staff to the individual client

- Managing claims to the NDIA

- Identifying outstanding payments

- Feeding the billing system (MYOB)

Cashflow & Decision-Making

To make meaningful reports from these operational activities, you connect to Calxa. This is where financial data is digested and re-appears in some format that important decisions can be based on:

- Costing of activities and building budgets to establish different scenarios

- Budget comparisons for Program Managers

- Management reports for CEOs and Boards

Calxa even extends to get a real snapshot of the organisation’s viability:

- Projections of client payments

- Cashflow forecasts to plan ahead for growth

Having these solutions in one hub, all linking to the central data holder, MYOB, provides the synergy to both the process as well as automation. In short, an efficient process and good systems will set your organisation up with the basis for success in the NDIS environment.

Here is more information to get started today.