If your head is spinning after reading this headline and you have no clue what we’re talking about but you employ staff, you best read on. There are some important legislation changes coming up regarding payroll, called Single Touch Payroll (or STP in short). Whilst payroll is not a core functionality of Calxa, we do understand it’s importance for our customers.

Here are some key points in a nutshell. that apply from 1 July 2018.

STP: What is it?

From 1 July 2018 the Australian Taxation Office (ATO) requires businesses with more than 20 employees to change the way they report on salaries and wages, allowances, deduction, PAYG and superannuation information. The new reporting obligations basically provides the ATO with up-to-date payroll details on completion of each payrun. This is done by connecting your payroll data directly to the ATO portal and electronically delivering the required data.

The idea here is that eventually employers won’t have to submit annual PAYG Summaries to employees nor submit the Annual Payment Summary Report. Check out this ATO video.

STP: What you have to do!

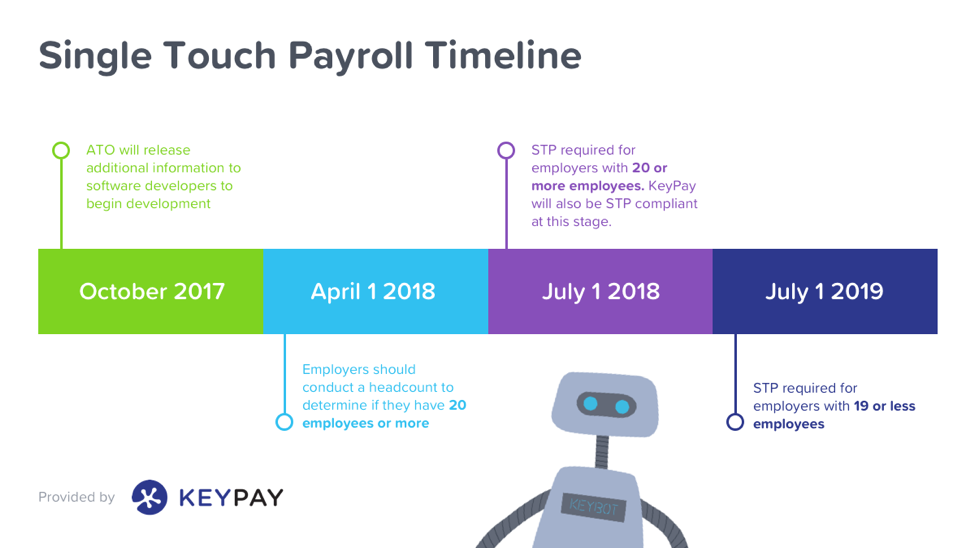

This great infographic displaying the important dates. Courtesy of KeyPay

So, make sure you start by doing a headcount of employees as at 1 April 2018 and see where you fit in. Find out more about STP at this ATO Page.

Employers with 19 or less Employees

There is nothing for you to do right now as your obligations won’t change until 1 July 2019. Don’t read on as you can relax for now.

Employers with 20+ Employees

You better get your house in order and get going to make some critical changes. Here are some suggestions.

- Get more info from the ATO or join one of their webinars.

- Check to make sure your accounting software is STP compliant and follow the set up steps.

- MYOB AccountRight has you covered in version 2018.1 – pages 1-4 in this release article covers the necessary steps to take.

- For Xero users there is a simple set-up process that you can follow in this Xero blog.

- The QuickBooks Online article has the great infographic above with some informative FAQs to help you better understand the requirements.

- If you’re not ready, you may be eligible for a deferral. Check out the section on this ATO page on who will be considered and how to apply.

If you are stuck or are unsure how to implement this, get in touch with one of our awesome Accredited Partners who are accounting software specialists and are up-to-date with the latest ATO requirements.