The last thing any business wants is a knock on the door from the Tax Man.

The Australian Taxation Office (ATO) sets standard industry benchmark ratios to give them an indicator of businesses that may be doing some creative accounting. So the key thing is to be aware of how NOT to fall outside these benchmarks.

This may affect retailers and businesses that receive payments for goods and services in cash. It is this ‘cash economy’ the ATO doesn’t like as it offers temptations not to declare the said income. The Cost of Sales to Turnover ratio is used to identify businesses that fall into this category.

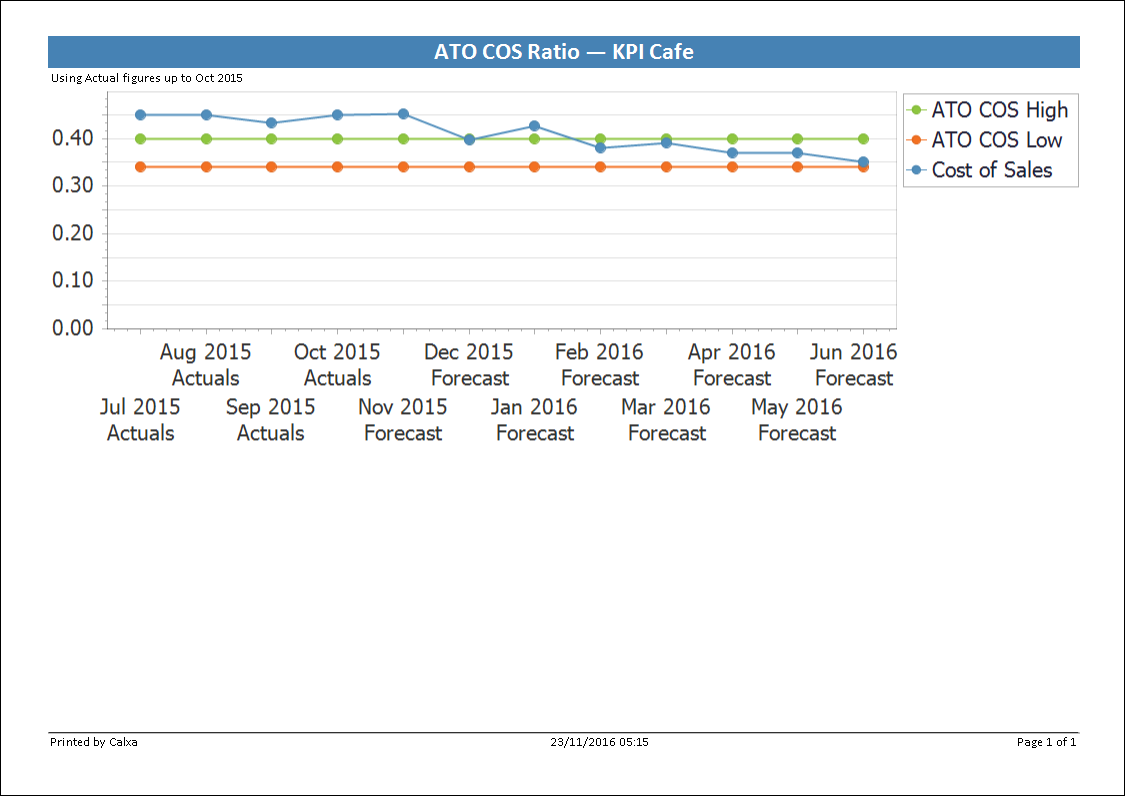

If you are part of a pre-dominant cash industry, it is a good idea to be vigilant and know your ratio and regularly compare this to the published benchmarks. It could look something like this line chart below.

Of course, there may be times when you do fall outside these parameters for reasons outside your control. Common situations are a change in your trading conditions or trading location. Just remember, the ATO is just doing their job as it is chartered to minimise these taxation losses. And, to be fair, they are working on our behalf, the Tax Payers.

Reporting tools like Calxa have the technology to graphically track your position each month and alert you to take measures if you consistently fall outside the said benchmark ratios.

Check out this cool tip that offers more resources and some guides on how you can achieve this.